Supplier engagement is my term for shareholder engagement with the goal to address suppliers either directly or indirectly. I provide an overview of current scientific research regarding supplier engagement. I also explain my respective recommendations to the companies I am invested in. Supplier engagement can be very powerful.

The other two stakeholder groups which I address with my “leveraged shareholder engagement” are customers and employees (compare HR-ESG shareholder engagement: Opinion-Post #210 – Responsible Investment Research Blog (prof-soehnholz.com)).

Supplier emissions can be very high

Supplier relations have become much talked about in recent years. Climate change is one of the reasons. Greenhouse gas (GHG) emissions are one of the prime shareholder concerns if they are interested in environmental topics. To compare more or less vertically integrated companies with their competitors, evaluating GHG emissions of suppliers is important. Often, GHG emissions of suppliers (part of so-called scope 3) are much higher than the (scope 1 and 2) emissions of the analyzed company itself.

Relevant research (1): Managing climate change risks in global supply chains: a review and research agenda by Abhijeet Ghadge, Hendrik Wurtmann and Stefan Seuring as of June 13th, 2022: “The research … captures a comprehensive picture of climate change and associated phenomenon in terms of sources, consequences, control drivers, and mitigation mechanisms. … The study contributes to practice by providing visibility into the industry sectors most likely to be impacted; their complex association with other supply chain networks. The drivers, barriers, and strategies for climate change mitigation are particularly helpful to practitioners for better managing human-induced risks …” (p. 59).

Supply chain becomes more important for ESG-analyses

COVID and geopolitical changes such as the Russian attack on the Ukraine also showed that the management of supply chains is crucial for many companies. Even before, many supplier related incidents such as the Foxconn/Apple discussions had significant effects on company ESG perceptions and potentially also on ESG-ratings. Also, supply chains are becoming more in many countries.

Relevant research (2): ESG Shocks in Global Supply Chains by Emilio Bisetti, Guoman She, and Alminas Zaldokas as of Sept. 6th, 2023: “We show that U.S. firms cut imports by 29.9% and are 4.3% more likely to terminate a trade relationship when their international suppliers experience environmental and social (E&S) incidents. These trade cuts are larger for publicly listed U.S. importers facing high E&S investor pressure and lead to cross-country supplier reallocation …. Larger trade cuts around the scandal result in higher supplier E&S scores in subsequent years, and in the eventual resumption of trade” (abstract).

On the positive side, many suppliers have great knowhow and can help their clients to become better in ESG-terms.

Relevant research (3): Stakeholder Engagement by Brett McDonnell as of Nov. 1st, 2022t: “Suppliers, like employees, also provide inputs to the production process of companies. Retaining the loyalty of suppliers may be important for companies, depending in part on how firm-specific inputs are. Where inputs are fungible, they can be bought on the market for the prevailing market price, but where they are firm-specific, the buying firm will have more trouble replacing a supplier that decides to withdraw. Suppliers have information about the quality of what they supply, and about conditions which may affect future availability and prices” (p. 8).

Supplier engagement: How investors can indirectly engage

Investors in publicly listed companies do probably not want to directly with the often many important suppliers of their portfolios companies. But they can indirectly leverage the knowhow and energy of suppliers. Here is what Brett McDonnell suggests:

Relevant research (4): Stakeholder Governance as Governance by Stakeholders by Brett McDonnell as of August 31st, 2023: “… American stakeholder engagement is limited to soliciting (and on occasion responding to) the opinions of employees, customers, suppliers, and others. True stakeholder governance would involve these groups in actively making corporate decisions. I have suggested various ways we could do this. The focus should be on employees, who could be empowered via board representation, works councils, and unions. Other stakeholders could be less fully empowered through councils, advisory at first but potentially given power to nominate or even elect directors” (p. 19).

In my opinion, too, advisory councils of suppliers could be helpful to improve listed companies. I prefer other forms of ESG engagement with suppliers, though. First, companies could regularly survey most of their direct and even some important indirect suppliers in a regular way regarding ESG topics. With regular surveys companies can find out how happy their suppliers are with the companies ESG activities and ESG-improvement ideas by suppliers can be collected.

Example (1): Surveys from Stakeholders Make Good Business Sense by Terrie Nolinske from the National Business Research Institute (no date) mentions The Body Shop and Michelin who use supplier surveys.

Example (2): AA1000 Stakeholder Engagement Standard from Accountability as of 2015 “provides a … practical framework to implement stakeholder engagement and … Describes how to integrate stakeholder engagement with an organization’s governance, strategy, and operations”.

I specifically suggest to regularly ask suppliers the following questions: 1) “How satisfied are you with the environmental, social and corporate governance activities of company XYZ?” and 2) “Which environmental, social and corporate governance improvements do you suggest to company XYZ?”.

Systematic supplier engagement using ESG evaluations

In my view, even more important to improve the full supply chain ESG-profile is that companies regularly, broadly and independently evaluate the ESG-quality of their suppliers. Independent ESG-ratings can be very useful for that purpose, since they systematically cover many environmental, social and governance aspects.

I try to invest in the 30 most sustainable publicly listed companies globally (see Active or impact investing? – (prof-soehnholz.com)), but even most of these companies do not have such a supplier ESG evaluation process. Here are the two best examples of my portfolios companies:

Supplier ESG evaluation (1): Watts Water Sustainability Report 2022 p. 63: “In 2022, we met our goal of reviewing suppliers representing approximately 30% of our global annual spend using the Dun & Bradstreet (D&B) ESG Rating Service. The service is a web-based ratings platform that assesses the ESG operations of suppliers across 70 key topics, including through peer benchmarking and using leading sustainability frameworks …. Through our expanded use of this tool, we gained increased insight into our suppliers’ sustainability practices, including that suppliers making up one-sixth of the global spend we assessed already have advanced ESG systems in place”.

Supplier ESG evaluation (2): CAFs 2022 Sustainability Report: “… the evaluation effort focuses on 349 target suppliers out of a total of approximately 6,000 suppliers. The evaluations are carried out by Ecovadis …. Ecovadis adapts the evaluation questionnaire to each supplier based on the locations in which it operates, its sector and its size to evaluate 21 aspects of sustainability alligned with the most demanding international norms, regulations and standards …. Suppliers‘ responses are evaluated by specialised analysts … This analysis results in a general rating with a maximum score of 100 points …. If the result of an evaluation does not meet the requirements established by CAF (a general score of 45 out of 100 in sustainability management), the supplier is required to implement an action plan to improve the weaknesses identified. If the supplier does not raise its assessment to acceptable levels or does not show a commitment to improve, it is audited by experts in the field” (p. 83).

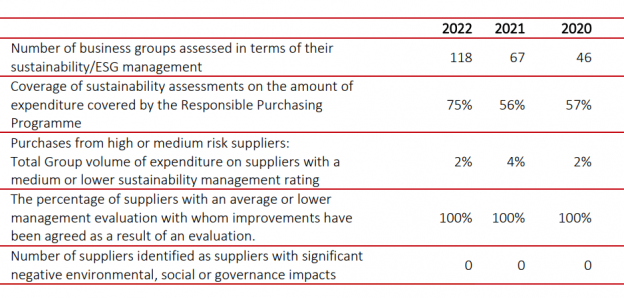

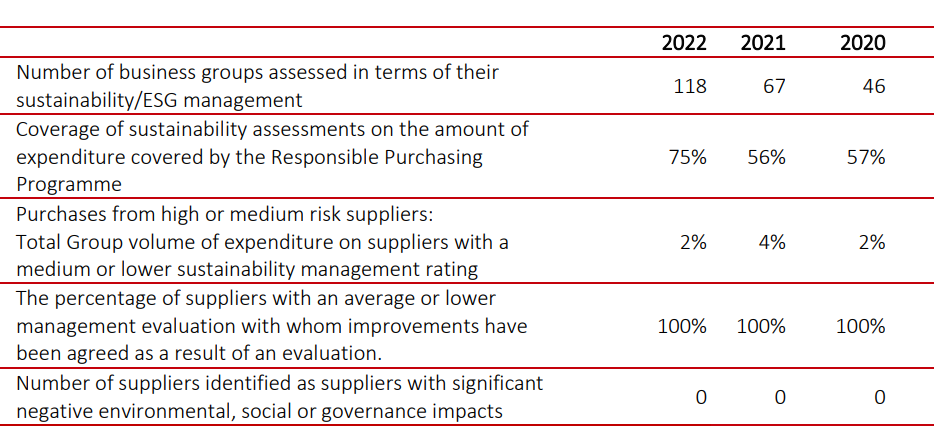

“By the end of 2022, the activities … have assessed … 78% of the prioritised suppliers (118 business groups) …. The assessed suppliers have an average overall rating of 58.6 out of 100 … which is 13 percentage points higher than the average of all suppliers assessed by Ecovadis worldwide (45/100). In addition, 71% of CAF suppliers reassessed in the last year improved their general rating … As a result of these assessments it has also been identified that 2% of the Group’s total purchases are made from suppliers with average or lower sustainability management and an improvement plan has been agreed with all of them”(p. 84).

The picture of my blogpost summarises the results of the 2022 supplier assessment campaign of one of my portfolio companies: Construcciones y Auxiliar de Ferrocarriles (CAF Sustainability Report 2022, p. 85):

But even Watts Water and CAF currently only cover a relatively small share of their suppliers with these evaluations.

Better fewer suppliers?

Such a sustainability-oriented supplier evaluation approach could result in fewer and therefore more important suppliers.

Relevant research (5): A Supply Chain Sourcing Model at the Interface of Operations and Sustainability by Gang Li and Yu A. Xia as of Aug. 25th, 2023: “This research investigates … how to integrate sustainability with sourcing planning decisions and how to address the challenges associated with the integration, such as the balance between operational factors and sustainability factors and the quantitative evaluation of sustainability performance. … Our model suggests that while increasing the number of suppliers may cause additional sustainability risk in supply chain management, decreasing the supply base will decrease the production capacity and increase the risk of delivery delay. Therefore, a firm should carefully set up its global sourcing network with only a limited number of selected suppliers. This finding is particularly true when the focus of sourcing planning gradually moves away from decisions based solely on cost to those seeking excellence in both supply chain sustainability and cost performance“ (p. 32).

Supplier engagement: Powerful supplier ESG disclosures

I think that is very important to make the supplier engagement activities transparent. Only transparent activities can be controlled by stakeholders. It is very useful for stakeholders, too, to know the identities of the major suppliers.

Relevant research (6): Green Image in Supply Chains: Selective Disclosure of Corporate Suppliers by Yilin Shi, Jing Wu, and Yu Zhang as of Sept. 9th, 2022 (#2015): “We uncover robust empirical evidence showing that listed firms selectively disclose environmentally friendly suppliers while selectively not disclosing suppliers with poor environmental performance, i.e., they conduct supply chain greenwashing. This is a prevalent behavior in the sample of more than 40 major countries or regions around the world that we study. … we find that customer firms that face more competitive pressure, care more about brand image and reputation, and have larger shares of institutional holdings are more likely to conduct such selective disclosure. … we find that information transparency reduces such behavior. Finally, we study the outcomes of selectively disclosing green suppliers and find that customers benefit from the practice in terms of sales, profitability, and market valuation“ (p. 22/24).

A supplier engagement proposal and first engagement experiences

Based on my engagement policy (Shareholder engagement: 21 science based theses and an action plan – (prof-soehnholz.com)), I try to make it as simple as possible for my portfolio companies to implement my suggestions. Comprehensive and regular supplier ESG surveys would be a rather simple and low-cost approach and I certainly encourage them.

Given the importance of the supply chain for ESG-topics and the risks of greenwashing, I especially recommend a more demanding supplier ESG-rating approach to all my portfolio companies. Specifically, I tell them: “Favoring suppliers with better overall/comprehensive ESG scores is probably the way to go. Reporting aggregated information such as percentage of suppliers with XYZ ESG-scores can be one first step regarding transparency”. I also inform them about current relevant research and the two examples mentioned above.

No supplier engagement results yet

I started my respective engagement activities only at the end of 2022. Some companies answered that they like my suggestions and plan to analyze them, but I cannot report implementations so far (compare 230831_FutureVest_Engagementreport-2830ab605a502648339b4f8f58fa2ee2dce539ef.pdf).

I am only a small investors and cooperative engagement can me more powerful. Unfortunately, my attempts for cooperative engagement with other investors have not been fruitful yet. One reason is that I could only find very few sustainable investment funds with a dedicated small-and midcap focus such as mine. With the few such funds I have typically very little company overlap. The asset managers and the shareholder organizations which I have asked so far want to cooperate with larger asset managers and not with such a small entity as mine.

Nevertheless, I will continue to ask my portfolio companies for such stakeholder engagements and the publication of their results. I am confident, that at least a few companies will adopt such surveys and evaluations and thus position themselves even more as ESG-leaders. Research such as “A Test of Stakeholder Governance” by Stavros Gadinis and Amelia Miazad as of Aug. 25th, 2021 is one of the reasons for optimism on my part. And, maybe, with publications such as this blog post, I can encourage other companies, investors etc. to support such broad stakeholder engagement activities as well.

Additional research:

Bringing ESG Accountability to Global Supply Chains as of Oct. 30th, 2023 by Ingrid Cornander, Michael Jonas, and Daniel Weise from The Boston Consulting Group

A Procurement Advantage in Disruptive Times: New Perspectives on ESG Strategy and Firm Performance by Wenting Li and Yimin Wang as of May 8th,2024