Customer ESG engagement is my term for shareholder engagement with the goal to address corporate customers regarding ESG-topics. First, I want to help my respective portfolio companies to improve their ESG-profiles. In addition, I want to help to increase corporate revenues and thus to improve the returns for the clients in my investment portfolios.

Here I provide an overview of current scientific research regarding customer ESG engagement topics. I also explain my respective recommendations for the companies I am invested in.

The other two stakeholder groups which I address with my “leveraged shareholder engagement” are suppliers (see Supplier engagement – Opinion post #211 – Responsible Investment Research Blog (prof-soehnholz.com)) and employees (compare HR-ESG shareholder engagement: Opinion-Post #210 – Responsible Investment Research Blog (prof-soehnholz.com)).

Unfortunately, I did not find much research on the link between ESG quality of companies (which is typically measured with ESG ratings) and corporate revenues.

Customer ESG engagement goal 1: Avoid or reduce negative aspects

My first hypothesis: If ESG quality (ratings) declines and customers are informed about the reasons for this change, they may react in buying less from the negatively affected companies. Here are two recent studies which support this hypothesis:

Negative ESG aspects (1): How Does ESG Shape Consumption? by Joel F. Houston, Chen Lin, Hongyu Shan, and Mo Shen as of June 11, 2023: “Our study explores the effects of more than 1600 negative events captured from the RepRisk database, on 150 million point-of-sale consumption observations … Our baseline findings show that the average negative event generates a 5 – 10 % decrease in sales for the affected product in the six months following the event“ (p. 23/24).

Negative aspects (2): Assessing the Impact of ESG Violations on Brand-Level Sales by Yao Chen, Rakesh Mallipeddi, M. Serkan Akturk, and Arvind Mahajan as of June 22nd, 2023 (no full paper free download): “This study examines the effects of negative Environmental, Social, and Governance (ESG) news on the sales of retail brands. … our results reveal that news coverage of firms‘ violations related to ESG significantly affects brand sales” (abstract).

The effects in the business-to-business market may be even larger. On the other hand, substituting a professional supplier with another one is typically time-consuming and costly.

Customer ESG engagement goal 2: Support positive aspects

My second hypothesis: If ESG quality (ratings) improves and customers are informed about the reasons for this change, they may react in buying more (volume effect) from the positively affected companies or pay them more (price effect).

Here are two recent studies which support this hypothesis:

Positive aspects (1): Do Consumers Care About ESG? Evidence from Barcode-Level Sales Data by Jean-Marie Meier, Henri Servaes, Jiaying Wei, and Steven Chong Xiao as of July 11th, 2023: “… we find that higher E&S ratings positively affect subsequent local product sales. … revenue also declines after the release of negative E&S news. … we find a significant increase in the sensitivity of local retail sales to firm E&S performance after … (Sö: natural and environmental) disaster events for counties located closer to the events“ (p. 23).

Positive aspects (2): The Return on Sustainability Investment (ROSI): Monetizing Financial Benefits of Sustainability Actions in Companies by Ulrich Atz, Tracy Van Holt, Elyse Douglas and Tensie Whelan as of Jan. 23rd, 2022: “The beef supply chain yielded a potential net present value (NPV) between 0.01 percent to 12 percent of annual revenue, depending on the supply chain segment. For one automotive company, the five-year NPV (Sö: Net present value) based on realized benefits was 12 percent of annual revenue“ (abstract).

Investors can influence corporations

If corporate ESG quality can influence revenues and if investors can influence corporate ESG quality, this can be a win-win situation.

I have written in the past about the potential impact of investors on corporations and my shareholder engagement approach (see Shareholder engagement: 21 science based theses and an action plan – (prof-soehnholz.com)). Here is an exemplary research study explicitly mentioning the potential for customer ESG engagement:

Good for stakeholders: Engagement on Environmental, Social, and Governance Performance by Tamas Barko, Martijn Cremers, and Luc Renneboog as of Nov. 18th, 2022: “Our results thus suggest that the activism regarding corporate social responsibility generally improves ESG practices and corporate sales and is profitable to the activist. Taken together, we provide direct evidence that ethical investing and strong financial performance, both from the activist’s and the targeted firm’s perspective, can go hand-in-hand together” (abstract).

I try to invest in the already most sustainable companies (see for example Active or impact investing? – (prof-soehnholz.com)). Therefore, my customer ESG engagement focuses on informing customers, that ESG is important for the respective companies. In addition, I want to encourage customers to suggest ESG improvements for the companies I am invested in.

My customer ESG engagement recommendations

I expect easier and faster adoption of my shareholder proposals for simple and low cost recommendations. Many companies already use regular customer surveys. Adding additional questions to such surveys should be rather easy for them.

I propose regular and formal questions to customers such as “How satisfied are you with the environmental, social and corporate governance activities of “your company”?” and “Which environmental, social and corporate governance improvements do you suggest to “your company”?” plus the publication of the main results of the answers in the next sustainability report“

With these questions, I also want to help to educate customers on ESG topics, since the surveys should be accompagnied by some basic ESG information. Also, if customers find ESG important, as I expect, then company internal ESG-sceptics may become less negative on ESG. Thirdly, regularly measuring customer ESG satisfaction can help to monitor customers ESG perception changes. With the publication of the main survey results e.g. in regular sutainability reports, other stakeholders can monitor these perception changes and intervene, if they want.

Since I only started my shareholder engagement by the end of last year, I cannot report much adoption of my proposals yet. But the good news is that I am currently in more or less active discussions with 29 of my 30 portfolio companies. I am confident, that at least a few companies will introduce such survey questions and thus position themselves even more as ESG-leaders.

Research such as “A Test of Stakeholder Governance” by Stavros Gadinis and Amelia Miazad as of Aug. 25th, 2021 is one of the reasons for optimism on my part. They summarise: „Our findings suggest that companies turned to stakeholders during the pandemic with increasing frequency and asked for input on issues that are central to their business … Today, stakeholder governance seeks to proactively cover the company’s social profile as comprehensively as possible, collecting information in a regular and standardized manner“ (abstract).

And, with publications such as this blog post, maybe I can encourage others to support such broad stakeholder engagement activities as well.

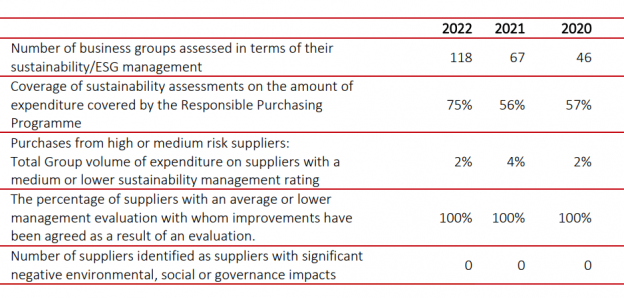

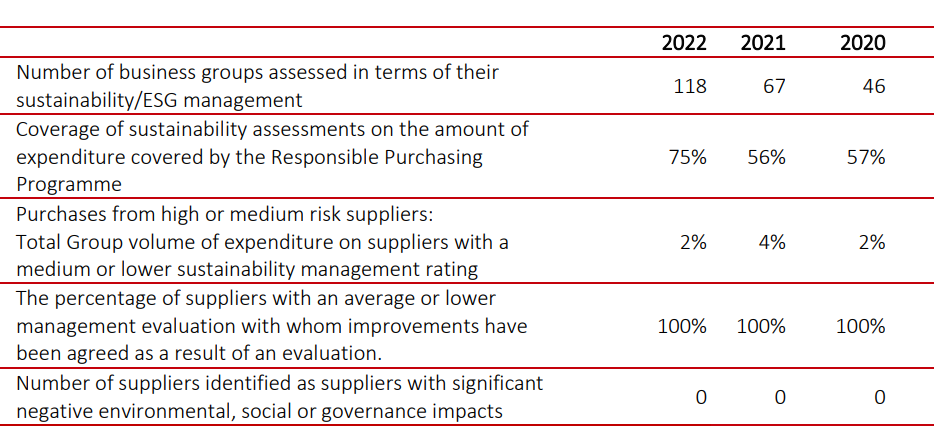

Update information: In their 2023 Sustanability Report (p.48/49) Nordex, one of my investments, documents that it surveys customers since 2022 on ESG issues. The response rate of 30% and the overall satisfaction rate of 4,6 out of 6 can still be improved, though.

………………………………………………………………………………….

Advert for German investors:

Sponsor my research by investing in and/or recommending my global small/midcap mutual fund (SFDR Art. 9). The fund focuses on social SDGs and uses separate E, S and G best-in-universe minimum ratings and broad shareholder engagement with currently 29 of 30 engaged companies: FutureVest Equity Sustainable Development Goals R – DE000A2P37T6 – A2P37T

………………………………………………………………………………….