Financial health: Illustration from Riad Tchakou from Pixabay

9x new research on financial health, startups, circular economy, family firms, green revenues, green bonds, green CAPM, and index funds (# shows SSRN full paper downloads as of May 23rd, 2024)

Social and ecological research: Financial health and more

Financial health 1: Connecting Mental and Financial Wellbeing – Insights for Employers by Surya Kolluri, Emily Watson and High Lantern Group as of May15th,2024 (#29): “Financial health is deeply intertwined with mental health. Financial stresses, such as debt, significantly contribute to mental health challenges. This stress affects personal wellbeing and has profound implications on workplace productivity and employee engagement, affecting personal relationships, work performance, and overall wellbeing. Additionally, poor mental health also hinders effective decision-making by impairing the cognitive capacity crucial for evaluating financial options and risks which can lead to impulsive spending, poor financial planning, and increased vulnerability to stressinduced short-term financial decisions. By providing integrated education and support, employers play a crucial role in positively addressing the mutually reinforcing financial and mental health relationship” (p. 2).

Financial health 2: New insights into improving financial well-being by Jennifer Coats and Vickie Bajtelsmit as of May 1st, 2024 (#25): “Individual discount rates, risk preferences, and financial self-confidence consistently contribute to different indicators of FWB (Sö: Financial well-being). In particular, we find significant evidence that both the discount rate and self-confidence in financial decision-making have strong impacts on the dimensions of FWB. Financial literacy has an important moderating role in relation to these two drivers and to income. Personality traits, such as conscientiousness and neuroticism are influential in alternative ways across models” (abstract). … “The most important contribution of this study is the finding that individual discount rates play such an important role in determining composite financial well-being … Financial literacy appears to be necessary but not sufficient to enhance FWB. In particular, if individuals lack the confidence and/or patience to make sound financial decisions, the influence of financial literacy on FWB is limited” (p. 30).

Startup-migration: The Startup Performance Disadvantage(s) in Europe: Evidence from Startups Migrating to the U.S. by Stefan Weik as off Sept. 27th, 2023 (#202): “This paper explores the main drawbacks of the European startup ecosystem using a new dataset on European startups moving to the U.S. … Empirical evidence shows that startups moving to the U.S. receive much more capital, produce slightly more innovation, and are grow much bigger before exit than startups staying in Europe. More surprisingly, I find that U.S. migrants do not increase their revenues for many years after migration, instead incur higher financial losses throughout, and do not significantly improve their likelihood of achieving an IPO or successful exit. Additional evidence shows that large parts of the innovation, net income loss, and growth difference can be explained by U.S. migrants’ funding advantage. … European startups are only marginally, if at all, hindered by technology, product, and exit markets, but that the main disadvantage is the VC financing market“ (p. 24/25).

Full circle? The Circular Economy by Don Fullerton as of May 16th, 2024 (#47): “Research about the circular economy is dominated by engineers, architects, and social scientists in fields other than economics. The concepts they study can be useful in economic models of policies – to reduce virgin materials extraction, to encourage green design, and to make better use of products in ways that reduce waste. This essay attempts to discuss circular economy in economists’ language about market failures, distributional equity, and policies that can raise economic welfare by making the appropriate tradeoffs between fixing those market failures and achieving other social goals” (p. 15).

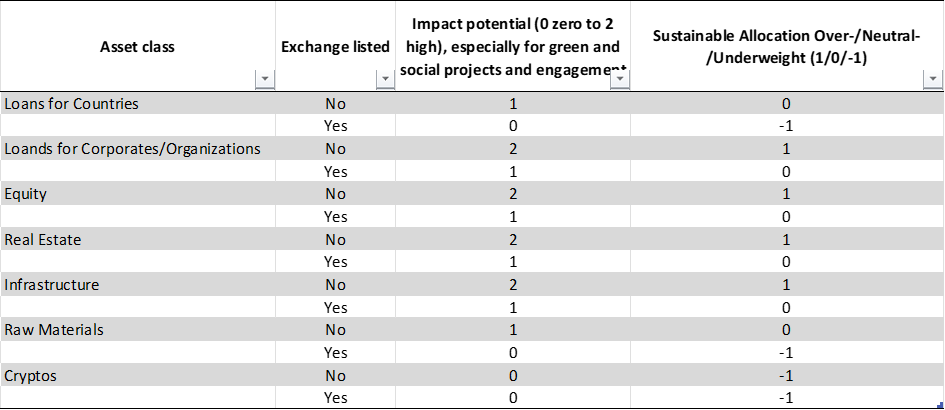

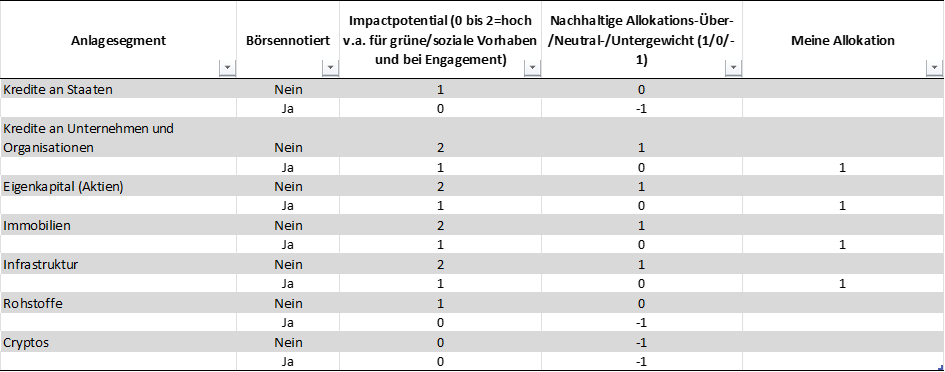

ESG investment research (in: “Financial health”)

Green families: Family-Controlled Firms and Environmental Sustainability: All Bite and No Bark by Alexander Dyck, Karl V. Lins, Lukas Roth, Mitch Towner, and Hannes F. Wagner as of May15th, 2024 (#11): “We find that family-controlled firms have carbon emissions that are indistinguishable from those of widely held firms. … Further, we find that family-controlled firms have significantly lower carbon emissions than widely held firms in countries where a government has not taken significant climate actions and there is thus a substantial risk of policy tightening in the future. … Our paper also finds that, relative to widely held firms, family-controlled firms are significantly less likely to disclose and perform well against the myriad qualitative metrics that comprise a large component of ESG rating agency scores …” (p. 26/27). My comment: With more supply chain transparence ESG-ratings of public and privately held suppliers will become much more important, see Supplier engagement – Opinion post #211 – Responsible Investment Research Blog (prof-soehnholz.com)

Green institutional benefits: In the Pursuit of Greenness: Drivers and Consequences of Green Corporate Revenues by Ugur Lel as of May 19th, 2024 (#142): “Firms are increasingly turning to green products and services in recent years …Drawing on an extensive dataset spanning from 2008 to 2023 across 49 countries, … I find that foreign institutional ownership, especially from countries with rigorous environmental regulations and norms, significantly boosts green revenue intensity. … These effects are mostly present in carbon-intensive firms …. I also observe a significant increase in green revenues following the implementation of EU Green Deal, accompanied by improvements in CO2 emissions and other environmental policies. There is also an immediate effect of green revenues on profit margins but only for firms in clean industries” (p. 26/27).

Green reputation pays: The reputation effect of green bond issuance and its impact on the cost of capital by Aleksandar Petreski, Dorothea Schäfer, and Andreas Stephan as of Nov. 19th, 2023 (#61): “This study provides a deeper understanding of the mechanism behind the established negative relationship between green bond issuances and financing costs. The paper hypothesized that this negative relationship can be explained by reputation effects that arise from repeated green bond issuances. … The econometric results … using Swedish real estate firms confirm that it is not the occasional issuance of green bonds but the repeated green bond issuance that reduces the firm’s cost of capital. This effect is also found for the cost of equity. … Additional econometric results confirm the effect of green-bond issuance on reputation using ESG scores as a reputation proxy variable. We find that all aspects of the ESG composite score—environmental, social, and governance pillars—are positively affected by a long track record of green bond issuance, whereas only the governance pillar of ESG is positively affected by a long track record of non-green issuance“ (p. 18).

ESG investment model: Modelling Sustainable Investing in the CAPM by Thorsten Hens and Ester Trutwin as of April 22nd, 2024 (#202): “We relate to existing studies and use a parsimonious Capital Asset Pricing Model (CAPM) in which we model different aspects of sustainable investing. The basic reasoning of the CAPM, that investors need to be compensated for the bad aspects of assets applies so that investors demand higher returns for investments that are harmful from an environmental, social, and governance (ESG) perspective. Moreover, if investors have heterogeneous views on the ESG–characteristics of a company, the market requires higher returns for that company, provided richer investors care more about ESG than poorer investors, which is known as the Environmental Kuznets Curve (EKC). Besides the effect on asset prices, we find that sustainable investing has an impact on a firm’s production decision through two channels – the growth and the reform channel. Sustainable investment reduces the size of dirty firms through the growth channel and makes firms cleaner through the reform channel. We illustrate the magnitude of these effects with numerical examples calibrated to real–world data, providing a clear indication of the high economic relevance of the effects” (abstract).

Traditional investment research

Smart investors: Is Money in Index Funds Smart? by Jeffrey A. Busse, Kiseo Chung, and Badrinath Kottimukkalur as of Jan. 17th, 2024 (#157): “Passive funds with inflows generate positive risk-adjusted returns during the subsequent year and outperform funds with outflows, consistent with the notion that index fund money is “smart.” Similar outperformance during the next year is not present in active funds seeing higher inflows. Passive funds that outperform see high inflows even though their performance does not persist after accounting for size, value, and momentum. These findings suggest that the “smart money” effect in passive funds reflects genuine investor ability …“ (abstract).

…………………………………………………………………………………………………………………………………………

Werbehinweis (in. „Financial health“)

Unterstützen Sie meinen Researchblog, indem Sie in meinen globalen Small-Cap-Anlagefonds (SFDR Art. 9) investieren und/oder ihn empfehlen. Der Fonds mit aktuell sehr positiver Performance konzentriert sich auf die Ziele für nachhaltige Entwicklung (SDG: Investment impact) und verwendet separate E-, S- und G-Best-in-Universe-Mindestratings sowie ein breites Aktionärsengagement (Investor impact) bei derzeit 27 von 30 Unternehmen: FutureVest Equity Sustainable Development Goals R – DE000A2P37T6 – A2P37T und My fund – Responsible Investment Research Blog (prof-soehnholz.com)