The beginning, stats and topics

„100 research blogposts“: I have been interested in scientific research for a very long time. Also, I have always enjoyed writing and published my first scientific articles while I was still a student. Since 2014 I have my own blog. I present links to and summaries of other people’s scientific contributions there since July 2018. Since mid-2019, I have been publishing 10 to 20 summaries of scientific studies every two weeks or so. On October 19, 2022, I created my one hundredth such research blogposts.

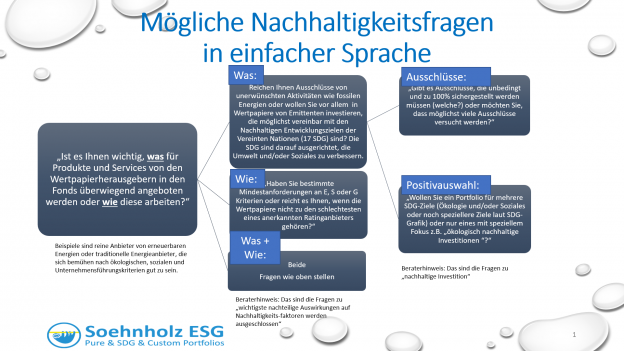

For this, I summarize research that I consider interesting and good. Initially, I focused only on research related to sustainable investing. Over time, other topics were added, specifically environmental, social, and corporate governance topics not directly related to investing, research on general investing topics such as asset allocation, fund selection, security selection, and risk management, and papers focusing on stocks, bonds, and especially alternative investments such as real estate, private equity, and hedge funds. In addition, cover financial technology (fintech) topics on advisortech, advicetech, wealthtech, and specifically model portfolios, robo-advisors, and direct indexing.

Research blogposts: Many sources and certain requirements

I mainly include scientific research articles which are free to access. My main source are the newsletters of publications of the Social Sciences Research Network. Currently, I subscribe to over 80 newsletters in the areas of Economics, Energy, Entrepreneurship, Financial Planning, Governance, Investments, Law, Management, Philosophy, Sociology, and Sustainability. From time to time I also actively search within SSRN for new contributions, especially those with the focus on ESG and Impact.

I also analyze contributions with interesting statistics from NGOs like Planet Tracker and for-profit organizations like Morningstar and MSCI and from my network (see e.g. my third-party links at www.prof-soehnholz.com). In addition, I point out innovative or surprising corporate activities, especially from the USA and Great Britain, which can serve as a model for German-speaking countries. I usually do not take into account unscientific surveys and purely conceptual or opinion contributions.

Early publication, but not necessarily peer-reviewed

Often, I am one of the first to download such contributions in their entirety. After briefly analyzing them, I include the contributions in my blogposts as soon as possible after they have been made available online. Also, I indicate the number of SSRN downloads at the time my blog post is published. This allows my readers to gauge how well-known or popular the research posts I include currently are.

At that point, the articles are often already scheduled for publication in scientific journals, but have not yet been reviewed by other scientists (i.e., without peer review). When downloading the full articles, SSRN explicitly points out this limitation. I myself cannot check the publications in detail for their quality, but I try to heed warning signals and to weed out bad contributions in advance, of which there are unfortunately more and more (cf. e.g. The Corrupt Institutions of Development Economics and Its Shadow Professoriate by Bryane Michael, September 10, 2022).

Anti-Quant research blogposts? Excursus on evidence

Left unconsidered are contributions that suggest they can generate future outperformance (alpha). This is due to the fact that many such studies are, in my opinion, based on so-called data mining and/or inappropriate or very sensitive models (this is what I call pseudo-optimizations, see e.g. Kann institutionelles Investment Consulting digitalisiert werden? Beispiele. – Responsible Investment Research Blog (prof-soehnholz.com)).

Similarly, I usually do not consider studies that attribute only positive diversification properties to any investments. The reason: If additional investments are different from already existing investments, one can, by definition, expect positive diversification properties.

Thus, I distance myself from so-called quantitative investors (quants) or a narrowly understood „quant“ evidence-based investments term. Thus, I do not define evidence-based investing to mean everything that can be shown with data as some others do, especially supporters of so-called factor investments. By evidence-based investments I understand that one should know the scientific results known at the time of investment and implement them if possible. I especially this definition: „Evidence-Based Investing (EBI) is a disciplined approach to asset management that combines the data we have from the past and present with honesty about the unknowable future. Where others would use forecasts, relationships or emotions to guide their decisions, practitioners of EBI would substitute facts, logic and reason“ (see 2016 Evidence Based Investing Conference by IMN; see also Evidence-Based Investing – Interesting for all Passive and Robo-Advisor Fans).

My biases and how I use evidence myself

I also have conscious and perhaps unconscious biases in that I primarily include research that could be relevant to financial investors and people interested in sustainability from Germany, Austria and Switzerland. My approach is selective and means that I certainly can not include all good contributions on the topics I mentioned above in my blog. Moreover, I do not present the complete abstracts or summaries of the respective contributions, but only the most important results from my point of view.

I have now been involved with sustainable investing for quite some time. After co-developing a Sustainable Private Equity fund of funds in 2007, I introduced ESG selection criteria for several equity funds starting in 2012. I pioneered ESG ETF portfolios (2015), pure ESG portfolios (2016) and SDG ETF portfolios (2019) and I am one of the first to advocate Direct ESG Indexing in Europe. Already in 2017, half of the portfolios I offered publicly were sustainable. Since then, new portfolios have been developed almost exclusively using ESG criteria and, more recently, SDG (Sustainable Development Goals) criteria. To do this, I take into account the findings from the studies I analyze as much as possible.

I also use the research findings to advise interested parties and clients. In „Das Soehnholz ESG und SDG Portfoliobuch„, my current investment principles and rules are documented in detail and in an „archive“ the corresponding documentation of previous years is also publicly available. I also use the research findings for my other publications, including my now nearly 200 other (“opinion”) blog posts.

Free for all research blogposts, including competitors

I want to advance evidence-based investing in general, and I don’t necessarily expect everyone interested in it to invest in my portfolios. That’s why I want to make the research as widely known as possible. This works best if I give it away for free. I am especially happy about supporters who further publicize my research. This can be done, for example, through social media referrals. I also like to collaborate with other companies. For example, Exxec News provides part of my research to its users for free.

The relatively extensive time I invest in reading and preparing the research I mentally chalk up to „pro-bono“ or marketing costs. Obviously, whoever would like to support my research activities is welcome to invest – starting at about 50 Euro – in my investment fund (see www.futurevest.fund) and/or recommend this fund or my other (model portfolio) services.

Additional information

My investment philosophy and portfolios: The Soehnholz ESG and SDG portfolio book

Blog posts by topic: Passive, responsible and online investing

Research blog posts: The Soehnholz ESG and Impact Research Book

Numerous other publications/presentations/videos at www.prof-soehnholz.com

This text has been translated with www.DeepL.com/Translator (free version)