SDG Performance: 14x new research on CEO pay, greenwashing, greenium, ESG risk, regulation, audits, ungreen ETFs, SDG scores and performance, voting, circular risk, non-normality and mutual funds (# shows SSRN full paper downloads as of March 21st, 2024)

ESG research

Being CEO pays: The State Of Corporate Sustainability Disclosure 2023 by Magali Delmas, Kelly Clark, Jiaxin Li, and Tyson Timmer as of March 14th, 2024 (#28): “… we analyze the most commonly disclosed corporate sustainability metrics among S&P 500 firms, based on data from the Open for Good initiative. Our focus is on greenhouse gas emissions (GHG), climate strategy, gender and ethnic diversity, and the ratio of CEO-to-median-employee compensation … Across all (Sö: ESG) metrics, the average disclosure rate is fairly low at 55% … reporting for Scope 1 and 2 GHG emissions is notably high, with average rates exceeding 80%. Conversely, the disclosure rate for Scope 3 emissions drops to 56% … the lack of detailed information on the assumptions and methodologies that these disclosures employ constrain this data’s usefulness … . On average, women comprise only 39% of employees in S&P 500 firms, with Financials and Health Care the sectoral exceptions, reporting averages of 50% and 51% women, respectively. At the board of directors’ level, the representation of women is lower, averaging 32%, with minimal sectoral variation … that average CEO compensation is 305 times greater than that of the median employee … However, this can vary significantly from year to year within each company …” (p. 4). My comment: With my shareholder engagement activities I encourage companies to report the CEO pay ratio so that all stakeholders can comment on them, see e.g. Wrong ESG bonus math? Content-Post #188 (prof-soehnholz.com)

Scope 3 reporting effects: Real Effects of the Proposed SEC Climate Disclosure Rule by Mary Ellen Carter, Lian Fen Lee, and Enshuai Yu as of March 15th, 2024 (#117): “We examine changes in firm supply chain decisions following the SEC’s proposed climate disclosure rule, which requires Scope 3 emissions disclosure. … we compare the import activity of treated firms (non-SRCs: Sö. Small reporting companies) to unaffected firms (SRCs) before and after the threat of Scope 3 disclosure in the proposed SEC rule was revealed. We find a decrease in import activity for non-SRCs relative to SRCs, implying that the proposed disclosure rule creates costs that make foreign outsourcing less favorable. … we provide evidence that non-SRCs also increase their in-house production, and exhibit greater improvements in environmental efforts, compared to SRCs“ (p. 30/31).

Greenwashing risks: A Greenwashing Index by Elise Gourier Hélène Mathurin as of Feb. 18th, 2024 (#314): “We construct a news-implied index of greenwashing. Our index reveals that greenwashing has become particularly prominent in the past five years. Its increase was driven by skepticism towards the financial sector, specifically ESG funds, ESG ratings and green bonds. … Unexpected increases in the greenwashing index are followed by decreases of flows into funds advertised as sustainable, both for retail and institutional investors. … When accounting for greenwashing, the climate risk premium becomes small and statistically insignificant” (abstract). My comment: With my shareholder engagement activities I encourage companies to report broadly defined GHG Scope 3 emissions so that all stakeholders can focus on them

ETF-Greenwashing? Unmasking Greenwashing: A call to clean up passive funds by Lara Cuvelier at al. from Reclaim Finance as of March 20th, 2024: “… the five big asset managers we selected for this report based on the size of their passive portfolios – BlackRock, Amundi, UBS AM, DWS and Legal & General Investment Management (LGIM) – still held at least US$227 billion in fossil fuel developers in 2023, with more than half of this amount coming from passive portfolios. … 70% of the 430 ‘sustainable’ passive funds we analyzed were exposed to fossil fuel expansion. Focusing our analysis on the most significant of these – 25 high-profile ‘sustainable’ passive funds – we found the majority were investing in some of the world’s biggest fossil fuel developers, such as ExxonMobil and Shell. The analysis also shows that especially when these funds are invested in bonds, they provide direct financing for fossil fuel developers“ (p. 4). My comment: This result is not surprising. The reason is that these products are supposed to have very little deviation (tracking error/difference/active share) from standard indices. Therefore, they use best-in-class approaches instead of the far more sustainable best-in-universe sustainability selection approach.

Grey definitions? Greenness confusion and the greenium by Luca De Angelis and Irene Monasterolo as of Feb. 19th, 2024 (#241): “We use different classifications of green assets and carbon stranded assets and develop six portfolios characterized by shades of green and brown technologies, from the VeryGreen to the VeryDarkBrown, and green-minus-brown factors. Then we analyse the market pricing of the factors in augmented CAPM and Fama-French models, focusing on the firms listed in the STOXX Europe 600 index. … we find that the presence of the greenium, i.e. significant abnormal returns, depends on the classification of green and non-green used. Our results show the presence of greenium for ESG-based portfolios, in particular for the LowESG and LowE portfolios. However, the greenium disappears when we test for the science-based classifications i.e. the CPRS (for carbon stranded assets) and the EU Taxonomy (for green assets) …“ (p. 24).

Risk reducing ESG: Investing During Calm and Crisis: Implied Expected Returns by Henk Berkman and Mihir Tirodkar as of March 15th, 2024 (#59): “… we use a novel and forward-looking measure of expected returns derived from contemporaneous stock option prices. Our main finding is that stocks with higher ESG scores have lower expected returns, however this is only observed during the Global Financial Crisis and the COVID-19 pandemic. We also find that the ESG risk premium term structure is positively related to ESG scores during crises, indicating that investors expect a reversion to normality within a year. .. we provide partial support for the theoretical prediction that ESG investing lowers expected returns. … our paper suggests that ESG investing may not be a source of systematically superior returns, but rather a way of expressing ethical preferences and temporarily reducing risk during unexpected crises …“ (p. 36).

Wenig Umweltwissen? Kooperation zwischen Aufsichtsrat, Wirtschaftsprüfer und Interner Revision – Empirische Befunde zum Einfluss von CSRD und CSDDD von Patrick Velte und Christoph Wehrhahn vom 15.3.2024: „Der Zusammenarbeit zwischen Aufsichtsrat, Wirtschaftsprüfer und Interner Revision kommt insbesondere vor dem Hintergrund aktueller EU-Nachhaltigkeitsregulierungen (CSRD und CSDDD) eine besondere Bedeutung zu. Eine intensivere Zusammenarbeit könnte u.a. in der Koordinierung von Revisions- bzw. Prüfungsschwerpunkten bei der (gemeinsamen) Überwachung der Nachhaltigkeitsberichterstattung nach der CSRD und der CSDDD bestehen. Hierfür ist eine signifikante Verbesserung der umwelt- und sozialbezogenen Kompetenzen und Ressourcen notwendig“ (p. 36).

Supplier audits: Selection, Payment, and Information Assessment in Social Audits: A Behavioral Experiment by Gabriel Pensamiento and León Valdés as of March 20th, 2024 (#9): “Companies often rely on third-party social audits to assess suppliers’ social responsibility (SR) practices. … We find that auditors who are paid and chosen by the supplier are more lenient, and the effect is more pronounced when the information observed suggests poor SR practices. … auditors who are merely paid by the supplier do not make more lenient decisions …. Our results … show that removing a supplier’s ability to choose its own auditor is critical to increase the detection of poor SR practices, particularly when the risk of bad practices is high” (abstract). My comment: With my shareholder engagement activities, I encourage companies to broadly evaluate all supplier according to ESG criteria, see Supplier engagement – Opinion post #211 (prof-soehnholz.com)

Impact investing research (in: SDG performance)

Benchmark-hugging: Optimizing Sustainable Performance: A Strategic Approach to Value Creation and Impactful Investing by Heiko Bailer as of Feb. 29th, 2024 (#51): “Backtests against the historic MSCI World benchmark from September 2019 to November 2023 … showed that stringent universe exclusions negatively impacted performance, increased portfolio size without lowering active risk though also reduced emissions and improved the overall Sustainable Development Goals (SDG) scores“ (abstract). “The amplification of regulatory constraints, coupled with an expanding array of universe exclusions, forms an unfavorable concoction restraining the potential for significant „Value Creation“ in sustainable investing. This circumstance results in a low sustainability threshold, shifting sustainable portfolio construction toward a predominantly “Value Alignment” strategy, albeit at substantial cost of traditional performance. …” (p. 21). My comment: For a detailed analysis see Nachhaltigkeit oder Performance? | CAPinside

Diverging SDG performance: The Costs of Being Sustainable by Emanuele Chini, Roman Kraussl, and Denitsa Stefanova as of Feb. 18th, 2024 (#24): “We define a new bottom-up measure of fund sustainability that links this concept to the alignment of the fund with the SDGs. Importantly, we disaggregate this measure in four components representative of different dimensions of sustainability: economy & infrastructure, environment, basic needs, and social progress. … funds with a positive impact on the economy & infrastructure and social progress SDGs are associated with higher returns whereas funds with a positive impact on environment and basic needs have lower returns. Second, institutional investors seem to infer this sustainability—returns relationship and show a preference for sustainability dimensions that are positively correlated with abnormal returns” (p. 24/25). My comment: As expected, different investment foci result in different performances. I doubt that good financial return prognostics (for different SDG-goals) are feasible. That speaks for SDG-goal diversification (which I sue in my mutual fund, see https://futurevest.fund/).

Homely shareholder voting: Home bias in shareholder voting by Xuan Li as of Nov. 10thm 2023 (#71): “Using a global data set from 2012 to 2022, I provide robust evidence that there is a significant home bias in shareholder voting. … An systematic review of investors’ voting polices suggests that investors actively seek out more information about domestic firms during the voting process in order to gain an information advantage in their home countries“ (p. 17).

Circular risk reduction: One, no one and one hundred thousand: how many firm risks are affected by the circular economy by Evita Allodi and Maria Gaia Soana as of March 20th, 2024 (#4): “We use a sample of 1,069 listed European non-financial companies over the period 2010-2022. We find that circular economy practices, implemented together, significantly decrease downside, idiosyncratic, and default risks. However, considering the three dimensions individually, only reduction and reusing mitigate these risks, while recycling does not“ (abstract).

Other investment research (in: SDG performance)

Normal non-normality: Diverging from the Norm: An Examination of Non-Normality and its Measurement in Asset Returns by Grant Holtes as of Feb. 17th, 2024 (#18): “This paper examines the normality of US equities and fixed income asset-class returns over 104 years” (abstract). “Returns are measurably non-normal … Returns are more normal at longer holding periods … The impacts section demonstrates that a normal assumption does not have a large impact on central estimates, but can have a large impact on estimates of low-probability events such as CVAR calculations …” (p. 10).

Crisis-delegation: Household portfolios and financial literacy: The flight to delegation by Sarah Brown, Alexandros Kontonikas, Alberto Montagnoli, Harry Pickard, and Karl Taylor as of Feb. 21st, 2024 (13x): “We analyse data on European household financial portfolios over the period 2004-2017, to explore how households change their asset allocations following the recent twin financial crises. … Our estimates show that the post-crisis period is associated with changes in European household asset allocation behaviour. Specifically, there are elevated holdings of safe assets and lower holdings of stocks and bonds, in line with the argument for cautiousness. At the same time, though, our findings reveal higher holdings of mutual funds in the post-crisis period. … This is consistent in line with a “flight to delegation”, that is, the utilisation of the perceived expertise of mutual funds managers. … the most literate households tend to hold significantly more mutual funds. … The findings for females implies a gender gap in financial literacy when investing in mutual funds which worsens following economic turmoil” (p. 14/15).

……………………………………………………………………………………………………………………………………..

Advert for German investors:

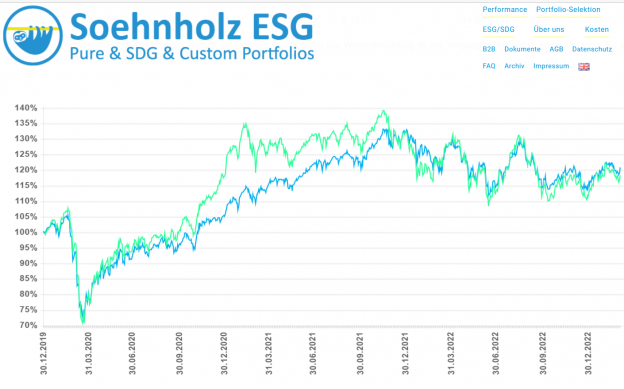

Sponsor my research by investing in and/or recommending my global small cap mutual fund (SFDR Art. 9). The fund focuses on the Sustainable Development Goals and uses separate E, S and G best-in-universe minimum ratings and broad shareholder engagement with currently 27 of 30 companies: FutureVest Equity Sustainable Development Goals R – DE000A2P37T6 – A2P37T or My fund (prof-soehnholz.com).