Complex RI: >20x new research on strategic sustainability, climate logistics, human rights, ESG flows, climate uncertainty, climate funds, banks, divestments, impact funds, sustainable startups, thematic funds, fund managers, passive investments, PFOF, DCF, REITS, NFT, ICO

I started my first research-blogpost in July 2018. The first 60 posts are included in Das Soehnholz ESG und Impact Researchbuch. Meanwhile, I almost weakly summarize about 20 third party research publications which may be interesting for others as well. Most of the research has been read by only a few people before me, unfortunately. Please feel free to like/comment/share my blogpost (to enhance evidence based and responsible investments).

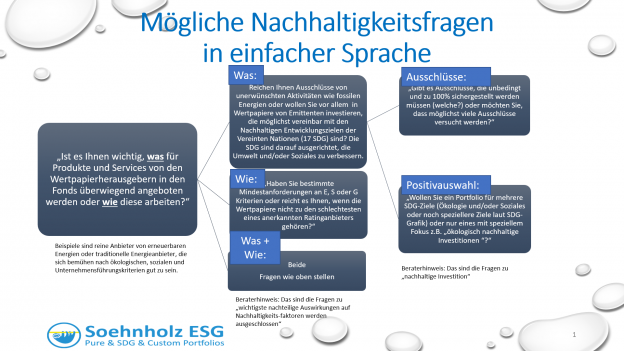

Advert: Check my article 9 SFDR fund FutureVest Equity Sustainable Development Goals. With my most-responsible selection approach I focus on social SDGs and midcaps and use best-in-universe as well as separate E, S and G minimum ratings.

Continue on page 2 (# indicates the number of SSRN downloads on May 1st):