Impactfonds: Foto von Mastertux von Pixabay

Es ist schwierig, passende nachhaltige Fonds zu finden

Nachhaltige Investments sind kein No-Brainer. Ein Problem dabei: Nachhaltige Investments können sehr unterschiedlich definiert werden. Ich verweise meist auf das von mir mit entwickelte Policies for Responsible Invesment Scoring Concept der DVFA (DVFA PRISC, vgl. Kapitel 7.3 in Das Soehnholz ESG und SDG Portfoliobuch). Damit können Anleger, Berater und Anbieter ihre individuelle Nachhaltigkeitspolitik festlegen. Das ist einfach. Schwierig wird es, wenn die dazu passenden Investmentfonds gefunden werden sollen. In diesem Beitrag zeige ich, wie man das machen kann und welche Fonds besonders gut zu meinen Nachhaltigkeitsanforderungen passen.

Wenig überraschend ist, dass der von mir beratene Fonds dabei am besten abschneidet. Neu für mich war aber, wie stark die Unterschiede zu anderen Smallcap-Fonds sind, die den Fondsnamen nach mit meinem Fonds vergleichbar sein sollten. Das gilt auch für die Performance.

Was ist ein liquider Impactfonds?

Laut Bundesinitiative Impact Investing ist wirkungsorientiertes Investieren ein Investmentansatz, der neben einer finanziellen Rendite auch eine messbare ökologische und/oder soziale Wirkung erzielen soll.

Ich beschränke mich in dieser Analyse auf liquide Investments. Das heißt, dass ich nur Fonds vergleiche, die in börsennotierte Wertpapiere investieren. Damit werden Fonds ausgeklammert, die Empfängern direkt zusätzliches Eigen- oder Fremdkapital bringen können. Das reduziert den potenziellen Impact von Fonds.

Allerdings ist mir die jederzeitige Änderungsmöglichkeit von Investments sehr wichtig. Das zeigt sich daran, dass ich bisher schon 60 Aktien aus meinem im August 2021 gestarteten und aus 30 Aktien bestehenden Fonds verkauft habe (vgl. Divestments: 49 bei 30 Aktien meines Artikel 9 Fonds und das Engagementreporting auf FutureVest Equity Sustainable Development Goals). Verkaufsgründe waren überwiegend meine zunehmend höheren Nachhaltigkeitsansprüche und (relativ) verschlechterte Nachhaltigkeit der Aktien im Portfolio. Mit illiquiden Investments ist man meistens mehrere Jahre an diese gebunden. Das bedeutet, dass man ein relativ hohes Nachhaltigkeitsrisiko eingeht (vgl. Free Lunch: Diversifikation nein, Nachhaltigkeit ja?).

Man kann zwei Arten von Impactinvestments unterscheiden, nämliche solche mit Fokus auf den Impact der Anlagen selbst und andere, die den Impact von Anlegern Berücksichtigen (vgl. Impactleitfaden der DVFA DVFA-Fachausschuss Impact veröffentlicht Leitfaden Impact Investing und ähnlich Eurosif und Forum nachhaltige Geldanlagen, Marktbericht 2024 S. 13). Im ersten Fall sind das zum Beispiel Aktien und Anleihen von Herstellern erneuerbarer Energien. Im zweiten Fall ist das die positive Einflussnahme von Anlegern über Stimmrechtsausübungen und andere Formen von Engagement, um Investmentziele nachhaltiger zu machen.

109 diversifizierte Impactfonds?

In Deutschland werden aktuell ungefähr neuntausend Investmentfonds mit insgesamt 34.500 Anteilsklassen öffentlich angeboten (vgl. Fonds-Suche | DAS INVESTMENT Fonds Explorer). Ungefähr 4% davon bzw. 350 sind Fonds nach dem strengsten Nachhaltigkeitsartikel 9 der Offenlegungsverordnung.

Man könnte annehmen, dass nur Artikel 9 Fonds auch Impactfonds sein können. Das Forum nachhaltige Geldanlagen kommt aber zu anderen Ergebnissen. Danach fallen „fast 60 Prozent der Artikel-6-Mandate bzw. Spezialfonds … in die Kategorie „Impact-Aligned“ (FNG Marktbericht 2024, S. 20). Das erscheint mir sehr viel.

Für meine eigene Analyse habe ich mir die verfügbaren Fonds auf www.morningstar.de angesehen und nach Stichworten im Fondsnamen gesucht. Ich interessiere mich dabei vor allem für Fonds mit Impact und Sustainable Development Goals im Namen. Bei den sogenannten aktiven Fonds finde ich nur 582 von 62325, also 0,9% aller potenziellen Anteilsklassen mit „Impact“ im Namen. Hinzu kommen 0,4% mit „Sustainable Development Goals“ bzw. „SDG“ im Namen. Insgesamt finde ich sich so 84 unterschiedliche Impactfonds.

Ohne Transitions-, reine Engagement- und wenig diversifizierte Fonds

Dabei habe ich Fonds ausgeklammert, die Transitionen von schlechteren zu besseren Nachhaltigkeiten anstreben. Das wären zum Beispiel Paris-Aligned Benchmark (PAB) Fonds. Diese investieren in Aktien und Anleihen von Organisationen, die sich auf einem CO2-Reduktionspfad befinden. Darunter sind oft Unternehmen mit aktuell noch hohen Emissionen und wenig nachhaltigen Produktangeboten. Solche Fonds sind nach meiner Auffassung keine konsequenten SDG-vereinbaren Fonds, zu denen ich nur Fonds mit Wertpapieren zähle, die in Bezug auf ihre Produkte und Services bereits möglichst nachhaltig sind.

Man könnte auch noch die 134 Anteilklassen mit „Engagement“ im Namen nutzen. Darauf verzichte ich aber ebenfalls (wenn nicht SDG oder Impact zusätzlich im Namen enthalten sind), denn für mich sollten die Emittenten der Wertpapiere im Fonds vor allem mit den SDG vereinbare Produkte und Services anbieten. Wenn dann noch Shareholder Engagement dazu kommt, ist das gut. Aber nur Engagement ohne SDG-Vereinbarkeit reicht mir für meinen Impactansatz nicht aus.

Ich interessiere mich vor allem für potenzielle Wettbewerber für den von mir beraten branchen- und länderdiversifizierten Aktienfonds. Deshalb betrachte ich hier keine länderspezifischen oder branchen- bzw. themenspezifischen Fonds, auch nicht solche für erneuerbare Energien oder Mikrofinanz. Ich klammere auch Anleihefonds mit Fokus auf grüne, soziale und andere nachhaltige Anleihen aus, sofern sie nicht SDG oder Impact im Namen nutzen.

Dafür füge ich Fonds hinzu, die dem Global Challenges Index bzw. dem nx25 Index folgen. Der Grund dafür ist, dass mein Fonds manchmal mit diesen Fonds verglichen wird.

Bei den ETFs finde ich nur einen Impact-ETF mit Umweltfokus sowie nur zwei SDG-diversifizierte-ETFs, die ich beide in der Detailanalyse berücksichtige.

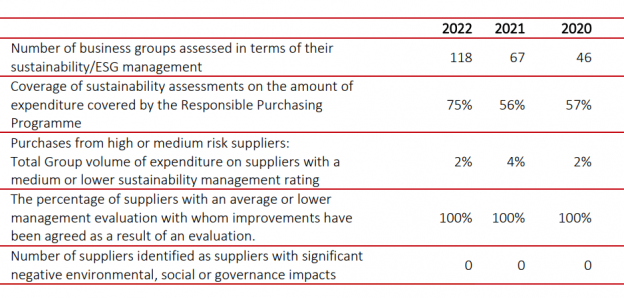

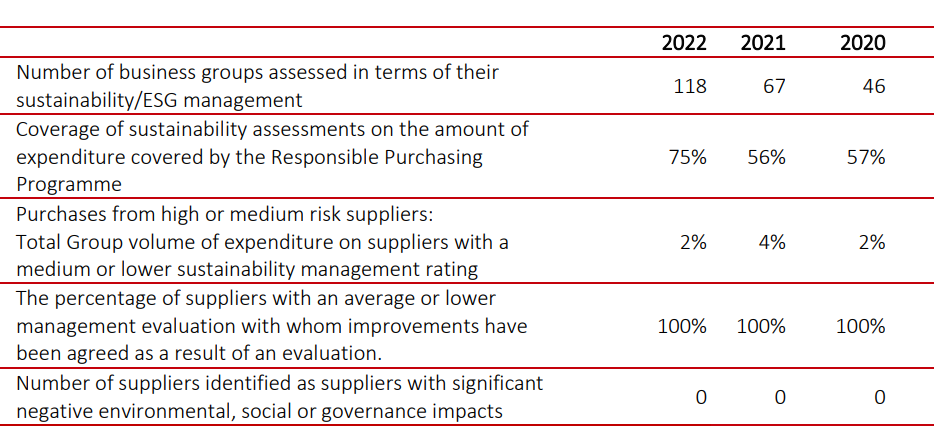

Insgesamt erhalte ich so 109 „Impactfonds“. 34 davon sind Anleihefonds, 7 sind Mischfonds und 3 sind Protected- bzw. Garantie- oder Hedgefonds. Damit bleiben 65 Aktienfonds übrig. 37 sind globale Aktienfonds, die grundsätzlich alle Unternehmensgrößen abdecken (Allcaps),12 sind überwiegend auf mittelgroße Unternehmen (Midcap) fokussierte globale Aktienfonds und 5 sind regional fokussierte Fonds. Bis auf zwei regionale Fonds enthalten diese nur relativ wenige Smallcaps, die in meinem Fonds vorherrschend sind. Damit bleiben 11 überregionale Smallcapfonds für den Detailvergleich übrig.

Detailvergleich von 11 globalen sogenannten Impactfonds mit Smallcapfokus

Idealerweise wird ein Nachhaltigkeitsvergleich der von mir selektieren Fonds mit kostenlos verfügbaren und damit extern einfach nachprüfbaren Daten durchgeführt. Die mir bekannten derartigen Datenbanken sind jedoch wenig transparent, nutzen nur Best-in-Class ESG Ratings und/oder enthalten nur einen Teil der mich interessierenden Fonds und Nachhaltgigkeitsdaten.

Deshalb habe ich die Fonds mit der kostenpflichtigen Datenbank von Clarity.ai analysiert. Diese hat den Vorteil, dass sie – mit Ausnahme eines neuen ETFs – für alle 11 Fonds detaillierte SDG- und ESG-Analysen ermöglicht. Dabei werden möglichst alle Aktien einzeln analysiert und dann auf Portfolioebene aggregiert.

Bei der Interpretation der Ergebnisse ist zu berücksichtigen, dass solche Nachhaltigkeitsanalysen je nach Datenanbieter und Stichtag (hier: Mitte Juni 2024) unterschiedliche Ergebnisse ergeben können. Zu beachten ist auch, dass die Ratings oft annähernd normalverteilt sind, d.h. die Streuung in der Mitte ziemlich hoch ist und Ausreißer selten sind. Das bedeutet, dass ein durchschnittliches ESG-Rating von 55 gegenüber 50 einen erheblichen Unterschied bedeuten kann.

Nur 1 diversifizierter konsequenter Smallcap-Impactfonds?

Ich analysiere sogenannte unerwünschte Aktivitäten, ESG-Ratings und SDG-Vereinbarkeiten. ESG-Ratings fassen dabei ESG-Risiken inklusive Kontroversen zusammen, ohne finanzielle Aspekte zu berücksichtigen. Dabei nutze ich ein Best-in-Universe Rating. Das bedeutet, dass Umwelt-, Sozial- und Unternehmensführungsrisiken aller über fünfundzwanzigtausend gerateten Unternehmen miteinander verglichen werden und nicht brancheninterne (Best-in-Class) Ratings genutzt werden. ESG-Risiken haben eine mögliche Bandbreite von 0 bis 100 und SDG-Vereinbarkeit wird über SDG-vereinbare Umsätze gemessen, von denen vorher unvereinbare Umsätze abgezogen werden (Netto-Umsatz-Ansatz).

Die hier analysierten 11 Fonds investieren insgesamt in über 200 Unternehmen mit einigen von 37 von mir unerwünschten und vermiedenen Aktivitäten. Das sind vor allem in Unternehmen, die Tierversuche durchführen. Dutzende weitere Unternehmen haben Abhängigkeiten von fossilen Brennstoffen oder Waffen.

Die SDG-(Netto-)Umsatzvereinbarkeit ist mir besonders wichtig. Am besten schneidet dabei der von mir beraten Fonds Futurevest Equities SDG R mit 88% ab. Drei weitere Fonds liegen um die 80%. Damit sind für mich nur diese 4 Smallcap-SDG Fonds konsequente Impactfonds. Zwei davon setzen vor allem auf erneuerbare Energien, einer auf Gesundheit und nur der von mir beratene Fonds auf beide und weitere Segmente.

Zwei weitere Fonds haben etwas über 50% SDG-Umsätze. Für mich überraschend ist, dass für 6 Fonds unter 50% netto SDG-Umsätze ausgewiesen wird. Ein Fonds mit „SDG-Engagement“ im Namen schneidet mit 7% am schlechtesten ab. Das Fondsmanagement will mit seinem Engagement dabei offensichtlich relativ wenig nachhaltige Investments nachhaltiger machen.

Impactfonds mit ESG-Risiken

In Bezug auf die ESG-Risiken ergeben sich ebenfalls erhebliche Unterschiede: Auch hier schneidet der von mir beratene Fonds mit einem durchschnittlichen ESG- Rating von 66 am besten ab. Bei Governance gibt es mit 71 einen noch besseren Fonds im Vergleich zu den 70 des Futurevest Fonds. Mit 62 bei Sozialrisiken und 68 von 100 Punkten bei Umweltrisiken scheidet der Futurevest-Fonds aber am besten ab.

Drei Fonds liegen bei den aggregierten ESG-Ratings aber auch bei Umwelt- und Sozialem unter 50 und haben damit überdurchschnittliche Risiken. Alle anderen Fonds liegen zwischen 53 und 60 bei den aggregierten Ratings. Beim Governancerating geht die Bandbreite nur von 52 bis 71, bei Umwelt von 40 bis 68 und bei Sozialem von 36 bis 63. Dabei liegen 9 Fonds bei den Sozialratings unter 50.

Auch bei den Emissionen gibt es starke Unterschiede. So reichen die umsatzgewichteten Scope 1 und Scope 2 Emissionen von 41 bis 1503 Tonnen mit fünf Fonds über 100 Tonnen. Mit 54 Tonnen hat der Futurevest-Fonds die drittniedrigsten Emissionen. Die Scope 3 Emissionen reichen von 88 bis 3.650 (Futurevest: 665) und scheinen damit kaum vergleichbar zu sein. Fonds, die bei ihren Investments auf Scope 3 Reporting drängen, wie ich das machen, werden bei solchen Vergleichen tendenziell benachteiligt.

Engagementdaten der Fonds werden in der Clarity.ai Datenbank nicht aufgeführt. Hierzu wäre eine relativ aufwändige separate Analyse nötig (Infos zu Futurevest siehe „Engagementreporting“ auf FutureVest Equity Sustainable Development Goals).

Strengster Fonds mit guter Performance

In Bezug auf Ausschlüsse, SDG-Umsätze und ESG-Ratings ist nach diesen Daten der von mir beratenen Fonds der mit Abstand am konsequentesten nachhaltige. Das ist auch nachvollziehbar, denn ich nutze fast nur Nachhaltigkeitskriterien für die Aktienselektion.

Aber natürlich ist auch Performance wichtig. In Bezug auf traditionelle Smallcapfonds erreicht der von mir beratene Fonds seit der Auflage marktübliche Renditen und Risiken. Für die Analyse der selektieren Smallcap-Nachhaltigkeitsfonds nutze ich, sofern vorhanden, die thesaurierenden nicht-währungsgesicherten Retailanteilsklassen. Bezüglich der Renditen von Anfang 2022 bis Mitte Juni 2024 (der Futurevest-Fonds ist erst im August 2021 gestartet) liegt mein Fonds aktuell an der zweitbesten Position, direkt nach dem aus meiner Sicht wenig nachhaltigen SDG Engagementfonds. Im aktuellen Jahr liegt er sogar an erster Stelle. Und die Volatilität von etwa 13% ist auch relativ niedrig. Die Bandbreite der Performance recht dabei von +11% bis -59%.

……………………………………………………………………………………………………………………….

Disclaimer

Dieser Beitrag ist von der Soehnholz ESG GmbH erstellt worden. Die Erstellerin übernimmt keine Gewähr für die Richtigkeit, Vollständigkeit und/oder Aktualität der zur Verfügung gestellten Inhalte. Die Informationen unterliegen deutschem Recht und richten sich ausschließlich an Investoren, die ihren Wohnsitz in Deutschland haben. Sie sind keine Finanzanalyse und nicht als Verkaufsangebot oder Aufforderung zur Abgabe eines Kauf- oder Zeichnungsangebots für Anteile der/s in dieser Unterlage dargestellten Aktie/Fonds zu verstehen und ersetzen nicht eine anleger- und anlagegerechte Beratung.

Die in diesem Artikel enthaltenen Informationen dienen ausschließlich zu Bildungs- und Informationszwecken. Sie sind weder als Aufforderung noch als Anreiz zum Kauf oder Verkauf eines Wertpapiers oder Finanzinstruments zu verstehen. Die in diesem Artikel enthaltenen Informationen sollten nicht als alleinige Quelle für Anlageentscheidungen verwendet werden.

Anlageentscheidungen sollten nur auf der Grundlage der aktuellen gesetzlichen Verkaufsunterlagen (Wesentliche Anlegerinformationen, Verkaufsprospekt und – sofern verfügbar – Jahres- und Halbjahresbericht) getroffen werden, die auch die allein maßgeblichen Anlagebedingungen enthalten.

Die Verkaufsunterlagen des Fonds werden bei der Kapitalverwaltungsgesellschaft (Monega Kapitalanlagegesellschaft mbH), der Verwahrstelle (Kreissparkasse Köln) und den Vertriebspartnern zur kostenlosen Ausgabe bereitgehalten. Die Verkaufsunterlagen sind zudem im Internet unter www.monega.de erhältlich. Die in dieser Unterlage zur Verfügung gestellten Inhalte dienen lediglich der allgemeinen Information und stellen keine Beratung oder sonstige Empfehlung dar. Die Kapitalanlage ist stets mit Risiken verbunden und kann zum Verlust des eingesetzten Kapitals führen. Vor einer etwaigen Anlageentscheidung sollten Sie eingehend prüfen, ob die Anlage für Ihre individuelle Situation und Ihre persönlichen Ziele geeignet ist.

Diese Unterlage enthält ggf. Informationen, die aus öffentlichen Quellen stammen, die die Erstellerin für verlässlich hält. Die dargestellten Inhalte, insbesondere die Darstellung von Strategien sowie deren Chancen und Risiken, können sich im Zeitverlauf ändern. Einschätzungen und Bewertungen reflektieren die Meinung der Erstellerin zum Zeitpunkt der Erstellung und können sich jederzeit ändern. Es ist nicht beabsichtigt, diese Unterlage laufend oder überhaupt zu aktualisieren. Sie stellt nur eine unverbindliche Momentaufnahme dar. Die Unterlage ist ausschließlich zur Information und zum persönlichen Gebrauch bestimmt. Jegliche nicht autorisierte Vervielfältigung und Weiterverbreitung ist untersagt.