My 21 theses on shareholder engagement [2]

Thesis 1: Engagement can be beneficial for both companies and investors[3].

Thesis 2: Even the largest investors have relatively small stakes in individual companies, but larger investors and those with higher stakes in companies have higher engagement success opportunities[4].

Thesis 3: Investors are often invested in very large numbers of companies that have numerous ESG and SDG improvement opportunities.

Thesis 4: Serious engagement can be costly. Even large investors have relatively few resources to engage.

Thesis 5: Intermediaries such as providers of investment funds who have many end clients with different interests need to be considerate of these[5].

Thesis 6: Far-reaching engagement requirements reduce the willingness of companies to implement them[6].

Thesis 7: Investors typically cannot be expected to perform comprehensive engagements for all their portfolio companies[7].

Thesis 8: Particularly low-sustainability companies can be improved the most[8].

Thesis 9: The more open-minded top management of companies is, the more likely positive engagement effects can be expected[9].

Thesis 10: Companies already advertising sustainability and companies trying to improve their reputation on the topic may be particularly open to sustainability engagement[10].

Thesis 11: Investors can cooperate regarding engagements to create more impact.

Thesis 12: Engagement collaboration among investors comes with legal uncertainties[11].

Thesis 13: There are few independent (non-commercial) engagement service providers that operate holistically (across all ESG and SDG aspects), globally and for all sizes of companies[12].

Thesis 14: Publishing engagement activities (signaling) can lead to positive imitation effects.

Thesis 15: Ideally, engagement results should be measurable.

Thesis 16: Engagement results should ideally be documented in a comprehensible way[13].

Thesis 17: Improvement of ESG ratings (meaning the reduction of ESG risks of companies), can be used as an indicator of success of sustainable engagement[14].

Thesis 18: Shareholder engagement can lead to rating downgrades for companies with good ex-ante ESG ratings[15].

Thesis 19: Successful engagements often lead to the withdrawal of voting proposals for shareholder meetings. However, voting proposals can also result from engagements. Approvals of voting proposals that have little chance of success are not a good indicator of engagement[16].

Thesis 20: It is difficult to attribute engagement successes to individual initiators or investors.

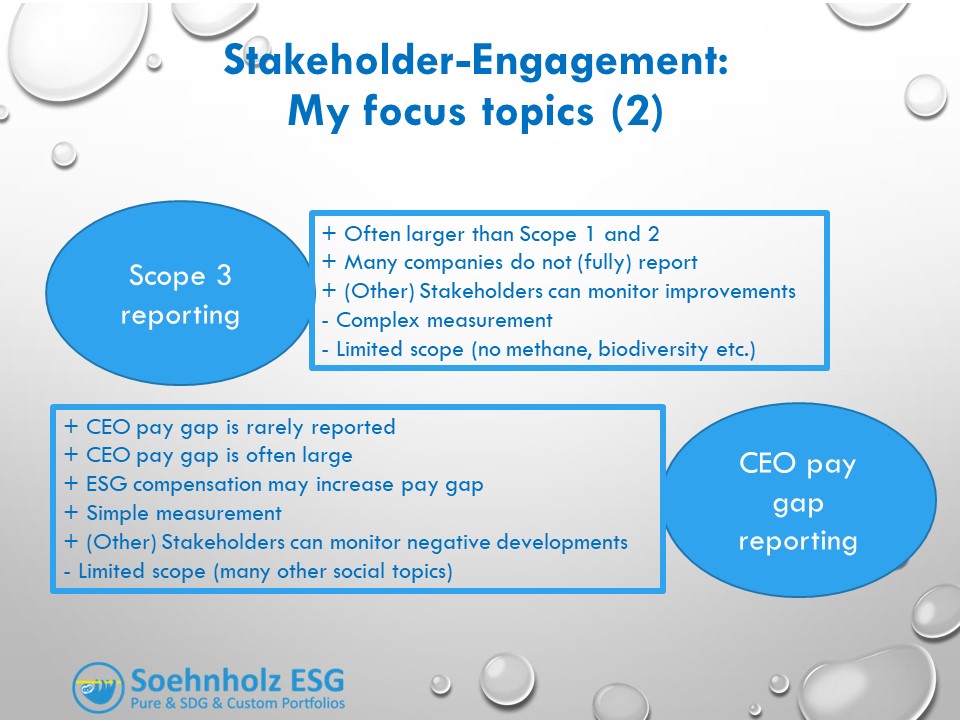

Thesis 21: Some engagement topics may also entail disadvantages. Potential disadvantages should be considered in engagements. An example is the possible increase in the CEO pay gap compared to normal employees when introducing ESG bonuses for executives[17]. Pay-gap changes should therefore be published and monitored when ESG bonuses are introduced.

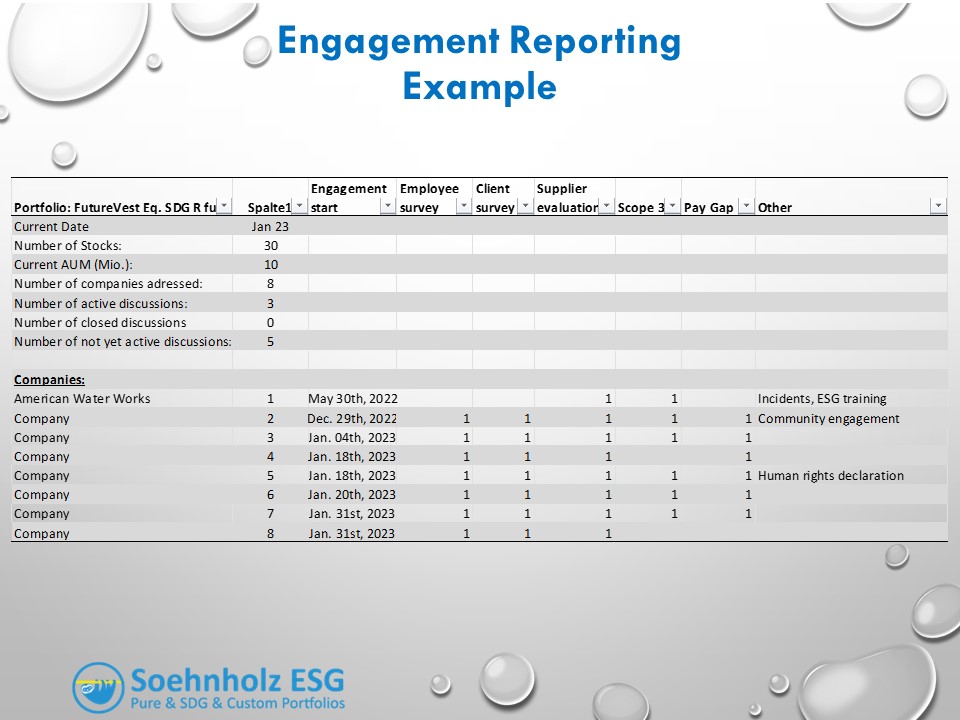

Engagement approach and engagement statistics at the end of January 2023

In 2021, I tested an engagement for the first time[18]. In the meantime, I have started further engagements. My procedure is as follows: I first analyze the detailed data from my primary ESG rating provider Clarity.ai. All stocks in my portfolios must have at least 50 out of 100 points for environmental, social and governance ratings at the time of selection with respect to all rated companies (best-in-universe approach). Therefore, the companies in my portfolios are typically relatively good in terms of ESG aspects and have few or no very large ESG vulnerabilities. Thus, the analysis gives me clues for improvement, but it is not sufficient.

In the second step, I check „Violation Tracker“[19]. In this database, penalty payments by companies are documented. In the third and most important step, I analyze the most recent sustainability reports of the companies concerned to uncover possible weaknesses.

In the meantime, I have written to 8 of the 30 companies in my fund with suggestions for improvement. Because my investments are roughly equally weighted, this corresponds to about 27% of my investment volume. With currently a good 10 million EUR fund assets and an average market capitalization of my investments of 16 billion EUR (median 8 billion EUR), the fund share is small. I am currently in active dialog with 3 of the 8 companies, i.e. 10%. I recently contacted the other companies for the first time.

Engagement prioritization: Which companies do I approach?

I developed my first exposure in cooperation with an external service provider. My portfolio was checked in relation to ongoing engagement activities of other investors. The result was negative. However, one of my portfolio company had a water contamination lawsuit (settled expensively in 2018) listed by Violation Tracker. We used this as an impulse to start an engagement with American Water Works[20]. In the meantime, I use Violation Tracker before stock selection for the fund, so no stocks with such litigation are included in the portfolio.

I undertook the next few engagements without the service provider mentioned above. I selected two companies based on proximity and language, respectively. After that, I focused on environmental, social and governance issues. This means that I approach companies in order of current minimum ratings, starting with the lowest E, S, or G ratings.

In execution, I contact the investor relations (IR) officers of the selected companies. So far, they have mostly responded to me in a timely manner and have processed my suggestions internally with their ESG specialists. Subsequently, I have remained in contact with the companies via the IR officers. Overall, I had the impression that the cooperation with the IR departments was efficient and that my suggestions were taken seriously. Therefore, currently I do not plan to prepare voting proposals for shareholder meetings.

My primary engagement content: Broad and deep and different

With my engagements, I would like to encourage what I see as already particularly sustainable companies to become even more sustainable, if possible on their own incentive. Even among what I define as particularly sustainable companies, there are still many sustainability improvement opportunities. That’s easy to understand, because ESG ratings are often made up of dozens of individual elements, and no company is perfect on all of them. This is especially true if, like me, you aspire to invest only in the most sustainable companies according to a best-in-universe approach.

In order to increase the likelihood of implementation of my engagement proposals, I would like to make only a few and ideally, at least initially, easily and quickly implementable improvement proposals per company.

Basically, the following procedures are possible:

1) Propose what other „engagers“ typically propose, e.g. CO2 emissions transparency and reduction targets and the introduction of ESG incentives for top management.

2) Propose what benefits the companies themselves the most to improve their ESG ratings with the major ESG rating agencies, e.g., reduction targets or implemented reductions in CO2 Scope 1 emissions. This also benefits investors if the ESG ratings on their investments, and thus their portfolios, improve in this way.

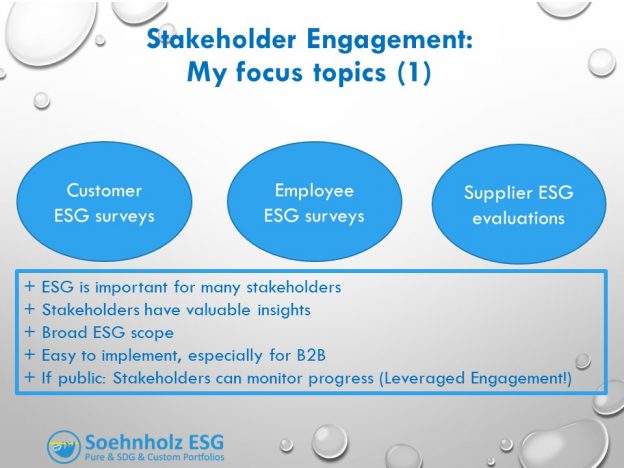

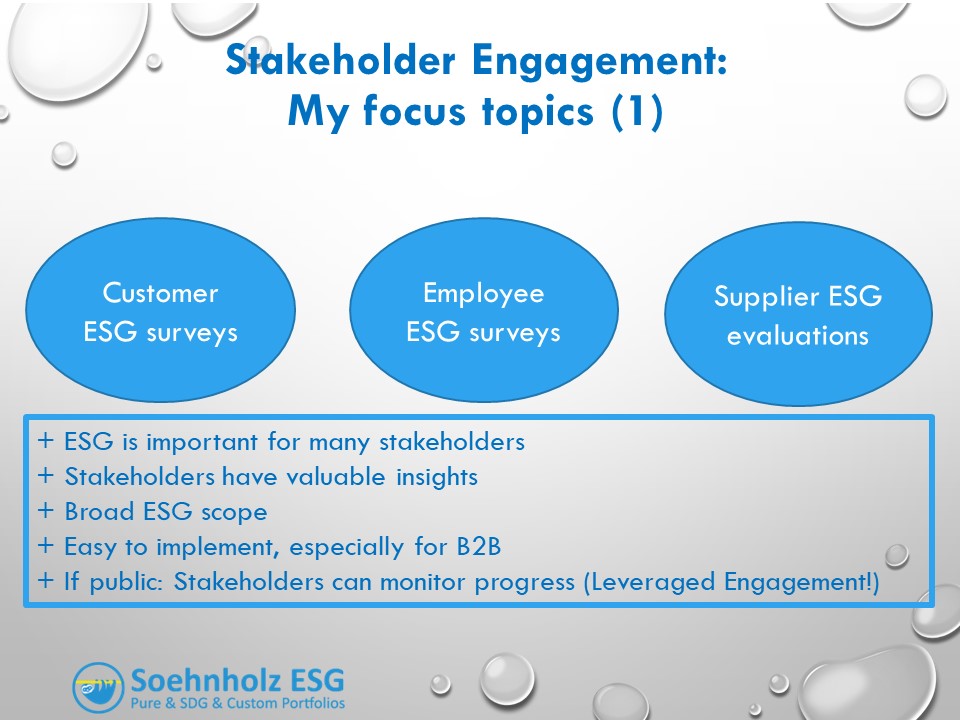

3) Propose what creates as much transparency as possible for other stakeholders (e.g. regular publication of data such as scope 3 emissions and CEO pay ratio) so that other stakeholders can engage accordingly.

4) Propose something that makes as many other stakeholders as possible aware of ESG deficits, e.g. regular ESG surveys or assessments of employees, customers and suppliers, including publication of the most important results.

While most investors probably prefer 1) and 2), for me 3) and 4) are the ones I use.

Specifically, I propose comprehensive supplier assessments as well as employee and customer surveys, which can highlight possible ESG deficits and encourage other stakeholders, especially those directly addressed, to undertake their own ESG improvements or engagement activities (see Stakeholder Engagement by Brett H. McDonnell as of Nov. 1st, 2022 and AccountAbility Stakeholder Engagement Standard). In this way, I am focusing on the issues of greater transparency and stakeholder rather than shareholder engagement or leverage from my engagement activities.

At the same time, I want to ensure that potential negative impacts of popular engagement proposals such as introductions of ESG bonuses are absent. That’s why I propose regular pay ratio disclosures.

Client ESG Issues: I typically suggest to the companies I invest with that they survey as many customers as possible on ESG issues as regularly and as comprehensively as possible. The goal is to have E, S and G suggestions from customers, whose satisfaction should be very important to companies (see Do Contented Customers Make Shareholders Wealthy? – Implications of Intangibles for Security Pricing by Erik Theissen and Lukas Zimmermann as of Jan. 9th, 2021), documented and incorporated in the future. For many stakeholders, including customers, social and environmental aspects are particularly important and/or are becoming more important. Customers can also have good suggestions, e.g., based on their experiences, and can show companies especially E and S good or „best practices“. Customer surveys can therefore be a valuable and inexpensive source of information for companies. All companies should take advantage of the enormous potential of customer surveys.

As many customers as possible should be surveyed, among other things, in order to obtain representative results from the surveys. Ideally, the surveys will also encourage customers to make ESG improvements in themselves. In order to achieve the highest possible impact, all customers should therefore be addressed with regard to ESG issues. The more customers are reached, the more – and thus perhaps more credible for management – suggestions customers can provide for the companies concerned. The regularity of the surveys should ensure that ESG issues are not quickly forgotten, but are repeatedly addressed.

I think that survey questions such as “How satisfied are you with the environmental, social and corporate governance activities of company XXX?” and “Which environmental, social and corporate governance improvements do you suggest to company XXX?” plus the publication of the main results of the answers in ESG-reports would be very helpful.

If a high percentage of customers say they are satisfied with the E, S or G aspects of the companies, this can be very useful for the companies‘ marketing. It also encourages the management of the companies to maintain or further increase the satisfaction levels.

Employee ESG Topics: I encourage as many employees as possible to be surveyed on ESG issues as regularly and comprehensively as possible. The goal is to ensure that E, S and G suggestions from employees (see Do Employees Have Useful Information About Firms’ ESG Practices? by Hoa Briscoe-Tran as of Nov. 11th, 2022), whose satisfaction should be very important to companies, are documented and included in the future.

Employees are also consumers or citizens and as such they are often interested primarily in social but also in environmental issues. Through their experiences, they can often provide good suggestions for improvement for companies (see research studies regarding the effects of employee suggestion systems in general). Ideally, the surveys will encourage them to actively monitor ESG improvements by their employers and also to adopt more sustainable behavior themselves. The prerequisite for the comprehensive success of this measure is related to a workforce trained in ESG topics. In terms of scope, frequency and publication of results, the same aspects apply as for customer surveys.

Supplier ESG Issues: To include supply chains, I suggest using comprehensive ESG criteria in the assessment of all major suppliers and ask about the proportion of suppliers for which ESG criteria are systematically used. Clear minimum ESG criteria for suppliers play a central role in my proposal. Up to now, suppliers have often only been expected to meet individual ESG aspects such as compliance with laws and, where applicable, international standards. From a buyer’s perspective, however, it is increasingly important to comprehensively control ESG risks including reputational risks of the entire supply chains. This is only possible if comprehensive and regular ESG assessments are undertaken (Good examples see Watts Water’s Sustainability Report 2021 p. 55, Commscope’s Sustainability Report 2022 p. 9 and 42 and CAFs Sustainability Report 2022 p. 81-85).

If companies manage to improve suppliers according to E, S and G criteria, they can make a big impact. Basically, similar aspects apply to ESG supplier assessments as those I mentioned for customer and employee surveys.

„Community“ ESG Issues: To better address concerns of other stakeholders, I suggest focusing shareholder engagement on tax rate. Simplistically, a very low tax rate of a company indicates the deliberate use of low-tax countries. With more taxes, more services can in principle be provided to „other stakeholders.“ This issue is particularly relevant for multinational (large) companies. Since I invest mainly in small- and midcaps, I do not actively pursue this point.

Ecology focus topic: If not yet published by the respective company, I suggest introducing reporting of comprehensive CO2 data in connection with reduction targets. This includes in particular broadly defined Scope 3 emissions and not only business travel induced Scope 3 emissions. While such important ecological aspects as biodiversity and methane gases etc. are not considered, my suggestions indirectly include other ecological aspects such as the expansion of the use of renewable energies. Furthermore, CO2 Scope 3 are not easy but still better to determine than biodiversity balances. In addition, transparency in CO2 data also allows other stakeholders to push companies to set concrete reduction targets. More such disclosure could to attract additional investments form responsible investors (see Environmental Disclosures and ESG Fund Ownership by Scott Robinson, Jonathan L. Rogers, A. Nicole Skinner, Laura Wellman :: SSRN).

Social focus: Many engagements of other shareholders call for companies to include sustainability targets in the remuneration systems of (top) managers. There are studies showing that this can lead to future ESG rating improvements. However, I expect such systems to lead to higher management compensation and thus to even wider gaps between mid-level and top management salaries (see Wrong ESG bonus math? Content-Post #188 – Responsible Investment Research Blog (prof-soehnholz.com)).

That’s why I usually suggest in my engagements to regularly publish the so-called CEO Pay Gap or Pay Ratio. Then other stakeholders can also check how high this is and how it is changing. I expect that other shareholders will also pay more attention to the pay ratio aspects in the future (see Citywire Selector | AllianzGI to evaluate executive pay against wider workforce and manual-sdpi-2022.pdf (unrisd.org) p. 33). Proactive disclosure therefore helps companies avoid future criticism and could even be positive for employee morale (see Employee Responses to Increased Pay Transparency: An Examination of Glassdoor Ratings and the CEO Pay Ratio Disclosure by Mary Ellen Carter, Lisa LaViers, Jason Sandvik, Da Xu :: SSRN).

However, publication also has disadvantages for companies if the pay ratio is high. High is relative. One sustainable bank I know says it avoids investing in companies with pay ratios above 100. I think 100 is far too high, because in that case the CEO would earn a hundred times more than the average employee. If layoffs are imminent, the CEO pay ratio transparency might make it easier to ask whether companies shouldn’t lay off the top earner instead of 100 employees. A recent United Nations report cites 30 to 1 as the highest acceptable upper limit (see manual-sdpi-2022.pdf (unrisd.org), p. 33) .

Additional topic „taxonomy“: It turned out that the auditor of my fund considers only those revenues of companies as EU-taxonomy compliant that have been reported by the companies themselves. Turnovers estimated by rating agencies or others are not considered. Because currently only EU-domiciled companies report such sales, the taxonomy rate of my fund, which invests only to a small extent in such companies, is very low. Therefore, I encourage my (non-EU) portfolio companies to report EU taxonomy compliant sales (and investments).

To emphasize the importance of my proposals, I also refer companies to relevant scientific studies (Such as Do Scope 3 Carbon Emissions Impact Firms’ Cost of Debt? by Ahyan Panjwani, Lionel Melin, and Benoit Mercereau as of Oct. 17th, 2022 and Making supply-chain decarbonization happen | McKinsey). I expect that possible negative aspects will be mentioned by those responsible for ESG in companies in the discussion with me and can thus be taken into account in my concrete engagement proposals.

By implementing my suggestions, companies can also position themselves (even) more strongly as sustainability role models. In my experience, hardly any companies have yet comprehensively implemented my broad stakeholder engagement proposals with regard to customers, employees and suppliers. CO2 Scope 3 reporting including the publication of ambitious targets, on the other hand, can often be found because other shareholders have been paying attention to this for some time. In contrast, I have almost only seen pay ratio publications from companies in countries where such publications are mandatory, such as the USA and Great Britain. Positive exceptions are Getlink (France) and Randstad (Netherlands).

Measuring success and accountability

Both the implementation and the impact of measures can take a long time. Therefore, I do not expect e.g. ESG ratings to improve in the short term. I therefore refrain from setting specific targets such as „I want the E, S or G rating of the company concerned to change by x% by ….”.

My engagement achievements can each be specifically reviewed e.g. as follows:

– Is comprehensive CO2 Scope 3 reporting with reduction targets implemented?

– Is there reliable and sustained reporting on the CEO Pay Gap?

– For what percentage of suppliers (number, value) are which minimum ESG aspects regularly measured and made transparent?

So far, I am not aware of any other engagement activities of other shareholders regarding the companies I have adressed. With the exception of the proposed CO2 reporting, I am also probably one of the very few investors with the specific change suggestions mentioned above. Therefore, attribution to my engagements should be relatively straightforward.

Engagement report as of Jan. 2023 by Soehnholz Asset Management GmbH

Collaboration, engagement communication (signaling), divestments, and communication with a rating provider

As mentioned above, engagement can work better when driven by more than one stakeholder. I can often identify the largest shareholders for the companies in my fund. However, because I am mostly invested in mid- and small-caps which are rarely the target of asset manager engagement, I have not yet actively sought out fellow stakeholders. I will try to do that in the future.

The companies I have approached so far advertise their high sustainability intensively. They should therefore have a high interest in becoming even more sustainable, or at least receive little public criticism of their sustainability.

As a first step, I would like to publicize my engagements. This has already been done in the case of my first engagement. In doing so, I verified the topics that were discussed and the results that were significant from my point of view with the company concerned. I plan to do the same for future engagements. However, I also plan to publish when companies do not respond to my suggestions.

I primarily use my blog for this purpose[24]. I subsequently publicize the blog posts via LinkedIn and Xing. I also send links to my blog posts to my (B2B) mailing list. In addition, the engagement activities will be published on the website www.futurevest.fund under „Shareholder Engagement“. With these publications, I hope to make other companies and investors aware of the identified issues such as „CEO Pay Gap“.

Additionally, I plan to bring improvements and deficiencies that I have identified to the attention of my primary rating provider. That may result in rating changes for the affected companies. As long as the companies continue to meet my minimum sustainability requirements, i.e., including those related to E, S and G ratings, I do not plan to divest from them.

Final comment

I remain skeptical especially about short-term benefits of shareholder engagement in addition to positive and negative screening of investments[25]. For my fund, I therefore primarily use strict negative and positive criteria, which regularly lead to divestments [26].

For the companies I include in my fund, I try to help improving their sustainability. However, investors should not expect that this will result in rapid, comprehensive and lasting environmental, social or governance improvements.

Disclaimer

This article has been created by Soehnholz Asset Management GmbH. The author assumes no responsibility for the accuracy, completeness and/or timeliness of the content provided. The information is subject to German law and is intended exclusively for investors who are resident in Germany. It is not to be understood as an offer to sell or a solicitation of an offer to buy or subscribe for units of the fund presented in this document and is not a substitute for advice appropriate to the investor and the investment. Investment decisions should only be made on the basis of the current statutory sales documents (Key Investor Information Document, Sales Prospectus and – if available – Annual and Semi-Annual Report), which also contain the investment terms and conditions that are solely authoritative. The sales documents are available free of charge from the capital management company (Monega Kapitalanlagegesellschaft mbH), the depositary (Kreissparkasse Köln) and the sales partners. The sales documents are also available on the Internet at www.monega.de. The content provided in this document is for general information purposes only and does not constitute advice or any other recommendation. The investment of capital is always associated with risks and may lead to the loss of the capital invested. Before making any investment decision, you should carefully consider whether the investment is suitable for your individual situation and personal objectives. This document may contain information obtained from public sources that the preparer believes to be reliable. The preparer does not warrant or guarantee the accuracy and/or completeness of this information. The contents presented, in particular the presentation of strategies and their opportunities and risks, may change over time. Assessments and valuations reflect the opinion of the compiler at the time of preparation and may change at any time. It is not intended to update this document on an ongoing basis or at all. It represents only a non-binding snapshot.

Note: The first draft of this article was translated by DeepL.

[1] i.e. Stewardship or trusteeship codes? by Maria Lucia Passador as of March 28th, 2022

[2] For recent studies on shareholder engagement compare Stakeholder engagement and ESG (Special Edition Researchposting 115) – Responsible Investment Research Blog (prof-soehnholz.com)

[3] i.e. Meta-Studie Exploring the antecedents and consequences of firm-stakeholder engagement process: A systematic review of literature by Avinash Pratap Singh and Zillur Rahman as of Oct. 31st, 2022 and Private Shareholder Engagements on Material ESG Issues by Rob Bauer, Jeroen Derwall, and Colin Tissen as of July 29th, 2022

[4] i.e. Coordinated Engagements by Dimson et al. 2021 and The Value of Andiversified Shareholder Engagement by Felix Nockher as of Dec. 6th, 2022

[5] i.e. Systemic Stewardship with Tradeoffs by Marcel Kahan and Edward B. Rock as of March 11th, 2022

[6] i.e. Shareholder Engagement on ESG Performance by Barko et al, 2022

[7] According to MSCI, there are currently exposures to only about a quarter of the largest 9,000 stocks, i.e. Net-Zero Alignment: Engaging on Climate Change by Chris Cote and Harlan Tufford from MSCI as of November 7th, 2022; i.e. Lazard Shareholder Advisory Group: Reviews of Shareholder Activism or the engagement reports from asset managers such as Blackrock and publicationc by organizations such as ShareAction, Shareholders for Change, As You Sow etc.; also comapre Resolution Database | PRI (unpri.org)

[8] i.e. Shareholder Engagement on ESG Performance by Barko et al, 2022

[9] i.e. Shareholder Engagement on ESG Performance by Barko et al, 2022

[10] i.e. Coordinated Engagements by Dimson et al. 2021, z.B. S. 31

[11] „collaborative Engagement“, i.e. Coordinated Engagements by Dimson et al. 2021; Emerging ESG-Driven Models of Shareholder Collaborative Engagement by Peter O. Mülbert and Alexander Sajnovits as of Dec. 12th, 2022

[12] Examples for such service providers are UN PRI Collaboration Platform, Share Action, As You Sow, Ceres Investor Network, Shareholder Commons, i.e. The Global ESG Stewardship Ecosystem by Tim Bowley and Jennifer G. Hill as of October 7th, 2022

[13] i.e. Green Pills by John Armour, Luca Enriques, and Thom Wetze as of August 30th, 2022

[14] i.e. Private Shareholder Engagements on Material ESG Issues by Rob Bauer, Jeroen Derwall, and Colin Tissen as of July 29th, 2022 and Shareholder Engagement on ESG Performance by Barko et al, 2022

[15] i.e. Shareholder Engagement on ESG Performance by Barko et al, 2022

[16] Regarding the relatively low number of successful voting proposals see i.e. Proxy Voting: Managers Focus on Environmental and Social Themes – Evaluating 25 asset managers’ approaches to ESG themes by Lindsey Stewart and Hortense Bioy from Morningstar research as of July 12th, 2022; i.e. Mutual funds’ strategic voting on environmental and social issues by Roni Michaely, Guillem Ordonez-Calafi, and Silvina Rubio as of Feb. 25th, 2022

[17] i.e. The Perils and Questionable Promise of ESG-Based Compensation by Lucian A. Bebchuk and Roberto Tallarita as of Dec. 13th, 2022 and also see The Economic (In) Significance of Executive Pay ESG Incentives by David I. Walker :: SSRN. Also compare ESG-Linked Pay Around the World -Trends, Determinants, and Outcomes by Sonali Hazarika, Aditya Kashikar, Lin Peng, Ailsa Röell, Yao Shen :: SSRN

[18] i.e. Engagement test (Blogposting #300) – Responsible Investment Research Blog (prof-soehnholz.com)

[19] Violation Tracker (goodjobsfirst.org)

[20] i.e. Engagement test (Blogposting #300) – Responsible Investment Research Blog (prof-soehnholz.com)

[24] i.e. www.prof-soehnholz.com

[25] i.e. Impact Investing mit Voting and Engagement? (Opinionpost #194) – Responsible Investment Research Blog (prof-soehnholz.com)

[26] i.e. Artikel 9 Fonds: Sind 50% Turnover ok? – Responsible Investment Research Blog (prof-soehnholz.com)