Preliminary remarks and shareholder engagement definition

Note: This shareholder engagement concept builds in part on analyses that I developed together with colleagues from the German Association for Financial Analysis and Asset Management (DVFA) as part of the Impact Expert Committee. It has been originally published on Feb. 8th and the chapter „engagement content“ has been expanded on Feb. 22nd, 2023).

My shareholder engagement definition: One or more investors (i.e. explicitly excluding non-investors such as media) seek to directly influence companies (i.e. excluding engagement with states and other organizations and excluding lobbying or other audiences). Voting at shareholder meetings (voting) may or may not be part of engagement. Engagement is typically not as comprehensive or long-term as trusteeship[1].

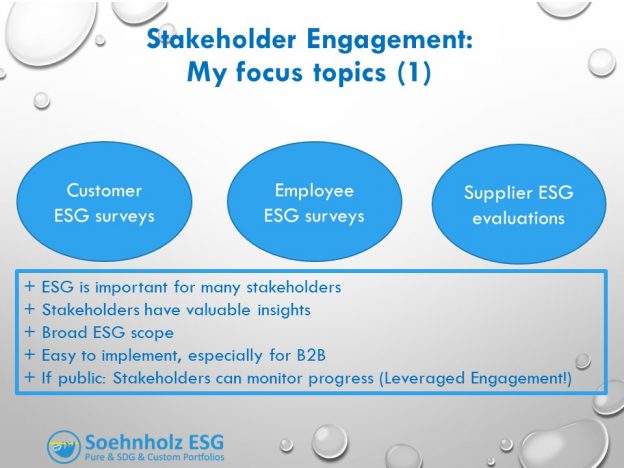

My engagement focus is sustainability, i.e. environmental, social and governance (ESG) issues. In the following, I list my engagement theses. I then describe my engagement policy and activities derived from them.

Advert for German investors: “Sponsor” my research by investing in and/or recommending my article 9 mutual fund. I focus on social SDGs and midcaps and use separate E, S and G best-in-universe minimum ratings. The fund typically scores very well in sustainability rankings, e.g. see this free new tool, and the performance is relatively good: FutureVest Equity Sustainable Development Goals R – DE000A2P37T6 – A2P37T

… continues on page 2: