Regeländerungen: Viele Untersuchungen zeigen, dass aktiv gemanagte Portfolios typischerweise schlechter rentieren als passive (z.B. ETFs). Bei der Gründung meines Unternehmens im Jahr 2016 wollte ich deshalb nur ETFs nutzen. Allerdings habe ich weder 2016 noch heute genug ETFs gefunden, die mir persönlich nachhaltig genug sind. Deswegen habe ich besonders nachhaltige Aktien-Modellportfolios entwickelt und biete inzwischen auch einen darauf aufbauenden Investmentfonds an. Die Portfolios und der Fonds sind regelbasiert, aber nicht passiv.

Man kann jede Regel diskutieren. Vor allem mein Postulat, dass ich Regeln verändern können möchte, wird manchmal kritisch hinterfragt. In diesem Beitrag erkläre ich, warum und wie ich meine Regeln seit dem Start meiner ersten Environmental-, Social-, Governance- (ESG) und Sustainable Development Goal (SDG) Portfolios verändert habe (detaillierte Dokumentationen dazu siehe Das Soehnholz ESG und SDG Portfoliobuch und ältere Versionen im Archiv – Soehnholz ESG).

Transparent- oder intransparent regelbasiert?

Ich bin schon lange ein Fan regelbasierter Investments (vgl. z.B. Investmentfondsselektion: Regeltransparenz nach Vorne (prof-soehnholz.com)). Anders als bei diskretionär aktiv gemanagten Portfolios kann man anhand von Regeln viel besser verstehen, wie sich Portfolios verhalten. Dafür müssen die Regeln und – für die Nachvollziehbarkeit auch die Informationen, die den Regeln zugrunde liegen -transparent und einfach zugänglich sein. Eine Regel kann beispielsweise lauten, dass eine Aktie bei einem schlechten unternehmensinternen ESG-Rating verkauft werden muss. Für Unternehmensexterne ist das wenig transparent.

Ähnliches gilt für die Nutzung von Prognosen, die sich oft schon bei kleinen Inputänderungen stark verändern können und die meistens von Externen nur schwer nachvollziehbar sind.

Wenn die Regel aber lautet, dass immer die 30 Aktien von den Unternehmen mit der monatlich gemessenen höchsten Marktkapitalisierung im Portfolio sind, dann ist das ziemlich transparent.

Weder aktiv noch passiv?

Zwischen aktiv und passiv gibt es viele Zwischenformen. So sind aktiv gemanagte Fonds, die sich eng an Indizes orientieren, in Bezug auf ihre Portfolios oft kaum von passiven Indextrackern zu unterscheiden. Und manche quantitativ orientierten aktiven Investmentmanager vermarkten sich als regelbasiert. Deren Regeln werden aber meistens nicht transparent offengelegt. Vielfach sind auch die für die Regeln genutzten Daten nicht einfach durch Externe prüfbar (Blackboxes).

Selbst wenn Regeln offengelegt werden, sind sie oft sehr komplex und wenig robust, wie das bei vielen sogenannten Optimierungsmodellen der Fall ist (vgl. z.B. Kann institutionelles Investment Consulting digitalisiert werden? Beispiele (prof-soehnholz.com).

3 mögliche Investmentphilosophien

Eine Investmentphilosophie definiere ich als ein umfassendes und kohärentes System von Investmentüberzeugungen (vgl. Investmentphilosophie: Prognosefans sollten prognosefreie Portfolios nutzen (prof-soehnholz.com). Dabei unterscheide ich drei Arten von Investmentphilosophien: Diskretionäre, regelbasiert-prognosebasierte und regelbasiert-prognosefreie.

Die meisten Investoren verfolgen diskretionäre Investmentphilosophien. Für die Umsetzungen nutzen sie aktive Fonds aber auch ETFs. Manche konsequenten „Quant“-Anleger können der regelbasiert-prognosebasierten Kategorie zugeordnet werden. Die regelbasiert-prognosefreie Philosophie-Variante ist sehr selten.

Meine regelbasiert-prognosefreie ganzheitliche (Multi-Asset) Investmentphilosophie ist dieser dritten Kategorie zuzuordnen. Ich nenne sie RETRO-Philosophie. RETRO steht dabei für regel- und evidenzbasiert, transparent, robust und optimierungsfrei (Details siehe 240110-Das-Soehnholz-ESG-und-SDG-Portfoliobuch.pdf (soehnholzesg.com)).

Meine Regelbestandteile: Nur nachhaltig, nicht finanziell

Wissenschaftliches Research zum Beispiel zu aktiven und Faktorinvestments zeigt, dass es keine klaren dauerhaften Outperformancefaktoren gibt. Aber ich kann umso anspruchsvollere Nachhaltigkeitsregeln nutzen, je weniger nicht-nachhaltige (traditionelle) Kriterien ich für die Wertpapier-Selektion nutze. Deshalb verwende ich keine klassischen finanziellen sondern (fast) nur Nachhaltigkeits-Selektionskriterien (weitere Details siehe 240110-Das-Soehnholz-ESG-und-SDG-Portfoliobuch.pdf (soehnholzesg.com)).

Meine Aktienselektionsregeln für ESG-Portfolios habe ich 2016 entwickelt und 2017 für ein „Impact“-Portfolio um SDG-Regeln ergänzt.

Statische oder dynamische Regeln?

Meine RETRO- und „so nachhaltig wie möglich“ Investmentphilosophie ist seit Jahren grundsätzlich unverändert. Weil sich die (Investment-)Welt aber ständig verändert und immer wieder neue (Nachhaltigkeits-)Informationen zur Verfügung stehen, bin ich skeptisch in Bezug auf völlig starre Umsetzungsregeln. Ich möchte die Möglichkeit haben, Regeln zu verändern.

Auch Regeln von einigen Indizes, wie dem DAX, werden von Zeit zu Zeit angepasst. Dafür gibt es Gremien, die – oft diskretionär – Regeländerungen bestimmen.

Statt Änderungen von Regeln von Bestandsprodukten können auch neue statisch-regelbasierte Produkte angeboten, wenn die alten Regeln nicht mehr adäquat erscheinen. Die Tatsache, dass es mehr als 3 Millionen Investmentindizes gibt (vgl. Home – Index Industry Association), deutet darauf hin, dass das sogar oft der Fall ist.

Für meine Investmentphilosophie ist ein strukturierter (regelbasierter) kontinuierlicher (Regel-) Verbesserungsprozess (KVP) am sinnvollsten.

Meine Regeländerungen von 2017 bis 2024

Bei regelbasierten Portfolios können schon kleine Änderungen zu relativ großen Portfolioveränderungen führen (vgl. Divestments: 49 bei 30 Aktien meines Artikel 9 Fonds – Responsible Investment Research Blog (prof-soehnholz.com)). Um die Zahl von Transaktionen bzw. Kosten zu begrenzen versuche ich, meine Regeln nur graduell zu ändern.

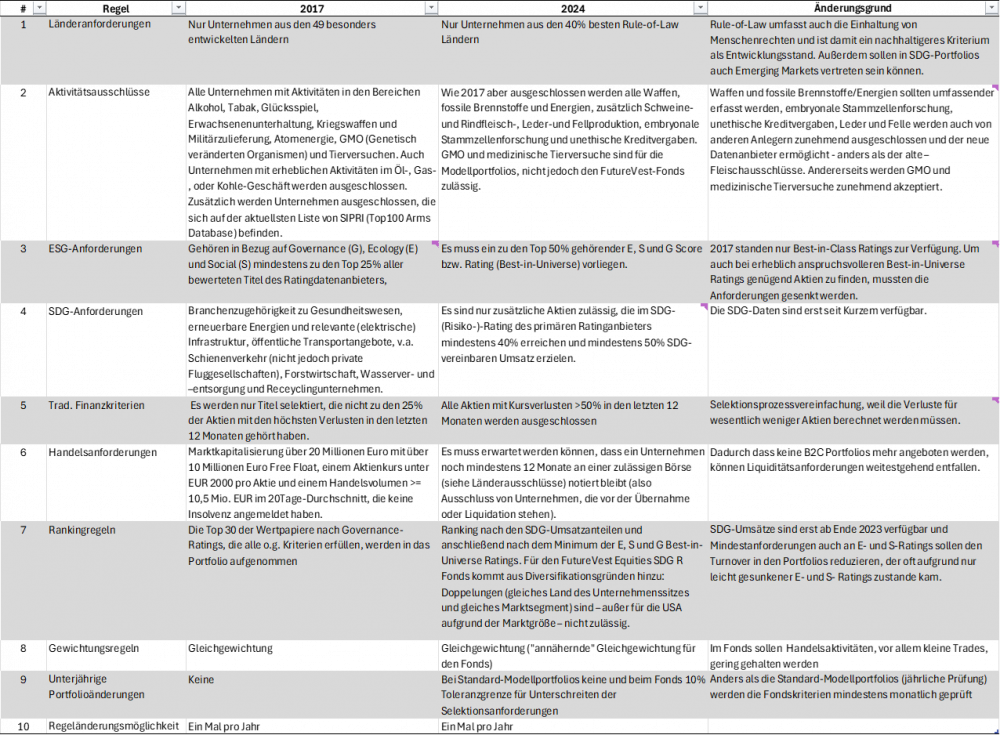

Die Tabelle zeigt meine Selektionsregeln in den Zeilen 1 bis 7. In Zeile 8 ist meine einfache Allokationsregel aufgeführt und die letzten beiden Zeilen beinhalten meine Änderungsregeln (KVP).

Regeländerungen: Wenige Änderungsgründe

Im Rückblick habe ich vor allem deshalb Regeln geändert, weil immer mehr und bessere Nachhaltigkeitsdaten zur Verfügung standen. So habe ich meine Datenanbieter schon bei meiner ersten Auswahl im Jahr 2012 wegen eines möglichst guten Datenangebotes ausgesucht. In der Zeit vom Start meines Unternehmens im Jahr 2016 bis heute habe ich den Datenanbieter einmal gewechselt. Die Hauptgründe für den Wechsel waren mehr abgedeckte Aktien, also auch Small Caps, monatliche statt jährliche Datenaktualisierungen und die Möglichkeit der Nutzung von Best-in-Universe ESG-Ratings. Hinzu kamen im Laufe der Jahre zusätzliche Datenangebote des jeweiligen Anbieters, was vor allem für die SDG-Vereinbarkeit zu Regeländerungen geführt hat. Ein weiterer Grund für meine Regeländerungen waren (Prozess-)Vereinfachungen.

Für den von mir konzipierten und beratenen Investmentfonds wurden einige wenige zusätzliche Regelergänzungen vorgenommen, um schneller auf schlechtere Nachhaltigkeitsdaten reagieren zu können und um unterjährige Kapitalflüsse möglichst effizient managen zu können.

Resultat bisher: Marktübliche Performance und Small-Cap Fokus

Wenn man wie ich mit den nachhaltigsten Aktien startet, reduziert Diversifikation die durchschnittliche Nachhaltigkeit (vgl. 30 stocks, if responsible, are all I need (prof-soehnholz.com)). Mein bewusst nur 30 Aktien umfassendes (Fonds-)Portfolio enthält deshalb nur Aktien aus wenigen Ländern (aktuell 12) und Marktsegmenten (vor allem Gesundheit, Industrie und erneuerbare Energien). Weil kleine Unternehmen einfacher SDG-vereinbar sein können, lag mein Fokus Anfangs auf Mid.Caps, weil der damalige Ratinganbieter kaum Small-Caps abdeckte. Seit dem Ratinganbieterwechsel sind vor allem Small-Caps in meinen ESG SDG Portfolios enthalten.

Die Performance seit Auflage ist ähnlich wie die von aktiv gemanagten globalen Small- und Mid-Cap-Fonds (vgl. Globale Small-Caps: Faire Benchmark für meinen Artikel 9 Fonds? – Responsible Investment Research Blog (prof-soehnholz.com).

Regeländerungen: Ausblick

Weil ich meinen konsequenten Nachhaltigkeitsfokus beibehalten werde, erwarte ich, dass auch künftig vor allem Small-Caps im Portfolio vertreten sein werden. Da es keine typischen Allokationsregeln gibt, können Länder- und Branchenallokationen aber weiter schwanken. Sofern keine zu ausgeprägten Konzentrationen erkennbar sind, werde ich weiterhin auf Mindest- oder Maximalgrenzen für Länder und Branchen verzichten.

Interessant ist, dass es nur sehr wenige global investierende nachhaltige Small-Cap-Portfolios gibt. Ich habe deshalb bisher noch keinen Investmentfonds gefunden, mit dem mein Fonds mehr als 5 Investments gemein hat. Für nachhaltig orientierte Anleger, die nicht wie ich (fast) all ihr Vermögen in meinen Fonds anlegen möchten, ist mein Fonds deshalb eine attraktive potenzielle Portfolioergänzung.

…………………………………………………………………………………………………………………………………………………

Werbung:

Der von mir beratene Fonds (SFDR Art. 9) ist auf soziale SDGs fokussiert. Ich nutze separate E-, S- und G-Best-in-Universe-Mindestratings sowie ein breites Aktionärsengagement bei aktuell 26 von 30 Unternehmen: FutureVest Equity Sustainable Development Goals R – DE000A2P37T6 – A2P37T oder Divestments: 49 bei 30 Aktien meines Artikel 9 Fonds

Disclaimer

Diese Unterlage ist von der Soehnholz ESG GmbH erstellt worden. Die Erstellerin übernimmt keine Gewähr für die Richtigkeit, Vollständigkeit und/oder Aktualität der zur Verfügung gestellten Inhalte. Die Informationen unterliegen deutschem Recht und richten sich ausschließlich an Investoren, die ihren Wohnsitz in Deutschland haben. Sie sind nicht als Verkaufsangebot oder Aufforderung zur Abgabe eines Kauf- oder Zeichnungsangebots für Anteile des in dieser Unterlage dargestellten Fonds zu verstehen und ersetzen nicht eine anleger- und anlagegerechte Beratung. Anlageentscheidungen sollten nur auf der Grundlage der aktuellen gesetzlichen Verkaufsunterlagen (Wesentliche Anlegerinformationen, Verkaufsprospekt und – sofern verfügbar – Jahres- und Halbjahresbericht) getroffen werden, die auch die allein maßgeblichen Anlagebedingungen enthalten. Die Verkaufsunterlagen werden bei der Kapitalverwaltungsgesellschaft (Monega Kapitalanlagegesellschaft mbH), der Verwahrstelle (Kreissparkasse Köln) und den Vertriebspartnern zur kostenlosen Ausgabe bereitgehalten. Die Verkaufsunterlagen sind zudem im Internet unter www.monega.de erhältlich. Die in dieser Unterlage zur Verfügung gestellten Inhalte dienen lediglich der allgemeinen Information und stellen keine Beratung oder sonstige Empfehlung dar. Die Kapitalanlage ist stets mit Risiken verbunden und kann zum Verlust des eingesetzten Kapitals führen. Vor einer etwaigen Anlageentscheidung sollten Sie eingehend prüfen, ob die Anlage für Ihre individuelle Situation und Ihre persönlichen Ziele geeignet ist. Diese Unterlage enthält ggf. Informationen, die aus öffentlichen Quellen stammen, die die Erstellerin für verlässlich hält. Die dargestellten Inhalte, insbesondere die Darstellung von Strategien sowie deren Chancen und Risiken, können sich im Zeitverlauf ändern. Einschätzungen und Bewertungen reflektieren die Meinung der Erstellerin zum Zeitpunkt der Erstellung und können sich jederzeit ändern. Es ist nicht beabsichtigt, diese Unterlage laufend oder überhaupt zu aktualisieren. Sie stellt nur eine unverbindliche Momentaufnahme dar. Die Unterlage ist ausschließlich zur Information und zum persönlichen Gebrauch bestimmt. Jegliche nicht autorisierte Vervielfältigung und Weiterverbreitung ist untersagt.