Brown banks picture from clker free vector images from Pixabay

Brown banks: 9x new research on CO2-costs, climate policy effects, Mittelstand climate, stock prices, ESG, CSR, gender diversity, green projects, and listed real estate (# shows the number of SSRN full research paper downloads as of June 13th, 2024)

Social and ecological research

Correct CO2 costs? Synthesis of evidence yields high social cost of carbon due to structural model variation and uncertainties by Frances C. Moore, Moritz A. Drupp, James Rising, Simon Dietz, Ivan Rudik, Gernot Wagner as of June 10th, 2024 (#9): “Estimating the cost to society from a ton of CO2 – termed the social cost of carbon (SCC) – requires connecting a model of the climate system with a representation of the economic and social effects of changes in climate, and the aggregation of diverse, uncertain impacts across both time and space. … we perform a comprehensive synthesis of the evidence on the SCC, combining 1823 estimates of the SCC from 147 studies with a survey of authors of these studies. The distribution of published 2020 SCC values is wide and substantially right-skewed, showing evidence of a heavy right tail (truncated mean of $132). … we train a random forest model on variation in the literature and use it to generate a synthetic SCC distribution that more closely matches expert assessments of appropriate model structure and discounting. This synthetic distribution has a mean of $284 per ton CO2, respectively, for a 2020 pulse year (5%–95% range: $32–$874), higher than all official government estimates … “ (abstract).

Strict policy effects: Climate and Environmental Policy Risk and Debt by Karol Kempa and Ulf Moslener as of April 25th, 2024 (#95): “… we find that policy determines how firms’ externalities, such as CO2 emissions and different types of environmental pollution, translate into credit risks and corporate bond pricing. The size as well as direction of the effect of externalities on credit risk and bond spreads depends on the stringency of policy. Ambitious policy increases the credit risk and costs of debt for dirty firms and decreases both for clean firms. Lenient regulation can have the opposite effect. … Finally, we find that a higher likelihood of stringent climate policies in the future increases the impact of CO2 emissions on credit risk“ (abstract).

Mittelstandsklima: Die unternehmerische Akzeptanz von Klimaschutzregulierung von Markus Rieger-Fels, Susanne Schlepphorst, Christian Dienes, Rodi Akalan, Annette Icks und Hans-Jürgen Wolter vom 3. Juni 2024: „Nur eine starke Volkswirtschaft kann die für den Klimaschutz erforderlichen Ressourcen aufbringen. Die Unternehmen sind dabei in der Mehrzahl bereit, diesen Weg mitzugehen. Speziell die mittelständischen Unternehmerinnen und Unternehmer weisen tendenziell eine hohe intrinsische Motivation auf, zum Schutz der Umwelt und des Klimas beizutragen. Das ist wichtig, da den Unternehmen stets ein strategischer Spielraum in der Umsetzung bleibt. Das Spektrum reicht dabei von einer Standortverlagerung über eine Produktionseinstellung und dem bewussten Ignorieren von Vorgaben bis hin zur freiwilligen Übererfüllung von Regulierungen …“ (p. 26/27). My comment: The reaction of global “Mittelstand” companies regarding my shareholder engagement activities (see Shareholder engagement: 21 science based theses and an action plan – (prof-soehnholz.com)) is more open than I thought

ESG investment research (in: Brown banks)

Brown banks? Banking on climate chaos – Fossil fuel finance report 2024 by Urgewald as of May 13th, 2024: “The 60 biggest banks globally committed $705 B USD to companies conducting business in fossil fuels in 2023, bringing the total since the Paris agreement to $6.9 T. These banks committed $347 billion in 2023 and $3.3 trillion total since 2016 to expansion companies – those companies that the Global Oil & Gas Exit List and the Global Coal Exit List report having expansion plans. … Total financing committed for companies with methane gas (LNG) import and export capacity under development, increased from $116.0 billion in 2022 to $121.0 billion in 2023. … 15.4 % of the financing by dollar value issued in 2023 matures after 2030; 3.7 % matures after 2050. Financing for fossil fuel extraction or infrastructure that matures after 2030 faces a risk of becoming stranded … several banks, including Bank of America and PNC, rolled back their previous exclusions in 2023 (see p. 32). Banks continue to prioritize net zero targets, though early research suggests that these targets, like other bank policies, leave loopholes for ongoing fossil fuel finance (see p. 35)” (p. 4). My comment: Check out you bank based on the detailed data: Banking on Climate Chaos 2024 – Banking on Climate Chaos

Climate correlations: The Cold Hard Cash Effect: Temperature’s Role in Shaping Stock Market Outcomes by Yosef Bonaparte as of April 15th, 2024 (#8): “The analysis conducted across 67 countries …highlight that warmer climates are linked to lower stock market returns, with a notable economic significance exceeding 9.12%, and reduced volatility, demonstrating an economic significance of at least 36.9%. Conversely, the Sharpe ratio, serving as a gauge of risk-adjusted returns, displays a positive co-movement with temperature change, indicating an economic significance surpassing 1.63%. Furthermore, cold countries earn greater stock market returns but are more negatively affected by temperature changes” (p. 16).

ESG or CSR? Combining CSR and ESG for Sustainable Business Transformation: When Corporate Purpose Gets a Reality Check by David Risi, Eva Schlindwein and Christopher Wickert as of June 7th, 2024 (#135): “ESG is a compliance-driven and metrics-oriented idea for stimulating sustainable business transformation. It focuses on reducing negative impacts and improving performance in specific areas. Moreover, it provides a reality check on how a firm is doing in light of increasing societal expectations for greater sustainability. By contrast, CSR is often viewed as a more values-based and internally driven approach to sustainability. It provides a strategy for developing a sense of meaning and purpose for responsible business conduct that reflects a firm’s values and identity… In their mutual integration, CSR and ESG create synergy since they can compensate for their respective weaknesses” (p. 12/13).

Good diversity: Board Gender Diversity and Investment Efficiency: Global Evidence from 83 Country-Level Interventions by Dave (Young Il) Baik, Clara Xiaoling Chen, and David Godsell as of May 4th, 2024 (#177): “We document increases in firms’ investment efficiency after the adoption of BGD interventions relative to firms in countries that do not concurrently adopt BGD interventions. Our results are economically significant, suggesting that treatment firms reduce inefficient investment by 0.6 percent of total assets or 6.5 percent of total investment and are 4 percentage points more likely to have above-median investment efficiency after interventions relative to firms in countries not concurrently adopting interventions“ (p. 33). My comment: I recently divested from a company because the social rating declined which was mainly due to low gender worker and board diversity

Impact investment research

Small climate steps: Inside the Blackbox of Firm Environmental Efforts: Evidence from Emissions Reduction Initiatives by Catrina Achilles, Peter Limbach, Michael Wolff and Aaron Yoon as of June 7th, 2024 (#35): “This study uses granular data at the firm’s project level, provided by the Carbon Disclosure Project, to present primary evidence on what large U.S. firms actually do to reduce greenhouse gas emissions. … the majority of emissions reduction projects require small investments – the median investment per project is $127,000, with the median of firms’ total annual investment in such projects amounting to only 0.2% of net income. Second, 63% of all projects have payback periods of at most three years, while just about 10% of all projects pay off after more than ten years. These short-term projects mostly target energy efficiency in buildings or production, and typically do not involve new transformative technology and low-carbon energy. … our results suggest that short-term emissions reduction projects generate more CO2e and monetary savings per year, yield greater NPVs, and predict higher environment-related ESG ratings in the near future. However, total CO2e savings over the projects’ lifetime are at least 25% lower for short-term payback projects. Firms that exhibit the most CO2e savings have a mix of short- and longer-term projects, while firms exclusively implementing only short-term or longer-term projects save significantly less CO2e. We also study how characteristics of firms’ emissions reduction projects, such as their payback period and efficiency in saving CO2e, evolve over time and show which firms implement more short-term projects …. the evidence presented in this paper suggests that the majority of large U.S. firms do not act … long-term oriented” (p. 31/32).

Other investment research (in: Brown banks)

Real estate hedge: U.S. and European Listed Real Estate as an Inflation Hedge by Jan Muckenhaupt, Martin Hoesli and Bing Zhu as of May 28th, 2024 (#27): “This paper investigates the inflation-hedging capability of an important asset class, i.e., listed real estate (LRE), using data from 1990 to the end of 2023 … Listed real estate provides an effective hedge against inflation in the long run, both in crisis and non-crisis periods. In the short term, listed real estate only hedges against inflation in stable periods. LRE effectively serves as a hedge against inflation shocks, particularly protecting against unexpected inflation from the first month and against energy inflation during stable periods. While stocks surpass LRE in long-term inflation protection and LRE has short-term benefits, gold distinguishes itself from LRE by offering reliable long-run protection, but only in economic downturns” (abstract). My comment: My “most-passive” multi-asset ETF portfolios have a target allocation of 10-12% Listed Real Estate, 5 to 6 % Listed Infrastructure and 5% US Treasury Inflation-Protected Securities

………………………………………………………………………………………………………………………………………..

Werbehinweis

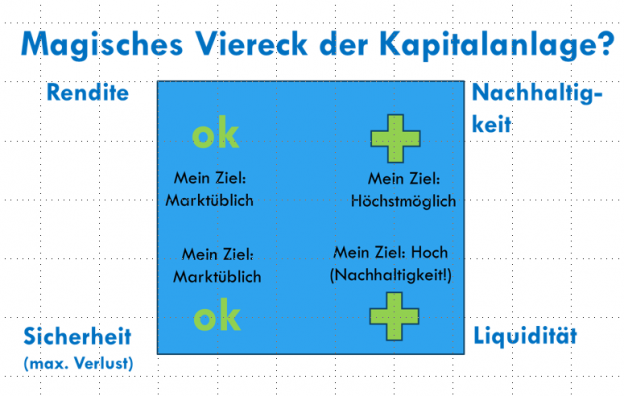

Unterstützen Sie meinen Researchblog, indem Sie in meinen globalen Small-Cap-Anlagefonds (SFDR Art. 9) investieren und/oder ihn empfehlen. Der Fonds konzentriert sich auf die Ziele für nachhaltige Entwicklung (SDG: Investment impact) und verwendet separate E-, S- und G-Best-in-Universe-Mindestratings sowie ein breites Aktionärsengagement (Investor impact) bei derzeit 29 von 30 Unternehmen: My fund – Responsible Investment Research Blog (prof-soehnholz.com). Zur jetzt wieder guten Performance siehe zum Beispiel Fonds-Portfolio: Mein Fonds | CAPinside