The background

Engagement test: I am skeptical regarding the effectiveness of shareholder voting and engagements (compare Divestments bewirken mehr als Stimmrechtsausübungen oder Engagement | SpringerLink and Impact Investing mit Voting und Engagement? (Opinionpost #194) – Responsible Investment Research Blog (prof-soehnholz.com).

Nevertheless, I wanted to try an engagement myself. The starting point was a call with a Linkedin contact in April 2022. He mentioned a German engagement startup and introduced me to its founder, David Hamel. David and I talked on May 3rd, 2022 and David suggested to review the portfolio of my investment fund (FutureVest Equity Sustainable Development Goals R – DE000A2P37T6 – A2P37T) for engagement opportunities.

My fund

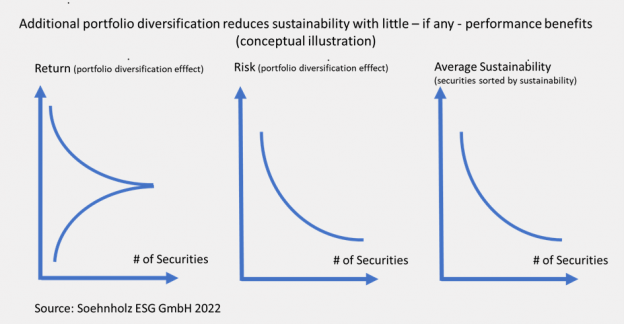

For my fund, I select 30 stocks globally almost only according to sustainability criteria. I use strict activity and country exclusions and high requirements for environmental, social and governance (ESG) best-in-universe ratings. This means that I do not look for the best ecological, social and governance ratings in pre-defined industries (best-in-class approach), but for the best ESG rated stocks globally across all industries. In addition, I try to include only companies which are best aligned with one or more of the Sustainable Development Goals of the United Nations (SDG).

More focused and therefore often smaller companies can have a better fit with my approach than diversified companies. Unsurprisingly, the median capitalization of the stocks in my portfolio is only slightly higher than 10 billion USD, meaning that a significant part of my stocks are so-called small- or midcaps.

The targets and topics of my engagement test

David’s startup, DeRisk.earth, tries to identify existing engagements as well as potential new engagement topics for stock listed companies worldwide. When I sent David my portfolio, he found no current engagements on any of the stocks by major activists or asset managers. That was to be expected, though, since statistics from MSCI show that for more than 70% of the almost 9000 Stocks in the MSCI ACW IMI Index there are no known active engagements of large asset managers (Net-Zero Alignment: Engaging on Climate Change – MSCI). Also, I try to select the best stocks according to environmental, social and governance ratings. Therefore I did not expect to find many engagements for my portfolio companies.

Comparing different data sources, all of the stocks in my portfolio showed good ESG scores. Nevertheless, David recommended to start an engagement with an US water utility and infrastructure company to try to even further improve that company. The reason for this recommendation was that the company was subject to litigation claims due to a chemicals spill.

My subsequent own analysis of that company made me suggest CO2 improvement, too, and in addition the use of ESG criteria for supplier selection and a supplier ESG improvement program.

The first contacts

On May 30st, we wrote our first Email to the head of investor relations of American Water Works (Amwater) with our suggestions. I mentioned that through the German mutual fund which I advise I only held shares of approximately three hundred thousand US Dollars.

Three weeks later, we received an answer and started an exchange of Emails. To support our proposals we referred to two research studies: Do Scope 3 Carbon Emissions Impact Firms’ Cost of Debt? by Ahyan Panjwani, Lionel Melin, and Benoit Mercereau as of Oct. 17th, 2022 and Making supply-chain decarbonization happen | McKinsey).

Amwater informed us that the learnings from the chemical spill as well as employee education topics were already covered by their Environmental Policy and their educational activities for employees. Therefore, we focused on other points and made our proposal regarding CO2 emissions more concrete. We specifically asked for “clear GHG emission targets, including separately disclosed scope 1, 2 and 3 emissions and their alignment with the Paris Agreement” and “comprehensive ESG-evaluation … of all major suppliers and clear minimum ESG-standards for new suppliers and for retention of existing suppliers”.

First results of my engagement test

On October 31st, Amwater publicly announced new targets: “By 2035, reduce absolute scope 1 and scope 2 emissions by 50% (2020 baseline). Achieve net zero scope 1 and scope 2 emissions by 2050. First time disclosure of scope 3 emissions”.

On November 9th, we had a videocall with two investor relations representatives, one of them focusing on ESG matters. In this call, we repeated our suggestion to set concrete scope 3 reduction goals. We also proposed to use water companies and not utilities overall as benchmarks. In addition, we suggested improved supplier codes of conduct, ESG evaluations especially for CO2-critical suppliers for fuels, energy and capital goods and supplier ESG audits. We further exchanged views on topics such as ESG- and climate data and data providers and greenwashing risks. We also agreed to continue our discussions.

Engagement test conclusion

It is very likely that Amwater would have made these public announcements without our input. On the positive side, the direct exchange of information and opinion potentially helped us and perhaps also the company to better understand obstacles towards more sustainability.

In general, shareholder engagement can only focus on a very select number of topics out of the many, which could be improved by almost all companies. And to measure the effects of engagements and the attribution to any one investor seems to be very difficult.

It is probably much more effective to hope that (the leaders of) companies are intrinsically motivated to significantly improve their sustainability. Engagement can very likely be much more effective with such companies than with ESG-skeptics. Also, strict regulation for all market participants may lead to more sustainability. Nevertheless, this case encouraged me to continue testing further engagements.

Disclaimer

Diese Unterlage ist von Soehnholz Asset Management GmbH erstellt worden. Die Erstellerin übernimmt keine Gewähr für die Richtigkeit, Vollständigkeit und/oder Aktualität der zur Verfügung gestellten Inhalte. Die Informationen unterliegen deutschem Recht und richten sich ausschließlich an Investoren, die ihren Wohnsitz in Deutschland haben. Sie sind nicht als Verkaufsangebot oder Aufforderung zur Abgabe eines Kauf- oder Zeichnungsangebots für Anteile des in dieser Unterlage dargestellten Fonds zu verstehen und ersetzen nicht eine anleger- und anlagegerechte Beratung. Anlageentscheidungen sollten nur auf der Grundlage der aktuellen gesetzlichen Verkaufsunterlagen (Wesentliche Anlegerinformationen, Verkaufsprospekt und – sofern verfügbar – Jahres- und Halbjahresbericht) getroffen werden, die auch die allein maßgeblichen Anlagebedingungen enthalten. Die Verkaufsunterlagen werden bei der Kapitalverwaltungsgesellschaft (Monega Kapitalanlagegesellschaft mbH), der Verwahrstelle (Kreissparkasse Köln) und den Vertriebspartnern zur kostenlosen Ausgabe bereitgehalten. Die Verkaufsunterlagen sind zudem im Internet unter www.monega.de erhältlich. Die in dieser Unterlage zur Verfügung gestellten Inhalte dienen lediglich der allgemeinen Information und stellen keine Beratung oder sonstige Empfehlung dar. Die Kapitalanlage ist stets mit Risiken verbunden und kann zum Verlust des eingesetzten Kapitals führen. Vor einer etwaigen Anlageentscheidung sollten Sie eingehend prüfen, ob die Anlage für Ihre individuelle Situation und Ihre persönlichen Ziele geeignet ist. Diese Unterlage enthält ggf. Informationen, die aus öffentlichen Quellen stammen, die die Erstellerin für verlässlich hält. Die Erstellerin übernimmt keine Gewähr oder Garantie für die Richtigkeit und/oder Vollständigkeit dieser Informationen. Die dargestellten Inhalte, insbesondere die Darstellung von Strategien sowie deren Chancen und Risiken, können sich im Zeitverlauf ändern. Einschätzungen und Bewertungen reflektieren die Meinung der Erstellerin zum Zeitpunkt der Erstellung und können sich jederzeit ändern. Es ist nicht beabsichtigt, diese Unterlage laufend oder überhaupt zu aktualisieren. Sie stellt nur eine unverbindliche Momentaufnahme dar.