Neutral ESG: 14x new research on migration gender topics, re-migration, AI, broadband, political ESG investments, ESG ratings, ESG alpha, ESG credit risk, greenium, anomalies, robo-advisors, private equity and finfluencers (# shows the number of SSRN full paper downloads as of Jan. 25th, 2024).

Social and ecological research (Neutral ESG)

Female migration disadvantages: Does Granting Refugee Status to Family-Reunified Women Improve Their Integration? by Linea Hasager as of Jan. 18th, 2024 (#4): “… I estimate the impact of recognizing women, who are initially admitted through family-reunification procedures, as refugees themselves. When they are recognized as refugees, they are able to divorce their husbands without automatically being returned to their origin countries. … I show that the divorce rate increases following asylum recognition. In addition, I document that the risk of being a victim of violence decreases when women change residency. … Asylum recognition also has positive consequences for females’ employment and earnings trajectories“ (p. 14).

Ukrainian return-migration: The Effect of Conflict on Ukrainian Refugees’ Return and Integration by Joop Adema, Cevat Giray Aksoy, Yvonne Giesing, and Panu Poutvaara as of Jan. 18th, 2024 (#16): “Our analysis has highlighted that the vast majority of Ukrainians in Ukraine plan to stay and most Ukrainian refugees in Europe plan to return. … we find that close to 2% of Ukrainian refugees returned every month. … Ukrainians’ confidence in their government and optimism have reached exceptionally high levels in international comparison (Fig. 6). … Confidence in the judiciary remains low, and corruption is perceived to be high“ (p. 24).

Is AI bad for migrants? The Impact of Technological Change on Immigration and Immigrants by Yvonne Giesing as of Jan. 18th, 2024 (#17): “We analyse and compare the effects of two different automation technologies: Industrial robots and artificial intelligence … (with) data on Germany … (we) identify how robots decrease the wage of migrants across all skill groups, while neither having a significant impact on the native population nor immigration flows. In the case of AI, we determine an increase in the wage gap as well as the unemployment gap of migrant and native populations. This applies to the low-, medium- and high-skilled and is indicative of migrants facing displacement effects, while natives might benefit from productivity and complementarity effects. In addition, AI leads to a significant inflow of immigrants“ (abstract).

Healthy broadband? Broadband Internet Access and Health Outcomes: Patient and Provider Responses in Medicare by Jessica Van Parys and Zach Y. Brown as of Jan. 23rd, 2024 (#16): “… we show that patients had better health outcomes and visited higher quality providers when they gained access to broadband internet. Our results imply that internet access makes patient demand more elastic with respect to quality. This mechanism is particularly important in hospital markets that are highly concentrated. … Overall, counterfactual simulations imply that broadband expansion was responsible for 16% of the total reduction in poor health outcomes for joint replacements from 1999 to 2008” (p. 25/26). My comment: I include this rather specific research because I have been discussing e.g. with ratings experts if telecommunications infrastructure can be SDG-aligned or not (for my approach see

ESG investment research (Neutral ESG)

Right-wing or green: Climate Polarization and Green Investment by Anders Anderson and David T. Robinson as of Jan. 24th, 2024 (#11): “Over the last decade, one of the world’s largest retirement systems (Sö: Sweden) went from offering very few climate-friendly investment choices to being dominated by them. … For men, proximity to extreme weather events increased the likelihood that they grew more concerned about global warming, while women across the board became more concerned about the climate, regardless of their proximity to adverse weather events. At the same time, men living in right-wing strongholds were generally less concerned about climate change after the extreme weather events than they were before” (p.28).

Negative or neutral ESG? Understanding the effect of ESG scores on stock returns using mediation theory by Serge Darolles, Gaelle Le Fol, and Yuyi He as of Dec. 7th, 2023 (#42): “We show that the information contained in corporate E, S, G or overall ESG scores is effectively incorporated into stock prices through both the investor demand channel and the fundamental/profitability channel. … institutional ownership is positively correlated with a firm’s environmental, social, governance and overall ESG scores. … We also find that they are more sensitive to G-performance and overall ESG performance than S and then E performance. Our results also show that ESG is priced by the market and that all scores have a significant negative impact on future returns. …” (p. 25/26). My comment: It would be interesting to see this approach applied not only to US stocks (mainly large caps) and more recent stock price levels.

Positive or neutral ESG? Material ESG Alpha: A Fundamentals-Based Perspective by Byung Hyun Ahn, Panos N. Patatoukas, and George S. Skiadopoulos as of Jan.17th, 2024 (#81): “We provide a fundamentals-based perspective on why firms with improving material ESG scores outperform. More financially established firms—firms with larger size, lower growth, and higher profitability relative to their sector—are associated with subsequent improvements in their material ESG score. … we find that the materiality portfolio does not generate alpha after we account for its exposure to profitability and growth pricing factors “ (p. 30). My comment: An investment strategy which focuses on ESG-improvement would have to ignore investments which already have high ESG-ratings or sell them to buy one with lower ratings to show improvement. This is not a responsible investment strategy.

Low ESG credit risks: ESG criteria and the credit risk of corporate bond portfolios by Andre Höck, Tobias Bauckloh, Maurice Dumrose, and Christian Klein as of Oct. 25th, 2023: “… our findings highlight that the implementation of an ESG-best-in-class strategy significantly affects the credit risk exposure without any performance or diversification penalty. … the higher the sustainability, the lower the credit risk. … The findings of this study are robust to the usage of ESG ratings from different providers and different asset pricing models” (p. 579).

Unstable greenium: The European Carbon Bond Premium by Dirk Broeders, Marleen de Jonge, and David Rijsbergen from De Nederlandsche Bank as of Jan. 16th, 2024 (#36): “We present evidence of the existence of a significant carbon premium in euro area corporate bonds, which has steadily increased since early 2020. Over the whole sample period, from 2016 to 2022, we observe that a doubling of a firm’s Scope 1 and 2 emissions on average implies 6.6 basis point higher bond yield spreads. … From early 2020, the carbon premium increases steadily so that the effect more recently, in early 2022, is substantially higher than the sample average. A doubling of Scope 1 and Scope 2 emissions by early 2022 on average results in a higher spread of 13.9 basis points. This means that European firms with high levels of carbon emissions face increasingly high financing costs. Our research also reveals a distinctive carbon premium term structure, rising with longer maturities. … the premium between short-term and long-term maturity bonds has diminished in recent years. … Our findings highlight, to some extent, why various studies have come to conflicting conclusions on the presence and magnitude of a carbon premium in financial asset prices. We show that the choice of sample period is an important determinant of the presence and extent of a carbon premium. … Additionally, we illustrate how climate litigation has become an important frontier of transition risk in the last years, which may have urged investors to progressively price a carbon premium” (p. 33/34).

Positive ESG pay: ESG-linked Pay Around the World —Trends, Determinants, and Outcomes by Sonali Hazarika, Aditya Kashikar, Lin Peng, Ailsa Röell and Yao Shen as of April 15th, 2023 (#308): “We study ESG-linked executive compensation contracts using an inclusive global sample of major firms across 59 countries over the period 2005-2020. We document a substantial increase in firms’ adoption of ESG-linked pay over the last decade, especially for firms from developed markets and those that belonging to the extractive and utility industries. The adoption decision is also strongly associated with the culture, shareholder rights and legal origin of the country where the firm resides. Among firm characteristics, large firms and firms with greater return on assets are more likely to adopt. The ESG-linked pay adopters exhibit significantly higher ESG scores, better ESG disclosure, and higher operating profit margin and return on assets. … we show that the treatment firms’ increased reliance on incentives tied to employee satisfaction is a plausible channel to achieve a “win-win” outcome” (p. 29/30). My skeptical comment: See HR-ESG shareholder engagement: Opinion-Post #210 and especially Wrong ESG bonus math? Content-Post #188

Other investment research

Normalized anomalies: Does U.S. Academic Research Destroy the Predictability of Global Stock Returns? by Guohao Tang, Yuwei Xie and Lin Zhu as of Jan. 16th, 2024 (#52): “We conduct a thorough investigation into 87 cross-sectional return anomalies, as documented in leading finance and accounting journals, spanning 38 countries. … In the global market, post-sample and post-publication returns diminish by 65% and 73%, respectively, from the in-sample mean. Intriguingly, predictors that demonstrate higher in-sample returns experience a more pronounced reduction in the post-publication phase“ (p. 16).

Robo-limits: Taming Behavioral Biases in Consumer Decision-Making: The Role of Robo-Advisors by Francesco D’Acunto and Alberto G. Rossi as of Dec. 20th, 2023 (#41): “… in many cases robo-advising applications can help consumers make better choices but this is in no way universal. Indeed, not only do robo-advisors in some cases exacerbate the effect of underlying behavioral biases, but they sometimes even exploit behavioral biases in ways that might improve or worsen choices. Even for those cases in which extant research shows a positive average effect of exposure to robo-advising on medium-term outcomes for consumers, the effects are often highly heterogeneous“ (p. 26).

Political PE: Political Connections and Public Pension Fund Investments: Evidence from Private Equity by Jaejin Lee as of Dec. 29th, 2023 (#36): “This paper investigates the effects of political connections on private equity (PE) investment decisions by public pension funds, using a regression discontinuity design on U.S. state elections. A comparison of PE managers (GPs) donating to winning and losing candidates reveals a twofold increase in the probability of post-election PE investments from pension funds for GPs supporting winners. Pension funds with such connections show underperformance in PE investments. These effects are pronounced among pension board members with connections and in states with high corruption levels. These connected pension funds pay higher PE fees and exhibit more home-state bias, suggesting politicians influence investment decisions for personal gain” (abstract).

Finfluencer issues: The Finfluencer Appeal: Investing in the Age of Social Media Serena by Espeute and Rhodri Preece from the CFA Institute as of Jan. 25th, 2024: “Our analysis of finfluencer content posted on YouTube, TikTok, and Instagram in the markets we studied shows that the most discussed asset classes were individual shares, index funds, and exchange-traded funds (ETFs). We found that 45% of this content offered guidance, 36% contained investment promotions, and 32% contained investment recommendations … Only 20% of the finfluencer content that contained recommendations, however, included any form of disclosure (such as the professional status of the finfluencer or whether the finfluencer received commissions or other forms of payment for recommending certain products). Further, just over half (53%) of the content that contained promotions made any form of disclosure. … Moreover, when disclosures regarding affiliate links (such as sign-up links to open accounts with trading platforms or free shares) were made, they were often generic, such as “some of the links may be affiliate links,” which obscured exactly which websites and/or product sign-ups the finfluencers were being remunerated for. … Finfluencers appeal to Gen-Z investors because they produce educational and engaging content that is free and instantly accessible. They are also relatable and, in some cases, perceived to be trustworthy“ (p. 3).

……………………………………………………………………………………………………………………………………………

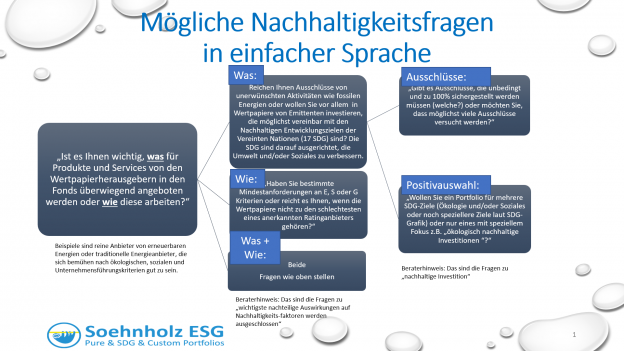

Advert for German investors

Sponsor my research by investing in and/or recommending my global small/midcap mutual fund (SFDR Art. 9). The fund focuses on social SDGs and uses separate E, S and G best-in-universe minimum ratings and broad shareholder engagement with currently 25 of 30 companies: FutureVest Equity Sustainable Development Goals R – DE000A2P37T6 – A2P37T or Noch eine Fondsboutique? – Responsible Investment Research Blog (prof-soehnholz.com)