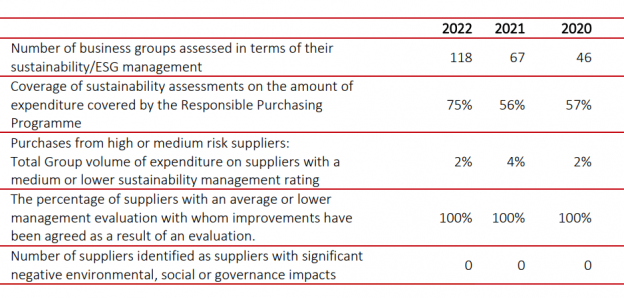

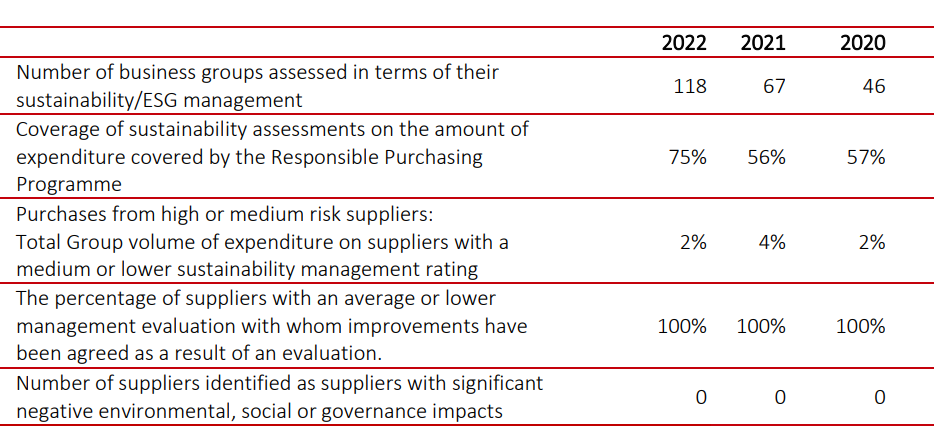

ESG and impact: 12x new research on AI, poverty, crime, green demand, ESG risks, brown lending, green agency issues, voting, engagement, impact investing, CEO compensation, small caps etc. (# shows the number of SSRN downloads as of Nov. 30th, 2023)

Social and ecological research

AI job-booster: New technologies and jobs in Europe by Stefania Albanesi, António Dias da Silva, Juan F. Jimeno, Ana Lamo and Alena Wabitsch as of Aug. 24th, 2023 (#111): “… we … find that AI-enabled automation in Europe is associated with employment increases. This positive relationship is mostly driven by occupations with relatively higher proportion of skilled workers … the magnitude of the estimates largely varies across countries, possibly reflecting different economics structures, such as the pace of technology diffusion and education, but also to the level of product market regulation (competition) and employment protection laws. … wages do not appear to be affected in a statistically significant manner from software exposure“ (p. 28).

Climate-induced poverty: Does Global Warming Worsen Poverty and Inequality? An Updated Review by Hai-Anh H. Dang, Stephane Hallegatte, and Trong-Anh Trinh from the World Bank as of Mov. 4th, 2023 (#38): “Our findings suggest that while studies generally find negative impacts of climate change on poverty, especially for poorer countries, there is less agreement on its impacts on inequality. … Our results suggest that temperature change has larger impacts over the short-term than over the long-term and more impacts on chronic poverty than transient poverty” (p. 32).

Refugee crimes: Do Refugees Impact Crime? Causal Evidence From Large-Scale Refugee Immigration to Germany by Martin Lange and Katrin Sommerfeld as of Nov. 14th, 2023 (#21): “Our results indicate that crime rates were not affected during the year of refugee arrival, but there was an increase in crime rates one year later. This lagged effect is small per refugee but large in absolute terms and is strongest for property and violent crimes. The crime effects are robust across specifications and in line with increased suspect rates for offenders from refugees’ origin countries. Yet, we find some indication of over-reporting“ (abstract).

ESG investment research (ESG and impact)

Green demand: Responsible Consumption, Demand Elasticity, and the Green Premium by Xuhui Chen, Lorenzo Garlappi, and Ali Lazrak as of Nov. 27th, 2023 (#122): “… decreasing product price are signals of high price competition and hence high demand elasticity. We sort firms into portfolios based on their demand elasticity and their ESG score. We refer the spread return on this portfolio as the Green Minus Brown (GMB) spread, or green premium” (p. 3). … “… when consumers have a “green” bias, green firms producing high demand elasticity goods are riskier than brown firms producing high demand elasticity products. The riskiness of these firms flips for firms that produce low demand elasticity goods. …. we find that the green-minus-brown (GMB) spread is increasing in the price elasticity of demand. Specifically, the annual spread is 2.6% and insignificant in the bottom elasticity tercile and 11.7% and significant in the top tercile. … we show that the cumulative positive return spread of green vs. brown stocks over the last decade is mainly attributed to high-demand-elasticity stocks, with low demand elasticity stocks earning an insignificant or negative spread“ (p. 32).

Risky calls: ESG risk by Najah Attig and Abdlmutaleb Boshanna as of Oct. 5th, 2022 (#62): “… using Natural Language Processing, we measure firm-level ESGR (Sö: ESG risk) faced by US firms, as reflected in the discussion of ESG issues associated with words capturing risk and uncertainty in the transcripts of firms’ earning calls. We first validate ESGR as measure of risk by documenting its positive association with the volatility of stock returns and CSR concerns. We then show that ESGR is associated with a deterioration in corporate value … We show also that ESGR bears negatively on conference call short-term returns during the COVID-19 pandemic“ (p. 31). My comment: I try to only invest in the best E/S/G rated companies, see e.g. Glorreiche 7: Sind sie unsozial? – Responsible Investment Research Blog (prof-soehnholz.com)

Retail ESG: Better Environmental Performance Attracts the Retail Investor Crowd during Crisis by Anil Gautam and Grace Lepone as of Nov. 24th, 2023 (#12): “… we use the Robinhood data set to examine the firm size-adjusted changes in investor numbers. We find that investors moved away from holding securities with low (Sö: ESG) scores following the COVID-19 pandemic shock. The observation holds for the bottom quartile of securities sorted by ESG, E, emissions, corporate social responsibility (CSR), human rights, management, shareholder and community scores. … No significant reaction to S and G scores is observed for either quartile“ (p. 16).

Green bank disclosure: Do banks practice what they preach? Brown lending and environmental disclosure in the euro area by Leonardo Gambacorta, Salvatore Polizzi, Alessio Reghezza, and Enzo Scannella from the ECB as of Nov. 14th, 2023 (#21): “… we found that banks that provide higher levels of environmental disclosure lend more to low polluting firms and less to highly polluting firms. … we found that banks that use a more negative tone (i.e. those that are more aware and genuinely concerned about environmental risks and climate change) lend less to brown firms, while banks that use a more positive tone (i.e. those that are less aware and concerned about environmental risks) tend to finance more brown firms. Therefore, we show that the tone of disclosures plays a crucial role in assessing whether a bank is engaging in window dressing or its willingness to inform stakeholders and investors on environmental matters results in actual behaviour to tackle environmental risks by reducing brown lending“ (p. 21).

Good transparency? The Eco-Agency Problem and Sustainable Investment by Moran Ofir and Tal Elmakiess as of Nov. 28th, 2023 (#10): “… we first define the eco-agency problem—the special conflict of interest between the corporate officers who focus on short-term profitability and the other stakeholders who seek long-term profitability and sustainability—and then discuss existing coping measures, such as green bonds, CoCo bonds, and ESG compensation metrics. To assess the extent of the eco-agency problem, we have conducted an experimental study of both professional and nonprofessional investors. According to our findings, both groups exhibit strong and significant preferences for sustainable investments. Revealing the preferences of investors towards sustainability can inspire corporate officers to embrace their role as sustainability advocates, encouraging them to align their decisions with investor preferences, and can thus drive positive change both within their organizations and across industries. … By embracing transparency as a strategic advantage, corporations can transcend traditional reporting boundaries, heralding a new era in which investors implement their ecological preferences in the capital market pricing mechanism” (abstract). My comment: My shareholder engagement strategy seems to focus on the right topics, see Shareholder engagement: 21 science based theses and an action plan – (prof-soehnholz.com)

Impact investing research (ESG and impact)

Voting and engagement approaches: UK Asset Owner Stewardship Review 2023: Understanding the Degree & Distribution of Asset Manager Voting Alignment by Andreas Hoepner as of Nov. 17th, 2023 (#33): “… Empirically, we observe misalignment between UK asset owners and asset managers to varying degrees. Specifically, misalignment is more pronounced (i) in recent years, (ii) for shareholder resolutions than for management resolutions, (iii) for issuers in the Americas compared with European issuers, (iv) and, on average, for non-participating than for participating asset managers (Sö regarding the survey). … (a) Only very selected asset managers publicly reason like asset owners. (b) Some asset managers somehow see voting and ESG engagement as mutually exclusive and appear to fear the loss of access to management if they voted against management. (c) Among asset managers, there appears to be a substantial divergence as to their interpretation of shareholders’ and even society’s interests. Some asset managers are aligned with asset owners, while others have fundamentally different views that may be consistent with short term commercial interest but do not reflect scientific evidence. Third, we reviewed the ESG Engagement success across all relevant issuers, which revealed three different engagement process types. Type 1 is “textbook style” persistent, long duration, large scale engagement with considerable progress. Type 2 appears to be “quick fix style” engagements which are characterised by less consistency, shorter duration, and more mixed progress. Type 3 engagements are “jumping the bandwagon style” as they appear to target only firms that already have been improved by others” (abstract). My comment: My approach and other potential shareholder engagement strategies see Shareholder engagement: 21 science based theses and an action plan – (prof-soehnholz.com) and DVFA-Fachausschuss Impact veröffentlicht Leitfaden Impact Investing – DVFA e. V. – Der Berufsverband der Investment Professionals

Risky impact? What Do Impact Investors Do Differently? by Shawn Cole, Leslie Jeng, Josh Lerner, Natalia Rigol, and Benjamin N. Roth as of Nov. 16th, 2023 (#340): “In recent years, impact investors – private investors who seek to generate simultaneously financial and social returns – have attracted intense interest and controversy. … we document that they are more likely to invest in disadvantaged areas and nascent industries and exhibit more risk tolerance and patience. We then examine the degree to which impact investors expand the financing frontier, versus investing in companies that could have attracted traditional private financing. … we find limited support for the assertion that impact investors expand the financing frontier, either in the deal-selection stage or the post-investment stage“ (abstract).

Other investment research

Lower-paid CEOs? CEO Compensation: Evidence From the Field by Alex Edmans, Tom Gosling, and Dirk Jenter as of Oct. 13th, 2023 (#3130): “We survey directors and investors on the objectives, constraints, and determinants of CEO pay. We find .. that pay matters not to finance consumption but to address CEOs’ fairness concerns. 67% of directors would sacrifice shareholder value to avoid controversy, leading to lower levels and one-size-fits-all structures. Shareholders are the main source of constraints, suggesting directors and investors disagree on how to maximize value. Intrinsic motivation and reputation are seen as stronger motivators than incentive pay“ (abstract). My comment: Within my shareholder engagement activities, I ask to disclose the CEO-medium employee pay ratio so that other interested parties can engage with the companies to reduce this typically vey large difference

Better big or small? The Size Premium in a Granular Economy by Logan P. Emery and Joren Koëter as of Nov. 21st., 2023 (#81): “… Our analysis provides robust evidence that the expected size premium increases during periods of higher stock market concentration. … we find that smaller firms receive less attention, are less likely to complete a seasoned equity offering, and have higher fundamental volatility during periods of higher stock market concentration. Moreover, our results occur predominantly among firms in industries with a greater dependence on external equity financing, or for firms with relatively low book-to-market ratios (i.e., growth firms). … we find that the expected size premium weakens following idiosyncratic shocks to the largest firms in the stock market” (p. 32).

ESG and Impact + Engagement advert for German investors

Sponsor my research by investing in and/or recommending my global small/midcap mutual fund (SFDR Art. 9). The fund focuses on social SDGs and uses separate E, S and G best-in-universe minimum ratings and broad shareholder engagement with currently 25 of 30 companies: FutureVest Equity Sustainable Development Goals R – DE000A2P37T6 – A2P37T or Noch eine Fondsboutique? – Responsible Investment Research Blog (prof-soehnholz.com)