Engagement-washing as a term, according to my research, was first used by Kunal Desai in an interesting study in early 2022 (see Active-Engagement-thought-piece-final-2.pdf (gibam.com)). Engagement-washing means pretending that shareholder engagement can create a significant positive real-world impact when it probably can’t. That is different from impact-washing which typically is used to describe overambitious product marketing claims to make the world better.

Impact investing and engagement-washing

Impact investing is clearly on the rise. With impact investing, investors want to improve the world through their investments in equity capital or through credits. Impact investing with secondary-market listed equities or bonds is especially difficult. With those products, one security holder buys the security from another one. With such a transaction, issuers of the securities do not receive any additional funds. Therefore, providers of listed products which want to create impact typically use shareholder voting and shareholder engagement to change the issuers of the securities they are invested in.

Limitation of shareholder voting

Shareholder voting is typically only possible at annual shareholder meetings. Votes can only be used regarding the proposals on the agenda. In most cases, corporate management proposals are supported by the majority of votes. Investors can try to put own proposals on the agenda, but even the largest shareholders alone typically do not have enough votes to get them through.

Shareholder (or bondholder) engagement can be exercised at any time and regarding every topic. If investors can convince the top management of companies to adopt their proposals, they may have impact.

So far, so good. But the reality may not be that simple (data see Kunal Desais paper which refers to ESG Shareholder Engagement and Downside Risk by Andreas G. F. Hoepner, Ioannis Oikonomou, Zacharias Sautner, Laura T. Starks, Xiaoyan Zhou :: SSRN):

7 limitations of ecological and social shareholder engagement

- Although engagement becomes more popular, the majority of investors most likely does not engage at all.

- Even if investor engage, engagements typically are undertaken only for a minority of investments. That is not surprising, because most institutional investors own very many securities and only have limited resources for engagement.

- The majority of engagements involves only one interaction with the targeted companies. Since changes at companies typically take some time, one interaction does not seem enough to change much.

- Governance topics typically dominate engagements whereas impact-relevant environmental and social topics are the minority of topics addressed during engagements.

- ESG-ratings cover dozens if not hundreds of topics. Engagement typically only focus on one or very few topics. Even very well managed companies have many and sometimes also huge improvement potential in several social and ecological issues. The typical share of actual shareholder engagement topics compared to potentially relevant social and ecological engagement topics therefore is very low.

- It is very unclear how many engagements are successful since so far there is no good system to measure engagement success. If anything, shareholders measure engagement activity and not success. Often, marketing only repeats the same case study of a successful corporate engagement over and over. Shareholders for Change (see SfC-ENGAGEMENT-Report2022-1.pdf (shareholdersforchange.eu) page 6) proposes an evaluation scheme but it does not allow to quantity the aggregate success of shareholder engagements.

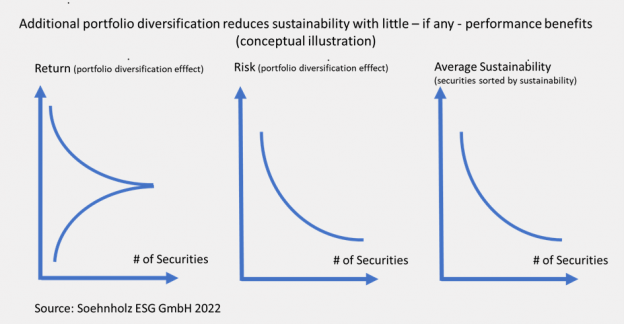

- Mostly, companies do not state clearly what the consequences are, when their engagements are not successful. I assume that there are no divestments or even reductions in investments after most unsuccessful engagements. The reason is the low openness to divestments and benchmark deviations of institutional investors. Most try to stay very close to their selected benchmarks, even though divestments typically would reduce their portfolio diversification only marginally.

Conclusion: No engagement-washing but investing as good as you can

Conclusion: Social and ecological shareholder engagement is the most important tool to create impact with listed companies. But investors should not pretend to be able to significantly change the engaged target companies. Calling listed equity or bond funds “impact” funds does not sound right to me (impact-aligned is somewhat better, though). And reliance on investors to change listed companies is insufficient.

Engagement-washing seems to be a real risk which, if revealed, would hurt the “washer” but also potentially the whole segment of responsible investments. Investors nevertheless should invest as responsibly as possible. They should also try to engage as much as they can afford to. And that should include engagements with industry associations, NGOs, politicians etc. to advance responsible investing in general.

Further reading regarding engagement-washing

Shareholder engagement: 21 science based theses and an action plan – (prof-soehnholz.com): The 21 theses already contain many of my arguments above and show my engagement topics which include leveraged or stakeholder engagement approaches. The article also refers to additional relevant research papers.

Stakeholder engagement and ESG (Special Edition Researchposting 115) – Responsible Investment Research Blog (prof-soehnholz.com)): Current research on shareholder ESG engagement

Active or impact investing? – (prof-soehnholz.com): Explains my engagement approach with a 100% engagement target for invested companies

Divestments bewirken mehr als Stimmrechtsausübungen oder Engagement | SpringerLink: approx. 20 pages with long literature list