Supplier ESG: 17x new research on SDG, green behavior, subsidies, SMEs, ESG ratings, real estate, risk management, sin stocks, trading, suppliers, acting in concert, AI and VC by Alexander Bassen, Andreas G.F. Hoepner, and many more (#: SSRN downloads on Sept. 21st, 2023)

Too late? Earth beyond six of nine planetary boundaries by Katherine Richardson and many more as of Sept. 13th, 2023: “This planetary boundaries framework update finds that six of the nine boundaries are transgressed, suggesting that Earth is now well outside of the safe operating space for humanity. Ocean acidification is close to being breached, while aerosol loading regionally exceeds the boundary. Stratospheric ozone levels have slightly recovered. The transgression level has increased for all boundaries earlier identified as overstepped. As primary production drives Earth system biosphere functions, human appropriation of net primary production is proposed as a control variable for functional biosphere integrity. This boundary is also transgressed. Earth system modeling of different levels of the transgression of the climate and land system change boundaries illustrates that these anthropogenic impacts on Earth system must be considered in a systemic context“ (abstract).

Ecological research (corporate perspective)

Social measures: How useful are convenient measures of pro-environmental behavior? Evidence from a field study on green self-reports and observed green behavior by Ann-Kathrin Blankenberg, Martin Binder, and Israel Waichmann as of Aug. 20th, 2023 (#12): “We conduct a field study with n = 599 participants recruited in the town hall of a German medium-sized town to compare self-reports of pro-environmental behavior of our participants with observed behavior (green product choice and donation to real charities). Our results indicate that self-reports are only weakly correlated to incentivized behavior in our sample of an adult population (r = .09∗ ), partly because pro-environmental behavior measures can conflate prosocial and pro-environmental preferences. … Our results … cast some doubt on the validity of commonly used convenient measures of pro-environmental behavior“ (abstract).

Expensive subsidies: Converting the Converted: Subsidies and Solar Adoption by Linde Kattenberg, Erdal Aydin, Dirk Brounen, and Nils Kok as of July 25th, 2023 (#18): „… there is limited empirical evidence on the effectiveness of subsidies that are used to promote the adoption of such (Sö: renewable energy) technologies. This paper exploits a natural experimental setting, in which a solar PV subsidy is assigned randomly within a group of households applying for the subsidy. Combining data gathered from 100,000 aerial images with detailed information on 15,000 households … The results show that, within the group of households that applied for the subsidy, the provision of subsidy leads to a 14.4 percent increase in the probability of adopting solar PV, a 9.6 percent larger installation, and a 1-year faster adoption. However, examining the subsequent electricity consumption of the applicants, we report that the subsidy provision leads to a decrease in household electricity consumption of just 8.1 percent, as compared to the rejected applicant group, implying a cost of carbon of more than €2,202 per ton of CO2”.

Regulatory SME effects: The EU Sustainability Taxonomy: Will it Affect Small and Medium-sized Enterprises? by Ibrahim E. Sancak as of Sept. 6th, 2023 (#52): “The EU Sustainability Taxonomy (EUST) is a new challenge for companies, particularly SMEs and financial market participants; however, it potentially conveys its economic value; hence, reliable taxonomy reporting and strong sustainability indicators can yield enormously. … We conclude that the EU’s sustainable finance reforms have potential domino effects. Backed by the European Green Deal, sustainable finance reforms, and in particular, the EUST, will not be limited to large companies or EU companies; they will affect all economic actors having business and finance connections in the EU“ (p. 14).

ESG rating credits: Determinants of corporate credit ratings: Does ESG matter? by Lachlan Michalski and Rand Kwong Yew Low as of Aug. 19th, 2023 (#25): “We show that environmental and social responsibility variables are important determinants for the credit ratings, specifically measures of environmental innovation, resource use, emissions, corporate social responsibility, and workforce determinants. The influence of ESG variables become more pronounced following the financial crisis of 2007-2009, and are important across both investment-grade and speculative-grade classes” (abstract).

Climate risk management: Climate and Environmental risks and opportunities in the banking industry: the role of risk management by Doriana Cucinelli, Laura Nieri, and Stefano Piserà as of Aug. 18th, 2023 (#22): “We base our analysis on a sample of 112 European listed banks observed from 2005 to 2021. Our results … provide evidence that banks with a stronger and more sophisticated risk management are more likely to implement a better climate change risk strategy. … Our findings underline that bank providing their employees and managers with specific training programs on environmental topics, or availing of the presence of a CSR committee, or adopting environmental-linked remuneration scheme, stand out for a greater engagement towards C&E risks and opportunities and a sounder C&E strategy” (p. 16).

Generic ESG Research (investor perspective)

ESG dissected: It’s All in the Detail: Individual ESG Factors and Firm Value by Ramya Rajajagadeesan Aroul, Riette Carstens and Julia Freybote as of Aug. 25th, 2023 (#29): “We disaggregate ESG into its individual factors (E, S and G) and investigate their impact on firm value using publicly listed equity real estate investment trusts (REITs) as a laboratory over the period of 2009 to 2021. … We find that the environmental factor (E) and governance factor (G) positively predict firm value while the social factor (S) negatively predicts it. … Further analysis into antecedents of firm value suggests that our results are driven by 1) E reducing cost of debt and increasing financial flexibility, operating efficiency, and performance, 2) S leading to a higher cost of debt as well as lower financial flexibility and operating performance, and 3) G increasing operating efficiency. … We also find evidence for time-variations in the relationships of E, S and G with firm value and its determinants” (abstract). My comment: This is not really new as one can see in my publication from 2014: 140227 ESG_Paper_V3 1 (naaim.org)

Greenbrown valuations: The US equity valuation premium, globalization, and climate change risks by Craig Doidge, G. Andrew Karolyi, and René M. Stulz as of Sept. 15th, 2023 (#439): “It is well-known that before the GFC (Sö: Global Financial Crisis of 2008), on average, US firms were valued more highly than non-US firms. We call this valuation difference the US premium. We show that, for firms from DMs (Sö: Developed Markets), the US premium is larger after the crisis than before. By contrast, the US premium for firms from EMs (Sö: Emerging Markets) falls. In percentage terms, the US premium for DMs increases by 27% while the US premium for EMs falls by 24%. … the differing evolution of the US premium for DM firms and for EM firms is concentrated among old economy firms – older firms in industries that have a high ratio of tangible assets to total assets. … We find that the valuations of firms in brown industries in non-US DMs fell significantly relative to comparable firm valuations in the US and this decline among brown industries in EMs did not take place. Though this mechanism does not explain the increase in the US premium for firms in DMs fully, it explains much of that increase. It follows from this that differences across countries in the importance given to sustainability and ESG considerations can decrease the extent to which financial markets across the world are integrated“ (p. 28).

Sin ESG: Does ESG impact stock returns for controversial companies? by Sonal and William Stearns as of Sept. 2nd, 2023 (#35): “We find that the market perception of ESG investments of controversial firms have changed over time. For the 2010-2015 period, ESG investments made by sinful firms are rewarded positively by increasing stock prices. However, for the sample period post 2015, increases in ESG no longer result in positive stock returns. We further find the maximum change for the oil and gas industry“ (p. 11/12). My comment see ESG Transition Bullshit? – Responsible Investment Research Blog (prof-soehnholz.com)

Portfolio ESG effects: Quantifying the Impacts of Climate Shocks in Commercial Real Estate Market by Rogier Holtermans, Dongxiao Niu, and Siqi Zheng as of Sept. 7th, 2023 (#251): “We focus on Hurricanes Harvey and Sandy to quantify the price impacts of climate shocks on commercial buildings in the U.S. We find clear evidence of a decline in transaction prices in hurricane-damaged areas after the hurricane made landfall, compared to unaffected areas. We also observe that …. Assets in locations outside the FEMA floodplain (with less prior perception about climate risk) have experienced larger price discounts after the hurricanes. … Moreover, the price discount is larger when the particular buyer has more climate awareness and has a more geographically diverse portfolio, so it is easier for her to factor in this risk in the portfolio construction” (abstract).

ESG investors or traders? Do ESG Preferences Survive in the Trading Room? An Experimental Study by Alexander Bassen, Rajna Gibson Brandon, Andreas G.F. Hoepner, Johannes Klausmann, and Ioannis Oikonomou as of Sept. 19th, 2023 (#12): “This study experimentally tests in a competitive trading room whether Socially Responsible Investors (SRIs) and students are consistent with their stated ESG preferences. … The results suggest that all participants who view ESG issues as important (ESG perception) trade more aggressively irrespective of whether the news are related to ESG matters or not. … More importantly, SRIs trade on average much less aggressively than students irrespective of their ESG perceptions and behaviors” (abstract). … “Investors mostly consider macroeconomic and id[1]iosyncratic financial news in their investment decisions. Updates on the ESG performance of a firm are perceived as less likely to move prices by the participants. In addition to that, we observe a stronger reaction to positive news compared to negative news” (p. 26). My comment: I prefer most-passive rules based to active investments, compare Noch eine Fondsboutique? – Responsible Investment Research Blog (prof-soehnholz.com) or Active or impact investing? – (prof-soehnholz.com)

Supplier ESG research (also see Supplier engagement – Opinion post #211)

Supplier ESG shocks: ESG Shocks in Global Supply Chains by Emilio Bisetti, Guoman She, and Alminas Zaldokas as of Sept. 6th, 2023 (#38): “We show that U.S. firms cut imports by 29.9% and are 4.3% more likely to terminate a trade relationship when their international suppliers experience environmental and social (E&S) incidents. These trade cuts are larger for publicly listed U.S. importers facing high E&S investor pressure and lead to cross-country supplier reallocation …. Larger trade cuts around the scandal result in higher supplier E&S scores in subsequent years, and in the eventual resumption of trade” (abstract).

Sustainable supplier reduction: A Supply Chain Sourcing Model at the Interface of Operations and Sustainability by Gang Li and Yu A. Xia as of Aug. 25th, 2023 (#204): “This research investigates … how to integrate sustainability with sourcing planning decisions and how to address the challenges associated with the integration, such as the balance between operational factors and sustainability factors and the quantitative evaluation of sustainability performance. … Our model suggests that while increasing the number of suppliers may cause additional sustainability risk in supply chain management, decreasing the supply base will decrease the production capacity and increase the risk of delivery delay. Therefore, a firm should carefully set up its global sourcing network with only a limited number of selected suppliers. This finding is particularly true when the focus of sourcing planning gradually moves away from decisions based solely on cost to those seeking excellence in both supply chain sustainability and cost performance“ (p. 32).

Empowering stakeholders: Stakeholder Governance as Governance by Stakeholders by Brett McDonnell as of August 31st, 2023 (#64): “… American stakeholder engagement is limited to soliciting (and on occasion responding to) the opinions of employees, customers, suppliers, and others. True stakeholder governance would involve these groups in actively making corporate decisions. I have suggested various ways we could do this. The focus should be on employees, who could be empowered via board representation, works councils, and unions. Other stakeholders could be less fully empowered through councils, advisory at first but potentially given power to nominate or even elect directors” (p. 19).

Impact investment research (supplier ESG)

Anti-climate concert: Rethinking Acting in Concert: Activist ESG Stewardship is Shareholder Democracy by Dan W. Puchniak and Umakanth Varottil as of Sept. 13th, 2023 (#187): “… the legal barriers posed by acting in concert rules in virtually all jurisdictions prevent institutional investors from engaging in collective shareholder activism with the aim or threat of replacing the board (i.e., “activist stewardship”). Perversely, the current acting in concert rules effectively prevent institutional investors from replacing boards that resist (or even deny) climate change solutions – even if (or, ironically, precisely because) they collectively have enough shareholder voting rights to democratically replace the boards of recalcitrant brown companies. This heretofore hidden problem in corporate and securities law effectively prevents trillions of dollars of shareholder voting rights that institutional investors legally control from being democratically exercised to change companies who refuse to properly acknowledge the threat of climate change” … (abstract).

Other investment research

AI investment risks: Artificial Intelligence (AI) and Future Retail Investment by Imtiaz Sifat as of Sept. 12th, 2023 (#20): “I have analyzed AI’s integration in retail investment. … The benefits spring from access to sophisticated strategies once exclusive to institutional investors. The downside is that the opaque models which facilitate such strategies may aggravate risks and information asymmetry for retail investors. To stop this gap from widening, proper governance is essential. Similarly, the ability to ingest copious alternative data and instantaneous portfolio optimization incurs a tradeoff—too much dependence on historical data invokes modelling biases and data quality cum privacy concerns. It is also likely that AI-dominated markets of the future will be more volatile, and new forms of speculation would emerge as trading platforms incentivize speculation and gamification. The combined forces of these concurrent challenges put a heavy stress on orthodox finance theories …“ (p. 16/17). Maybe interesting: AI: Wie können nachhaltige AnlegerInnen profitieren? – Responsible Investment Research Blog (prof-soehnholz.com)

Venture careers: Failing Just Fine: Assessing Careers of Venture Capital-backed Entrepreneurs via a Non-Wage Measure by Natee Amornsiripanitch, Paul A. Gompers, George Hu, Will Levinson, and Vladimir Mukharlyamov as of Aug. 30th, 2023 (#131): “Would-be founders experience accelerated career trajectories prior to founding, significantly outperforming graduates from same-tier colleges with similar first jobs. After exiting their start-ups, they obtain jobs about three years more senior than their peers who hold (i) same-tier college degrees, (ii) similar first jobs, and (iii) similar jobs immediately prior to founding their company. Even failed founders find jobs with higher seniority than those attained by their non-founder peers“ (abstract).

………………………………………………………………………………….

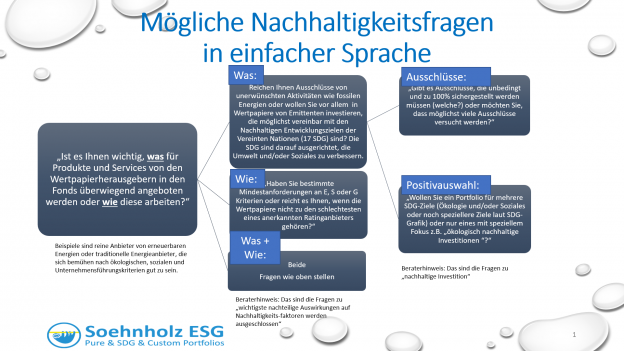

Advert for German investors:

Sponsor my research by investing in and/or recommending my global small/midcap mutual fund (SFDR Art. 9). The fund focuses on social SDGs and uses separate E, S and G best-in-universe minimum ratings and broad shareholder engagement with currently 30 of 30 engaged companies: FutureVest Equity Sustainable Development Goals R – DE000A2P37T6 – A2P37T; also see Active or impact investing? – (prof-soehnholz.com)

………………………………………………………………………………….