Impactinvesting ideas: 12x new research on terrorism, migrants, emissions, innovations, ESG-ratings, sustainable debt, impactinvesting, directors, ETFs, gamification and concentration by Timo Busch, Harald Hau, Ulrich Hege, Thorsten Hens and many more (#: SSRN downloads on Sept. 28th, 2023)

Social research

Terror success: Terrorism and Voting: The Rise of Right-Wing Populism in Germany by Navid Sabet, Marius Liebald, Guido Friebel as of Sept. 25th, 2023 (#15): “… we find that successful (Sö terror) attacks lead to significant increases in the vote share for the right-wing, populist Alternative für Deutschland (AfD) party. Our results are predominantly observable in state elections, though attacks that receive high media coverage increase the AfD vote share in Federal elections. These patterns hold even though most attacks are motivated by right-wing causes and target migrants. Using a longitudinal panel of individuals, we find successful terror leads individuals to prefer the AfD more and worry more about migration” (abstract).

Integration deficits: The Integration of Migrants in the German Labor Market: Evidence over 50 Years by Paul Berbée and Jan Stuhler as of Sept. 25th, 2023 (#47): “First, employment profiles tend to be concave, with low initial employment but rapidly increasing employment in the first years after arrival (convergence). However, income gaps widen with more time in Germany (divergence). … Second, for most groups the employment gaps do not close, despite the initial catch-up. … Third, the income and employment gaps close partially in the second generation, but the employment gaps shrink by only 25% and remain large for some groups. Finally, the perhaps most striking observation is the sudden collapse of employment among earlier arrivals from Turkey in the early 1990s. … The employment shares of the refugees arriving around 2015 are similar to earlier refugee cohorts, despite the unusual favorable labor market conditions and the increased focus on integration policies. Their predicted long-term gaps in employment (about 20-25 pp.) are more than twice as large as the corresponding gap for Ukrainian refugees (about 10 pp.). … Summing up, immigration has become indispensable for the German economy, and the experience from more than 50 years shows that many migrant groups achieve substantial employment rates and incomes. However, barriers to integration persist, and while integration policies have improved along some dimensions, as yet we see no systematic improvements in integration outcomes over time (“p. 36/37).

Ecological research

Loose commitments: Behind Schedule: The Corporate Effort to Fulfill Climate Obligations by Joseph E. Aldy, Patrick Bolton, Zachery M. Halem, and Marcin Kacperczyk as of Sept. 20th, 2023 (#66): “We analyze corporate commitments to reduce carbon emissions. We show that companies in their decisions to commit are more driven by external shareholder pressure and reputational concerns rather than economic motives due to cost of capital effects. We further show that many companies focus on short-term pledges many of which get revised over time. Despite the growth in commitment movement, we find that most companies have fallen behind on their commitments for reasons that could be both systematic and idiosyncratic in nature“ (abstract).

Innovative suppliers: Climate Innovation and Carbon Emissions: Evidence from Supply Chain Networks by Ulrich Hege, Kai Li, and Yifei Zhang as of Sept. 14th, 2023 (#83): “… we ask (i) whether climate innovation invented by a supplier firm allows its customer firms to reduce CO2 emissions, and (ii) whether climate innovation facilitates the acquisition of new business customers and what types of customers. We find that climate innovations help customer firms to reduce carbon emissions …. Emissions savings are accentuated for high-emission firms and firm with stronger environmental concerns. … We show that customer firms generally have a strong preference for suppliers’ climate innovations. Moreover, we show that climate innovation allows suppliers to expand their customer base. We find that the capacity to attract new customers is more pronounced for customers with a strong preference for reducing their carbon footprint: these include firms with a strong preference for environmental protection, measured by their high environmental scores in their ESG ratings, but also firms with elevated GHG emissions that presumably anticipate regulatory or investor pressure to curtail their GHG emissions“ (p. 31/32). My comment regarding supplier relations see Supplier engagement – Opinion post #211 – Responsible Investment Research Blog (prof-soehnholz.com)

ESG investment research: Impactinvesting ideas

E-Rating divergence: Environmental data and scores: Lost in translation by Enrico Bernardini, Marco Fanari, Enrico Foscolo, and Francesco Ruggiero from the Bank of Italy as of Sept. 19th, 2023 (#26): “… we find that environmental data have meaningful, although limited, explanatory power for the E-scores. … the scores of some providers are more related to raw data …. We identify some variables as significant and common across several providers, such as forward-looking measures like the presence of reduction targets for emissions and resource use as well as environmental and renewable energy policies. … We find the latent component to be heterogeneous across providers and this evidence may be due to different materiality in the providers’ assessments. Indeed, some providers focus their analysis on how the corporate financial conditions are affected by environmental issues, while others consider how corporate conduct can affect environmental conditions and others consider both perspectives (”double materiality”)” (p. 20).

More “sustainable” debt: Do Sustainable Companies Receive More Debt? The Role of Sustainability Profiles and Sustainability-related Debt Instruments by Julia Meyer and Beat Affolter as of Aug. 20th, 2023 (#89): “We have made use of three different sources of data to classify companies into one of three groups: (i) companies avoiding ESG risks (using the ESG rating), (ii) companies contributing to the SDGs (SDG score), and (iii) companies committed to transformation (SBTi targets or commitments). First, our results show that sustainability-related debt is largely issued by sustainable companies in all three dimensions. — Secondly, … we find a significant increase in levels of debt for more sustainable companies in all three dimensions. However, this increase seems not to be linked to the issuance of sustainability related debt instruments …. Our results, therefore, indicate that lenders have started to incorporate sustainability and transformation assessments over time and that good sustainability performance (again in all three dimensions) has led to additional debt financing compared to companies with a low sustainability performance” (p. 20).

Impactinvesting ideas: Research

Reactions to pollution: Sustainable Investing in Imperfect Markets by Thorsten Hens and Ester Trutwin as of Sept. 21st, 2023 (#42): “Given that the price for polluting the environment is too low, we show that impact investing can lead to a second-best solution. If at the margin the technology is ”clean”, investment should be increased while a capital reduction is appropriate if at the margin the firm’s technology is ”dirty”. However, sustainable investing requires households to anticipate the firm’s pollution activity. Therefor we show how the same solution can be implemented with ESG investing in which the burden of knowledge lies on the rating agency. Finally, we indicate that the first-best solution can be achieved by sustainable consumption” (abstract) My comment on impactinvesting ideas see Active or impact investing? – (prof-soehnholz.com)

Few Institutional directors: Do Institutional Directors Matter? by Heng Geng, Harald Hau, Roni Michaely, and Binh Nguyen as of Feb. 21st, 2023 (#168): “We find that board representation by institutional investors is relatively rare in U.S. public firms compared to the high institutional ownership in U.S. public firms. Only 7.61% of Compustat firm-years from 1999-2016 feature at least one institutional director representing an institutional shareholder owning more than 1% of outstanding shares. Second, Additional analyses indicate that banks, sophisticated investors (e.g., hedge funds, private equity), and activist shareholders are likely to obtain board seats. By contrast, large retail funds generally do not seek board representation. Common institutional directors representing the so-called “Big Three” asset management companies, which are concerned most for the potential antitrust implications, are only found in only 37 intra-industry firm pairs. Our third set of results reveals that rival firms sharing institutional investors rarely feature joint board representation by the same institutional investor. More importantly, in the rare cases of joint board representation, we do not find evidence that such overlapping board representation is related to higher profit margins than what is already predicted by common institutional ownership in a firm pair” (p. 23/24). My comment: Selecting adequate board directors is one of many potential of impactinvesting ideas

Practical Impactinvesting ideas: Principles for Impact Investments: Practical guidance for measuring and assessing the life cycle, magnitude, and tradeoffs of impact investments by Timo Busch, Eric Pruessner and Hendrik Brosche as of Sept. 26th, 2023 (#62): “For the impact life cycle, we propose a clear set of principles that create a standard for how impact-aligned and impact-generating investments should measure and assess impact. Regarding the topic of impact magnitude, the principles provide guidance for how large a company impact must be for impact investments to be considered significant. Ideally by using thresholds to determine the magnitude of a company impact, impact investments are directly connected to sustainable development objectives“ (p. 19).

Other investment research

ETF effects: Rise of Passive Investing – Effects on Price Level, Market Volatility, and Price Informativeness by Paweł Bednarek as of Sept. 12th, 2023 (#117): “I find that the growth of passive investing did not increase the overall price level, thus contradicting the common ETF bubble hypothesis, which postulated that rapid growth in passive strategies may lead to the detachment of prices of these securities from fundamentals. … We estimate that about 10% of current market volatility can be attributed to the rise of passive investing. It also resulted in diminished price informativeness due to weakened information acquisition. Further reduction in passive management fees will strengthen these effects“ (abstract).

The bank wins: The Gamification of Banking by Colleen Baker and Christopher K. Odinet as of Sept. 26th, 2023 (#42): “After providing an overview of gamification in general, we examined its rise in the context of stock trading … We next turned to early appearances of gamification in banking … we think that its pace is about to accelerate. Our perspective is supported by a number of examples involving banks and fintechs partnering or combining to offer banking services through a game-like interface. As in Truist’s case, bank-fintech partnerships are on the cusp of the gamification of banking that we predict will develop in three stages, culminating with meg one-stop-shop financial intermediary platforms anchored by cloud computing service providers“ (p. 39/40).

Better >10 stocks: Underperformance of Concentrated Stock Positions by Antti Petajisto as of Aug. 28th, 2023 (#473): “… we find that the median stock has underperformed the cap-weighted market portfolio by 7.9% over rolling ten-year investment periods (or 0.82% per year) since 1926. The relative underperformance over rolling ten-year periods increases to 17.8% (or 1.94% per year) when considering only stocks whose performance ranked in the top 20% over the prior five years. … the observed underperformance of the median stock applies across all industry groups and among both the smallest and largest stocks“ (p. 18/19). My comment: In this research concentrated means 10% or higher allocation to every stock. Here you find more research and my opinion: 30 stocks, if responsible, are all I need – Responsible Investment Research Blog (prof-soehnholz.com)

………………………………………………………………………………….

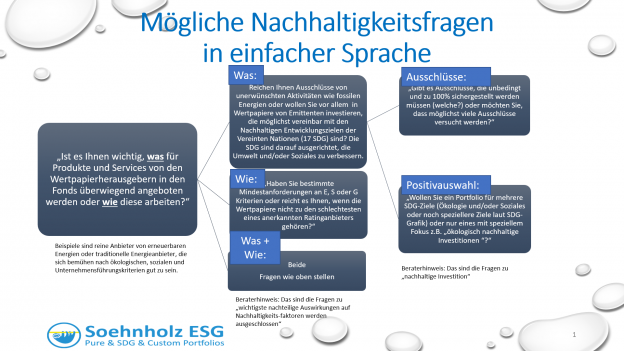

Advert for German investors:

Sponsor my research by investing in and/or recommending my global small/midcap mutual fund (SFDR Art. 9). The fund focuses on social SDGs and uses separate E, S and G best-in-universe minimum ratings and broad shareholder engagement with currently 29 of 30 engaged companies: FutureVest Equity Sustainable Development Goals R – DE000A2P37T6 – A2P37T

………………………………………………………………………………….