Emissions trading and more: Researchpost 146

Emissions trading: 15x new research on fossil subsidies, ECB eco policy, GHG disclosures, supplier ESG, workforce ESG, geospatial ESG data, ESG reputation and performance, investor driven greenwashing, sustainable blockchain, active management, GenAI for asset management and more

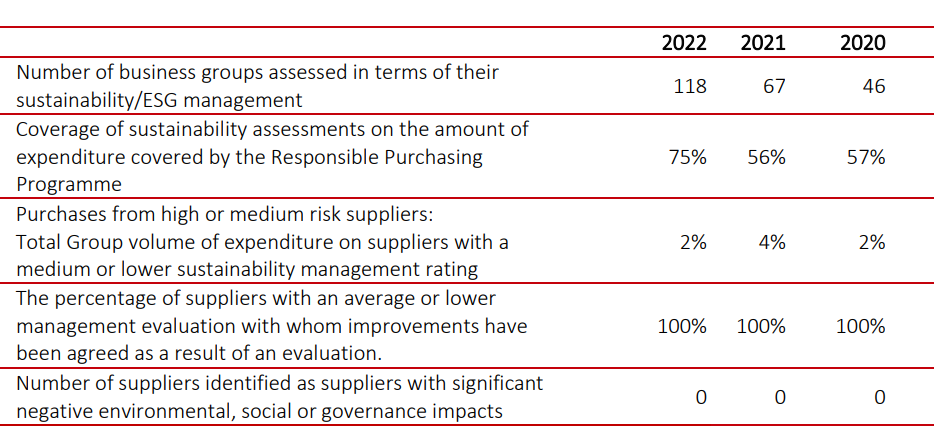

Supplier ESG: Researchpost 144

Supplier ESG: 17x new research on SDG, green behavior, subsidies, SMEs, ESG ratings, real estate, risk management, sin stocks, trading, suppliers, acting in concert, AI and VC

Supplier engagement: Opinionpost 211

upplier engagement is my term for shareholder engagement with the goal to address suppliers either directly or indirectly. I provide an overview of current scientific research regarding supplier engagement. I also explain my respective recommendations to the companies I am invested in. Supplier engagement can be very powerful.

Active ESG share: Researchpost 136

Active ESG share: 26x new research on SDG, climate automation, family firms, greenium and green liquidity, anti-ESG, ESG-ratings, diversity, sustainability standards, disclosure, ESG pay, taxes, impact investing, and financial education

ESG beliefs: Researchpost 124

10x new research on biodiversity, subsidies, governance, greenium, ESG beliefs, divestments, taxonomy reporting, fund commissions, SVB, private asset platforms etc.

Taxonomy reporting: Can companies boost their share-prices?

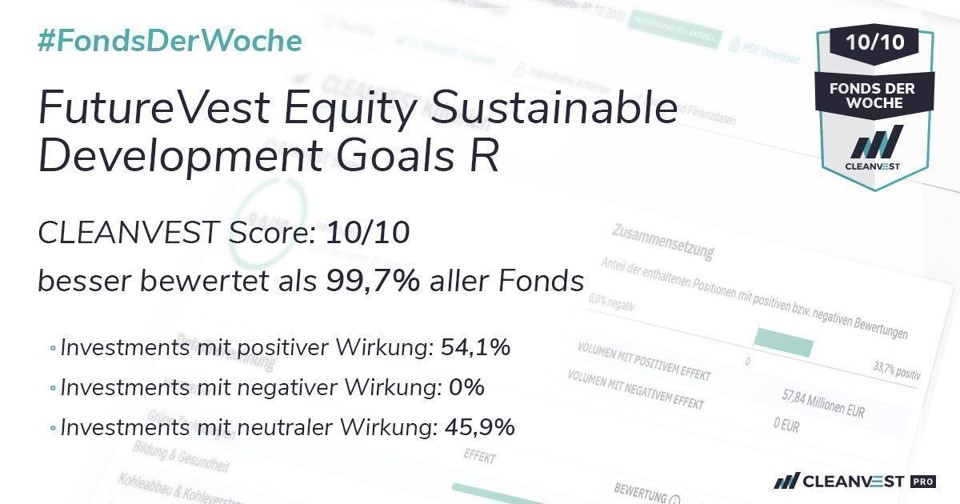

Taxonomy reporting: Many investors want to invest responsibly. Investment funds which want to attract such investors should report their share of responsible investments.

Greenium research and more: Researchpost 117

Greenium research: 25x new research on green subsidies, nature investing, populism, financial crime, ESG regulation, climate agreements, ESG scandals, transition, institutional investors, greenium, CDS, green loans, voting, multi-assets, gold, commodities, real estate, and private equity

Green illusion: Researchpost 108

Green illusion: 15x new research on social media, Scope 3, CSR, ESG bonifications, sovereigns, pensions, securitization, microfinance, trend-following, IQ, VCs and fintech

Microfinance risk and more: Researchpost 107

Microfinance risk: 15x new research on publication biases, green innovation, supply chains, biocredits, greenium, ESG ratings and loans, CSR, Kickbacks etc.