Under Fire: ESG investment criticism

Wrong ESG approach? Does ESG Investing improve risk-adjusted performance? by Véronique Le Sourd from the EDHEC-Risk Institute as of April 2022: “ESG does not really provide a positive risk premium, but rather a negative risk premium, once the performance is explained by the various risk factors and investment sectors. However, ESG can generate positive returns in certain conditions, using ESG momentum. The argument for the outperformance of stocks with high ESG scores is that stock markets underreact to ESG information, and so stocks from firms with a positive ESG impact may be undervalued. The ESG momentum strategy thus consists in overweighting stocks that have improved their ESG rating over recent time periods (see Nagy et al [2016]; Bos [2017]; Kaiser and Schaller [2019] for evidence of outperformance of ESG momentum strategies)”. My comment: I do not agree, see e.g. Absolute and Relative Impact Investing and additionality – Responsible Investments (Blog) (prof-soehnholz.com)

ESG Growth Benchmark: Is ESG’s Growth Tilt Really Necessary? By Jon Hale from Morningstar as of June 24th, 2022: “Growth funds have borne the brunt of this year’s bear market. The average large-growth fund has lost 29.3% (through June 22) while the average large-value fund has lost 12.3%. … most ESG equity funds skew stylistically toward growth … The 30 large-growth ESG funds have lost 27.9% so far this year. That is actually less than the drop for large-growth funds overall … The 17 large-value ESG funds have lost 15.9% for the year to date …”. My comment: According to Morningstar, my Article 9 fund has a midcap/blend with growth tilt focus and a significant YTD outperformance compared to traditional funds/indices, see FutureVest Equity Sustainable Development Goals R|DE000A2P37T6 (morningstar.de)

Good ESG commitment: Are All ESG Funds Created Equal? Only Some Funds Are Committed by Michelle Lowry, Pingle Wang, and Kelsey Wei as of May 31st, 2022 (#147): “… we classify ESG funds with high (low) incentives to engage with ESG firms as committed (nominal) ESG funds. We find that committed ESG funds … they tend to make more long-time oriented investments in high ESG stocks and are significantly less likely to sell following poor short-term financial performance. …. committed funds demonstrate greater attention to portfolio firms’ ESG risk exposure with more intensive information production surrounding ESG risk incidents. In contrast to nominal funds’ selling of stocks that are associated with severe ESG risk incidents, committed funds tend to hold or even buy these stocks as they intend to work with management to achieve change. Indeed, we find that firms intensively bought by committed funds subsequently experience significantly larger recovery in their ESG risk exposure, relative to those intensively sold by nominal funds. … we find that committed funds both outperform their nominal counterparts on their high ESG investments and exert greater real impacts on firms’ ESG metrics. However, we do not find evidence that average investors are sophisticated enough to differentiate committed ESG investments versus opportunistic window dressing behavior aimed to attract investor flows” (p. 33/34).

Room for responsible investment growth: UBS Global Family Office Report 2022 as of June 8th, 2022: “More than half (56%) of family offices allocate to sustainable investments. This varies regionally, with the lowest levels in the US (39%) and the highest in the Middle East (70%) and Western Europe (65%) … Reflecting the greater professionalization of how they approach sustainability, more than half (53%) of those invested have increased due diligence. More than half (52%) aren’t confident that they can identify greenwashing, though, and 60% think that performance evaluation remains a problem in impact investing. Of those family offices that still don’t invest sustainably, more than a quarter (27%) point to lack of standard definitions of sustainability as a barrier to investing” (p.32). “More than a third (38%) take the exclusions approach globally. While ESG integration and the pursuit of specific sustainability objectives have become a more prominent approach for various larger institutional investors, only just under a third (31%) of family offices have embraced it in their investment process. Finally, a quarter (24%) of family offices make impact investments” (p. 35).

SRI or scope 3? Are SRI funds financing carbon emissions? An Input-Output Life Cycle Assessment of investment funds by Ioana-Stefania Popescu, Thomas Gibon, Claudia Hitaj, Mirco Rubin, and Enrico Benetto as of March 28th, 2022 (#103): “Indirect greenhouse gas (GHG) emissions (scope 3) generally represent more than half of the total life cycle impact attributable to a company or an investment. However, widely used sustainability assessment tools for investment funds fail to take these into account. … we develop an Input-Output Life Cycle Assessment (IOLCA) methodology to estimate life cycle GHG emissions of companies and investment funds. We apply our method to a sample of 1,340 sustainable (SRI) and conventional equity funds domiciled in Europe and their 11,275 unique holdings. … Our model estimates life cycle emissions for 95% of the companies held – compared to 17% coverage in the Climate Disclosure Project (CDP). When including scope 3, the exposure to GHG emissions of both SRI and conventional funds is two to three times larger than when considering only direct impacts from holdings’ operations. Finally, 24% of the sampled Europe-domiciled SRI funds are more exposed to life cycle carbon emissions than the ETF tracking the conventional market index MSCI Europe” (abstract).

Under fire: Indexing and regulation

Curious (ESG) index investing facts: 1 in 1000 Cabinet of Curiosities by Jakob Thomä of the 2 Degree Investing Initiative as of May 23rd, 2022: “An investor investing in the MSCI World since 2015 would have had higher annual emissions intensity reduction (measured in WACI) than an investor invested in its low-carbon counterparts (p. 3) … Investing in the MSCI Environmental Index involves investing 50% of your assets in one company: Tesla. The same company that according to MSCI is aligned with a 2.63°C temperature outcome (p. 5) … Market-cap weighted benchmarks overweight economic sectors by up to 5x-6x relative to their “economic weight” (p. 6)”.

Anti-ESG backfire: Gas, Guns, and Governments: Financial Costs of Anti-ESG Policies by Daniel G. Garrett and Ivan T. Ivanov as of June 10th, 2022 (#407): “The recent laws in Texas … stipulate that banks with ESG policies restricting credit to oil & gas companies or to firearms firms can no longer contract with local governments, causing five of the largest underwriters to exit municipal underwriting in the state. … We show that affected issuers … receive fewer and less competitive bids from underwriters, raise less financing, and incur higher borrowing costs after the state prohibits banks with ESG policies from operating in the market. Assuming no other banks leave the state, Texas taxpayers can expect these bills to cost them about $445 million a year in additional borrowing costs” (p. 28/29).

Good regulation for banks, not customers: The Markets in Financial Instruments Directive and sensitivity of investors’ portfolio allocation to analyst recommendations by Falko Fecht, Patrick Weber, and Huiting Xu as of Oct. 26th, 2021 (#56): “… First, this paper answers the question that after MiFID II has been implemented, whether the information content of the analyst research has been improved? We find some evidence to support the information-content-improvement hypothesis that the earnings per share prediction (EPS) as an important input of analyst recommendation. … Second, … although customers decreased the likelihood of buying, they will buy more in the post-MiFID II period for those stocks their affiliated bank has a Buy-Recommendation once they buy. … We also find evidence to show that in the post-MiFID II era, bank proprietary trading makes customers economically worse” (p. 34/35).

Impact (aligned) investments

Impact potential: What’s material?! by Martin G. Viehöver of positive impact (PI) GmbH as of June 2022: “In a case study on the 100 biggest stock listed companies in Germany … in 2019 only 12% of the companies disclosed the dimensions impact on society and impact on business so that they can be seen as double materiality prepared. This number increased to 27% in 2021 …. No company in 2019 and only one company in 2021 was double materiality ready by applying the double materiality definition. … It is also shown that the stakeholder perception leads to very different outcomes when comparing the results with the impact on society judgments” (p. 8/9).

Investor engagement focus: Impact Case or Impact Washing? An Analysis of Investors’ Strategies to Influence Corporate Behavior by Joel Diener as of June 8th, 2022 (#9):“This paper outlines how the perspective in the socially responsible investment (SRI) industry has shifted from avoidance to impact. It emphasizes the importance of now also changing the strategies of SRI products. … Based on an extensive review of the SRI literature, various SRI strategies are theoretically evaluated. Subsequently, a best practice example of a bank that applies a sophisticated engagement strategy is presented. Findings: It is shown that there are indeed severe differences in the effects of exclusion, positive approaches, and shareholder engagement. Impact-oriented investment products should employ engagement strategies” (abstract). My comment: I am skeptical about engagement potential, see Divestments bewirken mehr als Stimmrechtsausübungen oder Engagement | SpringerLink

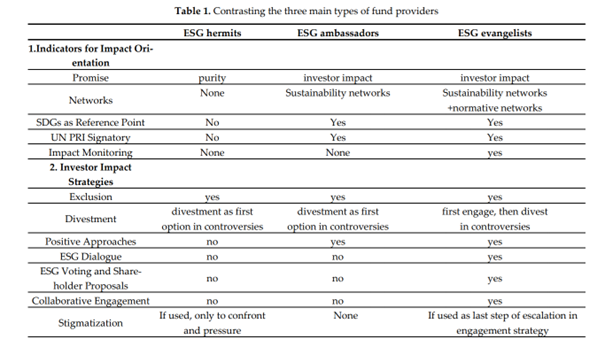

Investor impact categories: Sustainability Improvement or Impact Washing? Assessing Ethical Investment Policies of SRI Fund Providers from an Impact Perspective by Joel Diener and André Habisch as of June 8th, 2022 (#10): “We screened over 400 documents with around 8500 pages from 45 different providers of socially responsible funds from the USA, Germany, Austria, Switzerland, France, Spain, and the United Kingdom (p. 5). … We are the first to provide an impact-focused typology of socially responsible investment companies” (p. 2). … to distinguish three types of fund providers: ESG hermits, ESG ambassadors and ESG evangelists” (abstract).

(table see page 10). My comment: I am skeptical about dialogue, voting and engagement potential and prefer (positive) signaling of good investments (see my publications mentioned in my last comment above)