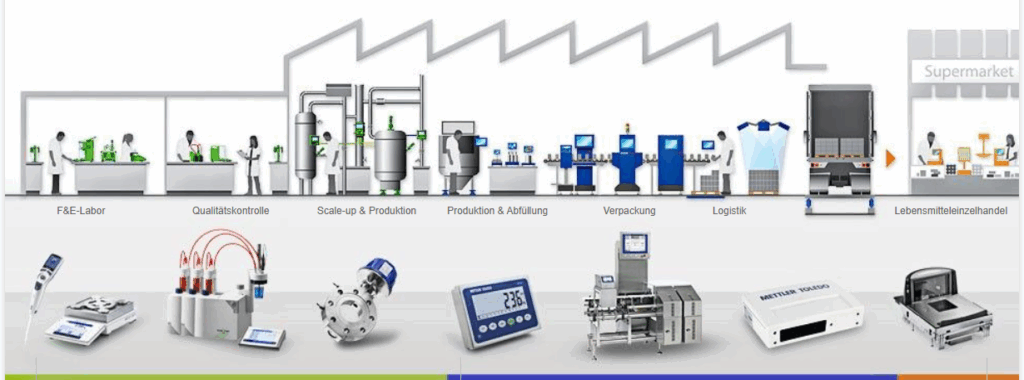

SDG-Investmentbeispiel 17: Mettler Toledo

Auch Mettler-Toledo erfüllt meinen wichtigsten Nachhaltigkeitsanspruch, nämlich Produkte oder Services anzubieten, die möglichst kompatibel mit den Nachhaltigen Entwicklungszielen der Vereinten Nationen (SDG) sind.

Clarity.ai weist für Mettler-Toledo ein SDG-Umsatzkompatibilität von 94% aus.

SDG-Investmentbeispiel 15: Smart Grids aus der Schweiz

Landis+Gyr: Unternehmensübersicht SDG-Investmentbeispiel 15 aus dem von mir beratenen Fonds ist Landis+Gyr aus der Schweiz. Das Unternehmen verkauft integrierte Energiemanagementprodukte und -services wie Strom-, Wärme- und Kältezähler, Softwaredienste, Netzverwaltungen und Kommunikationsnetzwerke für Energieversorger. Auf der Webseite heißt es: „Mit unserer Advanced Metering Infrastructure und anderen zukunftsweisenden Smart Grid-Technologien helfen wir Energieversorgungsunternehmen auf der ganzen Welt, […]

SDG-Investmentbeispiel 13: Fokus Grüner Star

Auch Glaukos erfüllt meinen wichtigsten Nachhaltigkeitsanspruch, nämlich Produkte oder Services anzubieten, die möglichst kompatibel mit den Nachhaltigen Entwicklungszielen der Vereinten Nationen (SDG) sind. Dabei sind nach Clarity.ai und meiner Einschätzung 100% der Umsätze mit dem SDG 3 (Gesundheit) vereinbar. Zum Vergleich: Die durchschnittliche SDG-Umsatzvereinbarkeit des Fonds liegt aktuell bei 97%.

SDG-Investmentbeispiel 11: Solartechnik aus den USA

First Solar hat einen sehr positiven Unternehmensimpact und meine Shareholder-Engagementvorschläge finden Gehör

SDG-Investmentbeispiel 10: US-Krebsvorsorge und -Diagnose

Das SDG-Investmentbeispiel 10 aus dem von mir beratenen Fonds ist Exact Sciences. Das Unternehmen beschreibt sich so: „Als führender Anbieter von Krebsvorsorge- und Diagnosetests verschafft Exact Sciences Patienten und Angehörigen der Gesundheitsberufe die nötige Klarheit, um lebensverändernde Maßnahmen früher zu ergreifen.

SDG-Investmentbeispiel 9: Krebsbekämpfung aus Schweden

Das neunte Beispiel für SDG-Investments aus dem von mir beratenen Fonds ist Elekta. Elekta ist ein schwedisches Medizintechnik-Unternehmen, das vor allem Geräte für die Strahlentherapie und Radiochirurgie für die Behandlung von Krebs und Hirnerkrankungen entwickelt und produziert. Fokus sind unter anderem nichtinvasive Verfahren zur Behandlung von Hirnkrankheiten wie Tumoren und arteriovenösen Missbildungen.

ESG disclosure benefits: Researchpost 193

14x new research on climate, water and ESG disclosure and litigation effects, World Bank greenwashing, pollution exports, green shows, ESG outperformance, emission credit risks, green bond and green fund benefits, low SDG alignments, financial LLMs, and degrowth theory problems by Heiko Bailer, Thorsten Hens, Stefan Ruenzi and many more

SDG-Investmentbeispiel 8: Baskische Schienenfahrzeuge

Auch CAF erfüllt meinen wichtigsten Nachhaltigkeitsanspruch, nämlich Produkte oder Services anzubieten, die möglichst kompatibel mit den Nachhaltigen Entwicklungszielen der Vereinten Nationen (SDG) sind.

Biodiversity risks: Researchpost 192

10x new research regarding ESG disclosure effects, green innovation, food waste reduction, biodiversity models and investments, climate equity risks, AI investment opportunities, listed equity impact, sustainability questionnaires, hedge funds, open-source investment AI