ESG regulation: >15x new research on climate, regulation, (un)sustainable funds, SDGs, greenium, ESG reporting, voting, wealth, buy-and-hold, private equity, private real estate and AI by Roman Inderst, Andreas Hoepner et al.

Ecological and social and governance research: ESG regulation

Climate-heuristics: Harnessing the power of communication and behavior science to enhance society’s response to climate change: A white paper for comment by Edward Maibach, Sri Saahitya Uppalapati, Margaret Orr, and Jagadish Thaker as of October 5th, 2022 (#181): “… we provide an evidence-based heuristic for guiding efforts to share science-based information about climate change with decisionmakers and the public at large. … We .. also provide a second evidence-based heuristic for helping people and organizations to change their climate change-relevant behaviors, should they decide to. These two guiding heuristics can help scientists and other to harness the power of communication and behavior science in service of enhancing society’s response to climate change” (abstract).

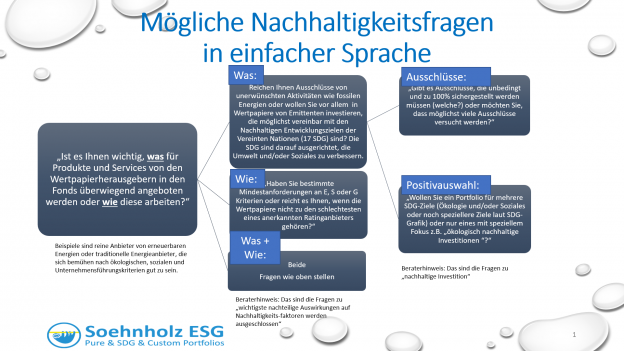

Advert for German investors: “Sponsor” my free research e.g. by buying my Article 9 fund. The minimum investment is around EUR 50. FutureVest Equity Sustainable Development Goals R – DE000A2P37T6 – A2P37T: I focus on social SDGs and midcaps and use best-in-universe as well as separate E, S and G minimum ratings.

For my approach to this blog see 100 research blogposts since 2018 – Responsible Investment Research Blog (prof-soehnholz.com)

For more current research please go to page 2 (# indicates the number of SSRN downloads on October 25th):