ESG overall: >15x new research on fixed income ESG, greenium, insurer ESG investing, sin stocks, ESG ratings, impact investments, real estate ESG, equity lending, ESG derivatives, virtual fashion, bio revolution, behavioral ESG investing

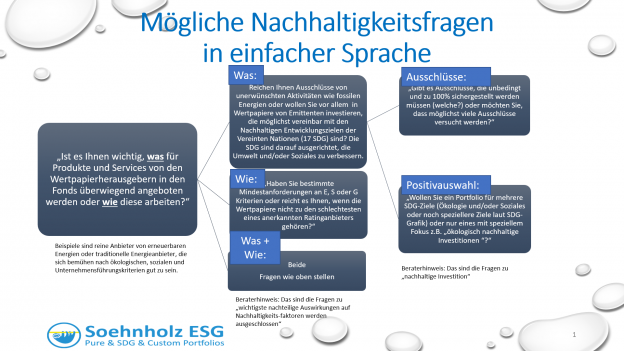

Advert: Check my article 9 SFDR fund FutureVest Equity Sustainable Development Goals (-2,9% YTD). With my most responsible stock selection approach I focus on social SDGs and midcaps and use best-in-universe as well as separate E, S and G minimum ratings.

Continue on page 2 (# indicates the number of SSRN downloads on July 25th):