30 stocks: In my last mini-survey on Linked-In I asked if 30, 300 or 3000 stocks can be sufficient for a global diversified investment portfolio. The survey answers were almost equally split between 30 and 300.

Popular cheap and expensive diversification

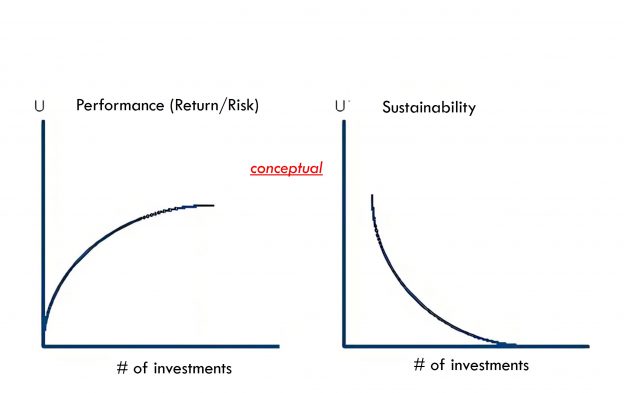

There is a lot of research showing that diversification is great to reduce portfolio volatility or other performance measures. Also, very diversified cheap ETFs are cheap and abundant and large mutual funds typically diversify broadly. Specialized investment boutiques often claim that any investment which is somewhat different from existing ones can improve investor portfolio diversification and therefore should be added to investor portfolios. There is little discussion though on the marginal utility of diversification. To illustrate this, think of expensive additional private capital investments which may reduce measured portfolio volatility but are expensive.

Sustainability as gamer-changer for diversification and research on minimum diversification

Sustainable investing may change the focus on diversification. If one starts with the most sustainable investment, every additional investment reduces the average sustainability of a portfolio (see Nachhaltiges Investieren: Konzentrieren statt diversifizieren?).

There is some research showing that concentrated portfolios can perform well, e.g. Portfolio Diversification: How Many Stocks Are Enough? As of Feb. 17, 2015 by Larry Swedroe. That research suggests that about 100 stocks may be sufficient.

Portfolio concentration and the performance of individual investors by Zoran Ivković, Clemens Sialm, and Scott Weisbenner as of March 7, 2005: “Stock investments made by households that choose to concentrate their brokerage accounts in a few stocks outperform those made by households with more diversified” (abstract).

Best Ideas by Miguel Antón, Randolph B. Cohen, and Christopher Polk as of Nov. 12, 2012 finds: “… the best ideas of active managers generate up to an order of magnitude more alpha than their portfolio as a whole … The poor overall performance of mutual fund managers in the past is not due to a lack of stock-picking ability, but rather to institutional factors that encourage them to overdiversify … We point out that these factors may include not only the desire to have a very large fund and therefore collect more fees [as detailed in Berk and Green (2004)] but also the desire by both managers and investors to minimize a fund’s idiosyncratic volatility: Though of course managers are risk averse, it seems investors may judge funds irrationally by measures such as Sharpe ratio or Morningstar rating. Both of these measures penalize idiosyncratic volatility, a penalty whose benefits in a portfolio context are extremely questionable” (p. 32).

On Diversification by Ben Jacobsen and Frans de Roon as of Nov. 21st, 2012: “Over 60% of the time we cannot reject our null hypothesis of stock picking in favor of well diversified benchmarks, even for individual stocks. Stock picking dominates during recessions, diversification during expansions” (abstract).

The Decision to Concentrate: Active Management, Manager Skill, and Portfolio Size by Keith C. Brown, Cristian Tiu, and Uzi Yoeli as of September 7th, 2017: “… we present a simple theoretical model showing that the greater the manager’s skill level, the more concentrated the portfolio should be. Second, we conduct an extensive simulation analysis of the capacity to make accurate ex ante security return forecasts and show that skilled managers would select only about 3-20% of the available securities and that the portfolio concentration decision is directly proportional to investment prowess. Finally, we provide an empirical examination of the actual skill-concentration relationship for actively managed U.S. equity funds over 2002-2015, documenting that managers who demonstrated skill in the past do form portfolios with higher concentration levels” (abstract).

Note: Also see some more recent contributions in Diversifikationsgrenzen und mehr neues (ESG) Research – Responsible Investment Research Blog (prof-soehnholz.com)

30 stocks: Test-it-yourself

You can test the limited effects of diversification yourself. A simple approach is to compare e.g. the S&P Global 100 with the S&P Global 1200. I especially like the free backtest function of Silicon Cloud’s Portfolio Visualizer tool (Backtest Portfolio Asset Allocation (portfoliovisualizer.com)). You can start with one stock and arbitrarily add other stocks and discover how fast the average portfolio risk decreases with mostly limited changes in returns.

30 stocks are enough for me

I typically use 30 stocks for my direct equity portfolios without any minimum or maximum allocations to countries or industries. My own experience with such concentrated direct equity portfolios is very positive. My Global Equities ESG S portfolio which includes only my top 5 responsible stocks has a better return even assuming annual fees of 1,2% than a traditional global diversified ETF with hundreds of stocks. Also, my Global Equities ESG and Global Equities SDG portfolios with 30 “most-responsible” stocks each perform very similar after fees compared to a very diversified global ETF (see ESG ok, SDG gut: Performance 1. HJ 2022 – Responsible Investment Research Blog (prof-soehnholz.com) and www.soehnholzesg.com). And my mutual fund with 30 stocks currently has a YTD return of -0,5% and thus belongs to top 10% of all equity funds worldwide (FutureVest Equity Sustainable Development Goals R – DE000A2P37T6 – A2P37T).

I published a shorter earlier version on LinkedIn on August 8th, 2022