Nachhaltige Geldanlage kann radikal anders sein als traditionelle. „Asset Allocation, Risiko-Overlay und Manager-Selektion: Das Diversifikationsbuch“ heißt das Buch, dass ich 2009 mit ehemaligen Kollegen der Bad Homburger FERI geschrieben habe. Nachhaltigkeit spielt darin keine Rolle. In meiner aktuellen Vorlesung zu diesen Themen ist das anders. Nachhaltigkeit kann eine sehr wichtige Rolle spielen für die Allokation auf Anlagesegmente, die Manager- bzw. Fondsselektion, die Positionsselektion und auch das Risikomanagement (Hinweis: Um die Lesbarkeit zu verbessern, gendere ich nicht).

Strenge Nachhaltigkeit kann sogar zu radikalen Änderungen führen: Mehr illiquide Investments, erheblich höhere Konzentration innerhalb der Anlagesegmente, mehr aktive statt passive Mandate und ein anderes Risikomanagement. Im Folgenden erkläre ich, wieso:

Zentrale Rolle von Investmentphilosophie und Nachhaltigkeitsdefinition für die nachhaltige Geldanlage

Dafür starte ich mit der Investmentphilosophie. Unter Investmentphilosophie verstehe ich die grundsätzlichen Überzeugungen eines Geldanlegers, idealerweise ein umfassendes und kohärentes System solcher Überzeugungen (vgl. Das-Soehnholz-ESG-und-SDG-Portfoliobuch 2023, S. 21ff.). Nachhaltigkeit kann ein wichtiges Element einer Investmentphilosophie sein. Anleger sollten ihre Investmentphilosophie möglichst klar definieren, bevor sie mit der Geldanlage beginnen.

Beispiel: Ich verfolge eine konsequent nachhaltige regelbasiert-prognosefreie Investmentphilosophie. Dafür definiere ich umfassende Nachhaltigkeitsregeln. Zur Operationalisierung nutze ich das Policy for Responsible Investment Scoring Concept (PRISC) Tool der Deutschen Vereinigung für Asset Management und Finanzanalyse (DVFA, vgl. Standards – DVFA e. V. – Der Berufsverband der Investment Professionals).

Für die nachhaltige Geldanlage ist mir vor allem wichtig, was für Produkte und Services die Unternehmen und Organisationen anbieten, an denen ich mich beteilige oder denen ich indirekt Kredite zur Verfügung stelle. Dazu nutze ich viele strenge Ausschlüsse und vor allem Positivkriterien. Dabei wird vor allem der Umsatz- bzw. Serviceanteil betrachtet, der möglichst gut mit Nachhaltigen Entwicklungszielen der Vereinten Nationen (UN SDG) vereinbar ist („SDG Revenue Alignment“). Außerdem lege ich viel Wert auf niedrige absolute Umwelt-, Sozial- und Governance-Risiken (ESG). Meine Möglichkeiten zur Veränderung von Investments („Investor Impact“) gewichte ich aber nur relativ niedrig (vgl. Das-Soehnholz-ESG-und-SDG-Portfoliobuch 2023, S. 141ff). Impact möchte ich dabei vor allem über Shareholder Engagement ausüben, also direkte Nachhaltigkeitskommunikation mit Unternehmen.

Andere Anleger, denen Impact- bzw. eigene Veränderungsmöglichkeiten besonders wichtig sind, legen oft viel Wert auf sogenannte Additionalität bzw. Zusätzlichkeit. Das bedeutet, dass die entsprechenden Nachhaltigkeitsverbesserungen nur durch ihre jeweiligen Investments zustande gekommen sind. Wenn ein Anleger einen neuen Solar- oder Windparkt finanziert, gilt das als additional und damit als besonders nachhaltig. Bei Geldanlagen an Börsen werden Wertpapiere nur anderen Anlegern abgekauft und den Herausgebern der Wertpapiere fließt – außer bei relativ seltenen Neuemissionen – kein Geld zu. Der Kauf börsennotierter Anleihen oder Aktien von Solar- und Windparkunternehmen gilt bei Additionalitätsanhängern deshalb nicht als Impact Investment.

Nachhaltige Geldanlage und Asset Allokation: Viel mehr nicht-börsennotierte bzw. alternative Investments und mehr Anleihen?

Eine additionalitätsfokussierte Investmentphilosophie bedeutet demnach im Extremfall, nur noch illiquide zu investieren. Die Asset Allokation wäre radikal anders als heute typische Geldanlagen.

Lieber keine Mehrallokation zu illiquiden Investments?

Aber wenn Additionalität so wichtig ist, dann muss man sich fragen, welche Art von illiquiden Investments wirklich Zusätzlichkeit bedeutet. Dazu muss man Investoren- und Projektimpact trennen. Die Finanzierung eines neuen Windparks ist aus Anlegersicht dann nicht zusätzlich, wenn andere Anleger den Windpark auch alleine finanzieren würden. Das ist durchaus nicht untypisch. Für Infrastruktur- und Private Equity Investments gibt es oft einen sogenannten Kapitalüberhang. Das bedeutet, dass über Fonds sehr viel Geld eingesammelt wurde und um Anlagen in solche Projekte konkurriert.

Selbst wenn nur ein Fonds zur Finanzierung eines nachhaltgien Projektes bereit ist, wäre die Beteiligung an einem solchen Fonds aus Anlegersicht dann nicht additional, wenn alternativ andere Anleger diese Fondsbeteiligung kaufen würden. Nicht nur Fonds renommierter Anbieter haben oft mehr Anfragen von potenziellen Anlegern als sie akzeptieren wollen. Investments in solche Fonds kann man nicht unbedingt als additional ansehen. Klare Additionalität gibt es dagegen für Investments, die kein anderer machen will. Ob solche Investments aber attraktive Performances versprechen, ist fragwürdig.

Illiquide Investments sind zudem längst nicht für alle Anleger geeignet, denn sie erfordern meistens relativ hohe Mindestinvestments. Hinzu kommt, dass man bei illiquiden Investments in der Regel erst nach und nach investiert und Liquidität in Bezug auf Zeitpunkt und Höhe unsichere Kapitalabrufe bereithalten muss. Außerdem sind illiquide meistens erheblich teurer als vergleichbare liquide Investments. Insgesamt haben damit illiquide Investments kaum höhere Renditepotenziale als liquide Investments. Durch die Art ihrer Bewertungen zeigen sie zwar geringe Schwankungen. Sie sind durch ihre hohen Mindestinvestments und vor allem Illiquidität aber teilweise hochriskant.

Hinzu kommt, dass illiquiden Investments ein wichtiger sogenannter Wirkungskanal fehlt, nämlich individuelle Divestmentmöglichkeiten. Während liquide Investments jederzeit verkauft werden können wenn Nachhaltigkeitsanforderungen nicht mehr erfüllt werden, muss man bei illiquiden Investments teilweise sehr lange weiter investiert bleiben. Divestmentmöglichkeiten sind sehr wichtig für mich: Ich habe in den letzten Jahren jeweils ungefähr die Hälfte meiner Wertpapiere verkauft, weil sich ihre Nachhaltigkeit verschlechtert hat (vgl. Divestments: 49 bei 30 Aktien meines Artikel 9 Fonds – Responsible Investment Research Blog (prof-soehnholz.com)).

Nachhaltigkeitsvorteile für (Unternehmens-)Anleihen gegenüber Aktien?

Auch liquide Anlagesegmente können sich in Bezug auf Impactmöglichkeiten unterscheiden. Für Aktien kann man Stimmrechte ausüben (Voting), für Anleihen und andere Anlagesegmente nicht. Allerdings finden nur selten Aktionärsversammlungen statt, zu denen man Stimmrechte ausüben kann. Zudem stehen nur selten umfassende Nachhaltigkeitsveränderungen zur Abstimmung. Falls das dennoch der Fall ist, werden sie meistens abgelehnt (vgl. 2023 Proxy Season Review – Minerva-Manifest).

Ich bin überzeugt, dass Engagement im engeren Sinn wirkungsvoller sein kann als Stimmrechtsausübung. Und direkte Diskussionen mit Unternehmen und Organisationen, um diese nachhaltiger zu machen, sind auch für Käufer von Anleihen möglich.

Unabhängig von der Frage der Liquidität bzw. Börsennotiz könnten nachhaltige Anleger Kredite gegenüber Eigenkapital bevorzugen, weil Kredite speziell für soziale und ökologische Projekte vergeben werden können. Außerdem können Auszahlungen von der Erreichung von nachhaltigen Meilensteinen abhängig gemacht werden können. Letzteres kann bei Private Equity Investments aber ebenfalls gemacht werden, nicht jedoch bei börsennotierten Aktieninvestments. Wenn ökologische und soziale Projekte aber auch ohne diese Kredite durchgeführt würden und nur traditionelle Kredite ersetzen, relativiert sich der potenzielle Nachhaltigkeitsvorteil von Krediten gegenüber Eigenkapital.

Allerdings werden Kredite meist mit konkreten Rückzahlungszeiten vergeben. Kurz laufende Kredite haben dabei den Vorteil, dass man öfter über die Wiederholung von Kreditvergaben entscheiden kann als bei langlaufenden Krediten, sofern man sie nicht vorzeitig zurückbezahlt bekommen kann. Damit kann man aus einer als nicht nachhaltig genug erkannter Kreditvergabe meistens eher aussteigen als aus einer privaten Eigenkapitalvergabe. Das ist ein Nachhaltigkeitsvorteil. Außerdem kann man kleinere Kreditnehmer und Unternehmen wohl besser nachhaltig beeinflussen, so dass zum Beispiel Staatsanleihen weniger Nachhaltigkeitspotential als Unternehmenskredite haben, vor allem wenn es sich dabei um relativ kleine Unternehmen handelt.

In Bezug auf Immobilien könnte man annehmen, dass Kredite oder Eigenkapital für oft dringend benötigte Wohn- oder Sozialimmobilien als nachhaltiger gelten können als für Gewerbeimmobilien. Ähnliches gilt für Sozialinfrastruktur gegenüber manch anderen Infrastruktursegmenten. Andererseits kritisieren manche Marktbeobachter die sogenannte Finanzialisierung zum Beispiel von Wohnimmobilien (vgl. Neue Studie von Finanzwende Recherche: Rendite mit der Miete) und plädieren grundsätzlich für öffentliche statt private Investments. Selbst Sozialkredite wie Mikrofinanz im ursprünglichen Sinn wird zumindest dann kritisiert, wenn kommerzielle (Zins-)Interessen zu stark werden und private Verschuldungen zu stark steigen.

Während nachwachsende Rohstoffe nachhaltig sein können, gelten nicht industriell genutzte Edelmetalle aufgrund der Abbaubedingungen meistens als nicht nachhaltig. Kryptoinvestments werden aufgrund fehlender Substanz und hoher Energieverbräuche meistens als nicht nachhaltig beurteilt.

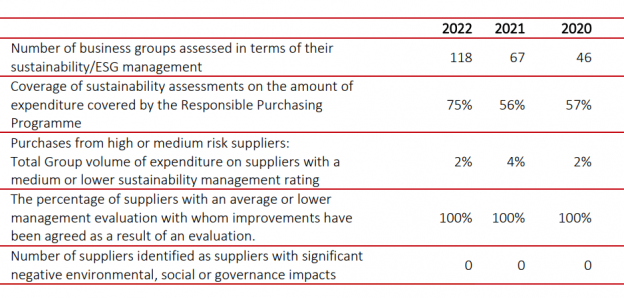

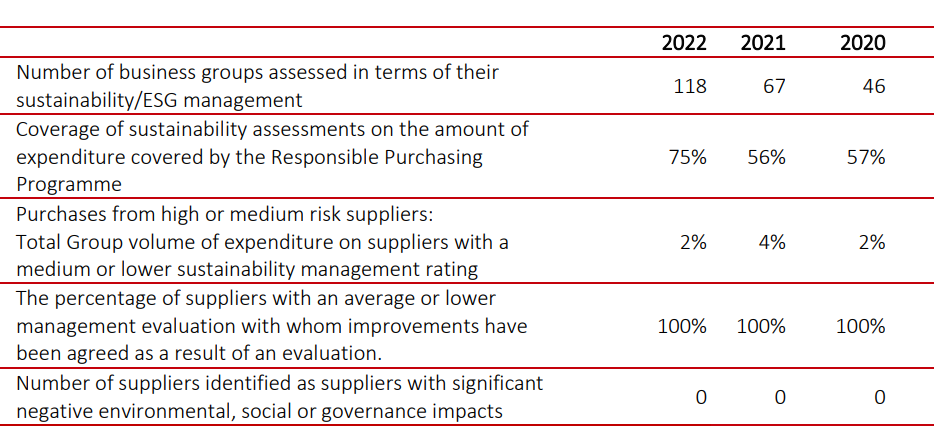

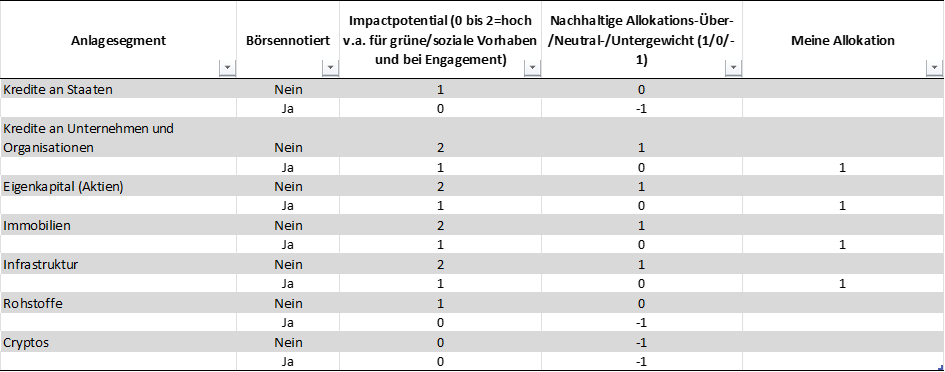

Bei der Annahme von potenzieller Additionalität für illiquide Investments und Wirkung vor allem über Investments mit ökologischem bzw. sozialem Bezug kann man zu der folgenden vereinfachten Anlagesegmentbeurteilung aus Nachhaltigkeitssicht kommen:

Nachhaltige Geldanlage: Potenzielle Gewichtung von Anlagesegmenten bei Annahme von Additionalität für illiquide Investments und meine Allokation

Quelle: Eigene Darstellung

Anleger sollten sich ihre eigene derartige Klassifikation erstellen, weil diese entscheidend für ihre jeweilige nachhaltige Asset Allokation ist. Unter Berücksichtigung von Mindestkapitaleinsatz und Kosten sowie Divestment- und Engagementmöglichkeiten investiere ich zum Beispiel nur in börsennotierte Investments. Bei einem Multi-Milliarden Vermögen mit direkten Nachhaltigkeits-Einflussmöglichkeiten auf Beteiligungen würde ich zusätzliche illiquide Investments aber in Erwägung ziehen. Insgesamt kann strenge Nachhaltigkeit also auch zu wesentlich geringerer Diversifikation über Anlageklassen führen.

Nachhaltige Geldanlage und Manager-/Fondsselektion: Wieder mehr aktive Investments?

Wissenschaftliche Forschung zeigt, dass aktives Portfoliomanagement meistens geringe Renditen und oft auch höhere Risiken als passive Investments einbringt. Mit sehr günstigen ETFs kann man in tausende von Wertpapieren investieren. Es ist deshalb kein Wunder, dass in den letzten Jahren sogenannte passive Investments immer beliebter geworden sind.

Diversifikation gilt oft als der einzige „Free Lunch“ der Kapitalanlage. Aber Diversifikation hat oft keinen nennenswerten Einfluss auf Renditen oder Risiken. Anders ausgedrückt: Mit mehr als 20 bis 30 Wertpapieren aus unterschiedlichen Ländern und Branchen sind keine besseren Renditen und auch kaum niedrigere Risiken zu erwarten als mit hunderten von Wertpapieren. Anders ausgedrückt: Der Grenznutzen zusätzlicher Diversifikation nimmt sehr schnell ab.

Aber wenn man aber mit den nachhaltigsten 10 bis 20 Wertpapiern startet und weiter diversifiziert, kann die durchschnittliche Nachhaltigkeit erheblich sinken. Das bedeutet, dass konsequent nachhaltige Geldanlageportfolios eher konzentriert als diversifiziert sein sollten. Konzentration hat auch den Vorteil, dass Stimmrechtsausübungen und andere Formen von Engagement einfacher und kostengünstiger werden. Divestment-Androhungen können zudem wirkungsvoller sein, wenn viel Anlegergeld in nur wenige Wertpapiere investiert wird.

Nachhaltigkeitspolitiken können sehr unterschiedlich ausfallen. Das zeigt sich unter anderem bei den vielen möglichen Ausschlüssen von potenziellen Investments. So kann man zum Beispiel Tierversuche in juristisch vorgeschriebene, medizinisch nötige, kosmetische und andere unterscheiden. Manche Anleger möchten alle Tierversuche konsequent ausschließen. Andere wollen weiterhin in Pharmaunternehmen investieren und schließen deshalb vielleicht nur „andere“ Tierversuche aus. Und Anleger, welche die Transition von wenig nachhaltigen Unternehmen zum Beispiel der Ölbranche zu mehr Nachhaltigkeit fördern wollen, werden explizit in Ölunternehmen investieren (vgl. ESG Transition Bullshit? – Responsible Investment Research Blog (prof-soehnholz.com)).

Indizes enthalten oft sehr viele Wertpapiere. Konsequente Nachhaltigkeit spricht aber für Investments in konzentrierte, individuelle und damit meist indexabweichende aktiv gemanagte Portfolios. Dabei ist aktiv nicht im Sinne von viel Handel gemeint. Um über Stimmrechtsausübungen und andere Engagementformen Einfluss ausüben zu können, sind eher längere als kürzere Haltedauern von Investments sinnvoll.

Immer noch nicht genug konsequent nachhaltige ETF-Angebote

Bei der Gründung meines eigenen Unternehmens Anfang 2016 war ich wahrscheinlich weltweit der erste Anbieter eines Portfolios aus möglichst konsequent nachhaltigen ETFs. Aber auch die nachhaltigsten ETFs waren mir nicht nachhaltig genug. Grund waren vor allem unzureichende Ausschlüsse und die fast ausschließliche Nutzung von aggregierten Best-in-Class ESG-Ratings. Ich habe aber hohe Mindestanforderungen an E, S und G separat (vgl. Glorreiche 7: Sind sie unsozial? – Responsible Investment Research Blog (prof-soehnholz.com). Ich interessiere mich auch nicht für die am besten geraten Unternehmen innerhalb aus Nachhaltigkeitssicht unattraktiven Branchen (Best-in-Class). Ich möchte branchenunabhängig in die am besten geraten Aktien investieren (Best-in-Universe). Dafür gibt es aber auch heute noch keine ETFs. Außerdem gibt es sehr wenige ETFs, die strikte ESG-Kriterien nutzen und zusätzlich SDG-Vereinbarkeit anstreben.

Auch in den in besonders konsequent nachhaltigen globalen Socially Responsible Paris Aligned Benchmarks befinden sich noch mehrere hundert Aktien aus sehr vielen Branchen und Ländern. Aktive globale nachhaltige Fonds gibt es dagegen schon mit nur 30 Aktien, also potenziell erheblich nachhaltiger (vgl. 30 stocks, if responsible, are all I need – Responsible Investment Research Blog (prof-soehnholz.com)).

Emittenten nachhaltiger ETFs üben oft nachhaltige Stimmrechtsausübungen und sogar Engagement aus, wenn auch nur in geringem Umfang. Das machen die meisten Anbieter aktiver Investments aber auch nicht besser (vgl. z.B. 2023 Proxy Season Review – Minerva-Manifest). Indexfolgende Investments nutzen aber typischerweise den Impactkanal Divestments nicht, weil sie Indizes möglichst direkt nachbilden wollen.

Nachhaltige Geldanlage und Wertpapierselektion: Weniger Standardprodukte und mehr individuelle Mandate oder Direct Indexing?

Wenn es keine ETFs gibt, die nachhaltig genug sind, sollte man sich aktiv gemanagte Fonds suchen, nachhaltige Mandate an Vermögensverwalter vergeben oder seine Portfolios selbst entwickeln. Aktiv gemanagte konzentrierte Fonds mit strengem ESG plus Impactansatz sind aber noch sehr selten. Das gilt auch für Vermögensverwalter, die solche Mandate umsetzen könnten. Außerdem werden für maßgeschneiderte Mandate oft hohe Mindestanlagen verlangt. Individuelle nachhaltige Portfolioentwicklungen werden dagegen zunehmend einfacher.

Basis-Nachhaltigkeitsdaten werden aktuell von zahlreichen Anbietern für Privatanleger kostengünstig oder sogar kostenlos angeboten. Finanztechnische Entwicklungen wie Discount-(Online-)Broker, Direct Indexing und Handel mit Bruchstücken von Wertpapieren sowie Stimmrechtsausübungstools helfen bei der effizienten und nachhaltigen Umsetzung von individuellen Portfolios. Schwierigkeiten bereiten dabei eher die Vielfalt an Investmentmöglichkeiten und mangelnde bzw. schwer zu beurteilende Datenqualität.

Ideal wäre, wenn Anleger auf Basis eines kuratierten Universums von besonders nachhaltigen Wertpapieren zusätzlich eigene Nachhaltigkeitsanforderungen berücksichtigen können und dann automatisiert in ihren Depots implementieren und rebalanzieren lassen (vgl. Custom ESG Indexing Can Challenge Popularity Of ETFs (asiafinancial.com). Zusätzlich könnten sie mit Hilfe moderner Tools ihre Stimmrechte nach individuellen Nachhaltigkeitsvorstellungen ausüben. Direkte Nachhaltigkeitskommunikation mit den Wertpapieremittenten kann durch den Plattformanbieter erfolgen.

Risikomanagement: Viel mehr Tracking-Error und ESG-Risikomonitoring?

Für nachhaltige Geldanlagen kommen zusätzlich zu traditionellen Risikokennzahlen Nachhaltigkeitskennzahlen hinzu, zum Beispiel ESG-Ratings, Emissionswerte, Principal Adverse Indicators, Do-No-Significant-Harm-Informationen, EU-Taxonomievereinbarkeit oder, wie in meinem Fall, SDG-Vereinbarkeiten und Engagementerfolge.

Nachhaltige Anleger müssen sich entscheiden, wie wichtig die jeweiligen Kriterien für sie sind. Ich nutze Nachhaltigkeitskriterien nicht nur für das Reporting, sondern auch für mein regelgebundenes Risikomanagement. Das heißt, dass ich Wertpapiere verkaufe, wenn ESG- oder SDG-Anforderungen nicht mehr erfüllt werden.

Die von mir genutzten ESG-Ratings messen Umwelt-, Sozial- und Unternehmensführungsrisiken. Diese Risiken sind heute schon wichtig und werden künftig noch wichtiger, wie man zum Beispiel an Greenwashing- und Reputationsrisiken sehen kann. Deshalb sollten sie in keinem Risikomanagement fehlen. SDG-Anforderungserfüllung ist hingegen nur für Anleger relevant, denen wichtig ist, wie nachhaltig die Produkte und Services ihrer Investments sind.

Stimmrechtsausübungen und Engagement wurden bisher meistens nicht für das Risikomanagement genutzt. Das kann sich künftig jedoch ändern. Ich prüfe zum Beispiel, ob ich Aktien bei unzureichender Reaktion auf mein Engagement verkaufen sollte. Eine unzureichende Engagementreaktion von Unternehmen weist möglicherweise darauf hin, dass Unternehmen nicht auf gute Vorschläge hören und damit unnötige Risiken eingehen, die man durch Divestments vermeiden kann.

Traditionelle Geldanleger messen Risiko oft mit der Abweichung von der Soll-Allokation bzw. Benchmark. Wenn die Abweichung einen vorher definierten Grad überschreitet, müssen viele Portfolios wieder benchmarknäher ausgerichtet werden. Für nachhaltige Portfolios werden dafür auch nachhaltige Indizes als Benchmark genutzt. Wie oben erläutert, können Nachhaltigkeitsanforderungen aber sehr individuell sein und es gibt meiner Ansicht nach viel zu wenige strenge nachhaltige Benchmarks. Wenn man besonders nachhaltig anlegen möchte, muss man dementsprechend höhere statt niedrigere Benchmarkabweichungen (Tracking Error) haben bzw. sollte ganz auf Tracking Error Kennzahlen verzichten.

Nachhaltigkeit kann also sowohl zu neuen Risikokennzahlen führen als auch alte in Frage stellen und damit auch zu einem erheblich anderen Risikomanagement führen.

Nachhaltige Geldanlage – Zusammenfassung und Ausblick: Viel mehr Individualität?

Individuelle Nachhaltigkeitsanforderungen spielen eine sehr wichtige Rolle für die Allokation auf Anlagesegmente, die Manager- bzw. Fondsselektion, die Positionsselektion und auch das Risikomanagement. Strenge Nachhaltigkeit kann zu stärkeren Unterschieden zwischen Geldanlagemandaten und radikalen Änderungen gegenüber traditionellen Mandaten führen: Geringere Diversifikation über Anlageklassen, mehr illiquide Investments für Großanleger, mehr Projektfinanzierungen, mehr aktive statt passive Mandate, erheblich höhere Konzentration innerhalb der Anlagesegmente und ein anderes Risikomanagement mit zusätzlichen Kennzahlen und erheblich geringerer Benchmarkorientierung.

Manche Analysten meinen, nachhaltige Geldanlage führt zu höheren Risiken, höheren Kosten und niedrigeren Renditen. Andere erwarten zukünftig überproportional hohe Anlagen in nachhaltige Investments. Das sollte zu einer besseren Performance solcher Investments führen. Meine Einstellung: Ich versuche so nachhaltig wie möglich zu investieren und erwarte dafür mittelfristig eine marktübliche Rendite mit niedrigeren Risiken im Vergleich zu traditionellen Investments.

………………………………………………………………………………………………………………….

Achtung: Werbung für meinen Fonds

Mein Fonds (Art. 9) ist auf soziale SDGs fokussiert. Ich nutze separate E-, S- und G-Best-in-Universe-Mindestratings sowie ein breites Aktionärsengagement bei derzeit 27 von 30 Unternehmen: FutureVest Equity Sustainable Development Goals R – DE000A2P37T6 – A2P37T oder Divestments: 49 bei 30 Aktien meines Artikel 9 Fonds