Greenwashing banks? Researchpost 129

Greenwashing banks? 12x new research on immigration, suppliers, greenwashing, banks, ESG ratings, AI voting, green bonds, climate inflation, (climate) VCs and crowdinvesting

Climate reporting: Researchpost 128

Climate reporting: 13x new research regarding inequality, climate reporting, biodiversity, green bonds, external costs, private equity real estate, gold, equal weighting, correlations, tail risks, robo advisors and AI

Banning dividends? Researchpost 127

Banning dividends: 10x new research on gender wealth, activists, dividends, greenium, correlations, diversification, ChatGPT and investment committees by Charlotte Bartels, Eva Sierminska, Carsten Schroeder, Marcos López de Prado, Bernd Scherer et al. (# indicates the number of SSRN downloads on May 17th, 2023)

Finfluencers: Researchpost 126

Finfluencers: 14x new research on CO2 storage, climate learnings, sustainable bonds, diversity, impact investing, active investing, and finfluencers

ESG AI: Researchpost 125

ESG AI: >10x new research on climate AI models (for banks), CO2 removal, bridge technology risks, human capital, ESG risk management and ESG bullshit, government greenium, double materiality and listed impact investing and industry versus regional diversification

ESG beliefs: Researchpost 124

10x new research on biodiversity, subsidies, governance, greenium, ESG beliefs, divestments, taxonomy reporting, fund commissions, SVB, private asset platforms etc.

Taxonomy reporting: Can companies boost their share-prices?

Taxonomy reporting: Many investors want to invest responsibly. Investment funds which want to attract such investors should report their share of responsible investments.

ESG or impact? Researchpost 123

15x new research on (social) housing, AI lawyers, DWS, climate models, divestments, sustainability loans and greenium, green fees, ESG ratings, ESG labels, Article 9 funds, fiduciary duty and suppliers

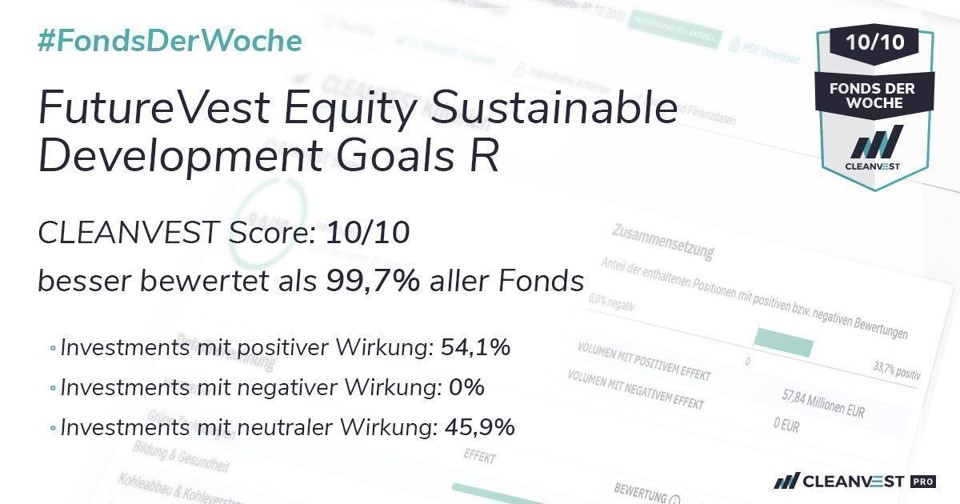

Q1: Nachhaltige Portfolios mit ordentlicher Rendite im ersten Quartal 2023

Vereinfacht zusammengefasst haben im ersten Quartal 2023 meine nachhaltigen ESG und SDG-Portfolios ähnlich rentiert wie vergleichbare traditionelle ETFs bzw. aktiv gemanagte Fonds. Nachdem meine Trendfolgeportfolios in 2022 Verluste in erheblichem Umfang reduzieren konnten, haben die Signale im ersten Quartal 2023 zu Verlusten gegenüber Portfolios ohne Trendfolge geführt.